//+------------------------------------------------------------------+

//| FFS_CrossTiming.mq4 |

//| Release date 20070128 |

//+------------------------------------------------------------------+

#property copyright "icm63 (user name at Forex-TSD)"

#property link "Forex-TSD"

//+---------------------------------------------------------------------------------------------------+

//| |

//| READ ME FIRST. |

//| I have nothing to do with www.forexforsmarties.com. |

//| You use these tools at YOUR OWN RISK. |

//| I do not endorse or sell FFS methods or products in any way. |

//| These tools are provided FREE of charge, I wish to promote the development of MT4 tools and minds|

//| of those who trade FFS to get the best 'How to FFS tools'. So we all can trade FFS thru easy |

//| and tough times. As the Forex market gives and takes away fortunes ! To make 5% monthly |

//| compounding over 10 years is not easy when the forex beast changes. |

//| |

//| Use with |

//| FFS_Trend |

//| FFS_Correlation |

//| FFS_Cross |

//| FFS_NetPipChange |

//| |

//| IMPORTANT: |

//| Make sure the 'IndexType' is the same within each MT4 tool. |

//| The FFS_Mode should be set as BUY, to mirror the FFS Calcutator. |

//| |

//| Like the FFS_Correlation tool, this is a fundamental watch. It shows the combined trend of |

//| all the crosses related to the hedge pair in question. All cross have been adjusted to be on |

//| the same price scale and treated as equal weight. |

//| |

//| When this start getting wild so will the accounts trading FFS, and settings will have to be |

//| adjusted for survival. Use the FFS_Trainspotter (in FFS_Trend) to see FFS_NetPipChange summary |

//| to view the extremes of the net pip swings of the hedge pairs. |

//| |

//| This is the index selection format |

//| 1. EUR/USD, USD/CHF |

//| 2. EUR/USD, USD/CHF, GBP/USD |

//| 3. EUR/USD, USD/CHF, GBP/USD, USD/JPY |

//| 4. EUR/USD, USD/CHF, USD/JPY |

//| 5. EUR/USD, GBP/USD, USD/JPY |

//| 6. USD/CHF, GBP/USD |

//| 7. USD/CHF, GBP/USD, USD/JPY |

//| 8. GBP/USD, USD/JPY |

//+---------------------------------------------------------------------------------------------------+

#property indicator_separate_window

#property indicator_buffers 3

//----

#property indicator_color1 Red

#property indicator_color2 DarkGreen

#property indicator_color3 Lime

//----

#property indicator_level1 60

#property indicator_level2 40

//User Inputs Parameters

extern int IndexType=9; // FFS Index see above

extern int CCI=5; //CCI period

extern double Lag1_Gamma=0.5; //Laguerre Gamma Short

extern double Lag2_Gamma=0.8; //Laguerre Gamma Long

//---- variables

double cross1[];

double CCI1[];

double Lag1[];

double Lag2[];

double normCCI1[];

double normcross1[];

string shortname;

//---- Laguerra Variables

double L0A=0;

double L1A=0;

double L2A=0;

double L3A=0;

double L0=0;

double L1=0;

double L2=0;

double L3=0;

double CU=0;

double CD=0;

double LRSI=0;

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

int init()

{

shortname="FFS_CrossTiming Index " + IndexType +

", CCI Red ("+CCI+ "), Laguerre("+DoubleToStr(Lag1_Gamma,1)+","+DoubleToStr(Lag2_Gamma,1)+"), ";

//----

IndicatorShortName(shortname);

IndicatorBuffers(6);

//----

SetIndexDrawBegin(0,CCI+1);

SetIndexStyle(0,DRAW_LINE);

SetIndexBuffer(0,normCCI1);

SetIndexLabel(0, "CCI1");

SetIndexDrawBegin(1,5);

SetIndexEmptyValue(1, -0.01);

SetIndexStyle(1,DRAW_LINE);

SetIndexBuffer(1,Lag1);

SetIndexLabel(1, "Lag1");

SetIndexDrawBegin(2,5);

SetIndexEmptyValue(2, -0.01);

SetIndexStyle(2,DRAW_LINE);

SetIndexBuffer(2,Lag2);

SetIndexLabel(2, "Lag2");

SetIndexBuffer(3,cross1);

SetIndexBuffer(4,CCI1);

SetIndexBuffer(5,normcross1);

return(0);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

int start()

{

int limit;

int counted_bars=IndicatorCounted();

if(counted_bars<0) return(-1);

if(counted_bars>0) counted_bars-=1;

limit=Bars-counted_bars;

//----

double EURCHFW, GBPCHFW, EURJPYW, GBPJPYW, CHFJPYW, EURGBPW;

//Determine correct weight to get all prices on scale of 10,000

EURCHFW=(10000/(iClose("EURCHF",0,1)*10000))*10000;

GBPCHFW=(10000/(iClose("GBPCHF",0,1)*10000))*10000;

EURJPYW=(10000/(iClose("EURJPY",0,1)*10000))*10000;

GBPJPYW=(10000/(iClose("GBPJPY",0,1)*10000))*10000;

CHFJPYW=(10000/(iClose("CHFJPY",0,1)*10000))*10000;

EURGBPW=(10000/(iClose("EURGBP",0,1)*10000))*10000;

//----

for(int i=limit; i>=0; i--)

{

switch(IndexType)

{

case 1:

//1. EUR/USD, USD/CHF"

cross1[i]= iClose("EURCHF",0,i) * EURCHFW;

break;

case 2:

//2. EUR/USD, USD/CHF, GBP/USD

cross1[i]= iClose("EURCHF",0,i) * EURCHFW + iClose("GBPCHF",0,i) * GBPCHFW

+ iClose("EURGBP",0,i) * EURGBPW;

break;

case 3:

//3. EUR/USD, USD/CHF, GBP/USD, USD/JPY

cross1[i]= iClose("EURCHF",0,i) * EURCHFW + iClose("GBPCHF",0,i) * GBPCHFW

+ iClose("EURJPY",0,i) * EURJPYW + iClose("GBPJPY",0,i) * GBPJPYW

+ iClose("CHFJPY",0,i) * CHFJPYW + iClose("EURGBP",0,i) * EURGBPW ;

break;

case 4:

//4. EUR/USD, USD/CHF, USD/JPY

cross1[i]= iClose("EURCHF",0,i) * EURCHFW + iClose("EURJPY",0,i) * EURJPYW

+ iClose("CHFJPY",0,i) * CHFJPYW ;

break;

case 5:

//5. EUR/USD, GBP/USD, USD/JPY

cross1[i]= iClose("EURJPY",0,i) * EURJPYW + iClose("GBPJPY",0,i) * GBPJPYW

+ iClose("EURGBP",0,i) * EURGBPW ;

break;

case 6:

//6. USD/CHF, GBP/USD

cross1[i]= iClose("GBPCHF",0,i) * GBPCHFW ;

break;

case 7:

//7. USD/CHF, GBP/USD, USD/JPY

cross1[i]= iClose("GBPCHF",0,i) * GBPCHFW + iClose("GBPJPY",0,i) * GBPJPYW

+ iClose("CHFJPY",0,i) * CHFJPYW ;

break;

case 8:

//8. GBP/USD, USD/JPY

cross1[i]= iClose("GBPJPY",0,i) * GBPJPYW ;

break;

case 9:

//9. Chart Symbol

cross1[i]= iClose(NULL,0,i) ;

break;

default:

//3. EUR/USD, USD/CHF, GBP/USD, USD/JPY

cross1[i]= iClose("EURCHF",0,i) * EURCHFW + iClose("GBPCHF",0,i) * GBPCHFW

+ iClose("EURJPY",0,i) * EURJPYW + iClose("GBPJPY",0,i) * GBPJPYW

+ iClose("CHFJPY",0,i) * CHFJPYW + iClose("EURGBP",0,i) * EURGBPW ;

break;

}

//Find Max and Min or series

double Maxcross1=-10000000, Mincross1=10000000;

for(int k=0; k<limit;k++)

{

if(cross1[i+k] > Maxcross1) Maxcross1=cross1[i+k];

if(cross1[i+k] < Mincross1) Mincross1=cross1[i+k];

}

}

//Normalise Data btw 0 and 100

for(int m=limit; m>=0; m--)

{

if (Maxcross1 - Mincross1!=0) normcross1[m]=NormalizeDouble(100*(cross1[m]-Mincross1)/(Maxcross1-Mincross1),2);

}

//INDICATORS FOR NORMALISED CROSSES DATA FOR ENTRY AND EXIT TIMING FOR FFS TRADES

//Calculate CCI and Laguerre arrays

if(CCI > 0)

{

for(int g=limit; g>=0; g--)

{

CCI1[g]=iCCIOnArray(normcross1,limit,CCI,g); //Red

Lag1[g]=LaguerreRSI(normcross1[g],Lag1_Gamma);

}

for(int y=limit; y>=0; y--)

{

Lag2[y]=LaguerreRSI(normcross1[y],Lag2_Gamma);

}

}

NormaliseSeries(CCI1,normCCI1,limit);

//----

return(0);

}

//+------------------------------------------------------------------+

//|FUNCTIONS |

//+------------------------------------------------------------------+

void NormaliseSeries(double& InData[], double& OutData[],

int limit)

{

double nMax= -10000000;

double nMin= 10000000;

//----

for( int k=0; k<limit;k++)

{

if(InData[k] > nMax) nMax=InData[k];

if(InData[k] < nMin) nMin=InData[k];

}

//Normalise Data btw Min and Max

for(int m=limit; m>=0; m--)

{

if (nMax - nMin!=0) OutData[m]=NormalizeDouble(100*((InData[m]-nMin)/(nMax-nMin)),2);

}

}

//+------------------------------------------------------------------+

//|Laguerre calc |

//+------------------------------------------------------------------+

double LaguerreRSI(double InData, double gamma)

{

L0A=L0;

L1A=L1;

L2A=L2;

L3A=L3;

L0=(1 - gamma)* InData + gamma* L0A;

L1=- gamma * L0 + L0A + gamma * L1A;

L2=- gamma * L1 + L1A + gamma * L2A;

L3=- gamma * L2 + L2A + gamma * L3A;

//----

CU=0;

CD=0;

//----

if(L0>=L1)

CU=L0 - L1;

else

CD=L1 - L0;

//----

if(L1>=L2)

CU=CU + L1 - L2;

else

CD=CD + L2 - L1;

//----

if(L2>=L3)

CU=CU + L2 - L3;

else

CD=CD + L3 - L2;

//----

if(CU + CD!=0) LRSI=NormalizeDouble((CU/(CU + CD))* 90,2);

return(LRSI);

}

//+------------------------------------------------------------------+

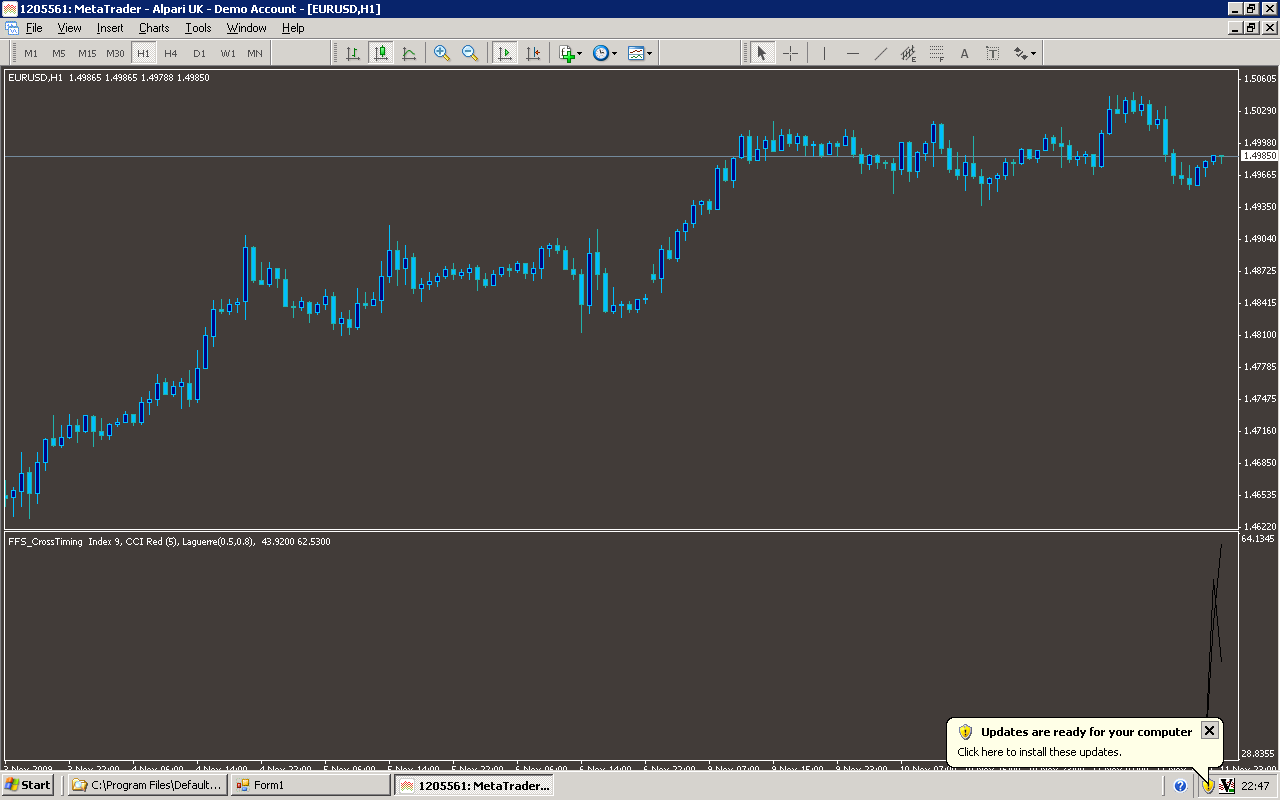

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Commodity channel index

Custom Indicators Used:

Order Management characteristics:

Other Features: