//+------------------------------------------------------------------+

//| Pivot Points v8.mq4 |

//| Copyright © 2007, MetaQuotes Software Corp. |

//| http://www.metaquotes.net |

//+------------------------------------------------------------------+

#property copyright "Jason Normandin"

//FiboPivot calculations inserted by Jack Hewings

#property link ""

#property indicator_chart_window

#property indicator_buffers 7

#property indicator_color1 MediumVioletRed

#property indicator_color2 MediumVioletRed

#property indicator_color3 MediumVioletRed

#property indicator_color4 Tomato

#property indicator_color5 Teal

#property indicator_color6 Teal

#property indicator_color7 Teal

#property indicator_width1 3

#property indicator_width2 2

#property indicator_width3 1

#property indicator_width4 3

#property indicator_width5 1

#property indicator_width6 2

#property indicator_width7 3

/*

#property indicator_style1 STYLE_DOT

#property indicator_style2 STYLE_DOT

#property indicator_style3 STYLE_DOT

#property indicator_style4 STYLE_SOLID

#property indicator_style5 STYLE_DOT

#property indicator_style6 STYLE_DOT

#property indicator_style7 STYLE_DOT

*/

#define SECONDS_IN_MINUTE 60

#define SECONDS_IN_HOUR 3600

#define SECONDS_IN_DAY 86400

#define PIVOTSET_DAILY 1

#define PIVOTSET_WEEKLY 2

#define PIVOTSET_MONTHLY 3

#define PIVOT_R3 0

#define PIVOT_R2 1

#define PIVOT_R1 2

#define PIVOT_PP 3

#define PIVOT_S1 4

#define PIVOT_S2 5

#define PIVOT_S3 6

// input parameters

extern int PivotSet = PIVOTSET_DAILY;

extern int DayStartHour = 0; // Metaquotes is +2 GMT

// buffers

double dR3Buffer[];

double dR2Buffer[];

double dR1Buffer[];

double dPPBuffer[];

double dS1Buffer[];

double dS2Buffer[];

double dS3Buffer[];

int init() {

SetIndexBuffer(0,dR3Buffer);

SetIndexBuffer(1,dR2Buffer);

SetIndexBuffer(2,dR1Buffer);

SetIndexBuffer(3,dPPBuffer);

SetIndexBuffer(4,dS1Buffer);

SetIndexBuffer(5,dS2Buffer);

SetIndexBuffer(6,dS3Buffer);

switch (PivotSet) {

case PIVOTSET_DAILY:

IndicatorShortName("Daily Pivot Points");

SetIndexLabel(0,"Daily Pivot R3");

SetIndexLabel(1,"Daily Pivot R2");

SetIndexLabel(2,"Daily Pivot R1");

SetIndexLabel(3,"Daily Pivot Point");

SetIndexLabel(4,"Daily Pivot S1");

SetIndexLabel(5,"Daily Pivot S2");

SetIndexLabel(6,"Daily Pivot S3");

break;

case PIVOTSET_WEEKLY:

IndicatorShortName("Weekly Pivot Points");

SetIndexLabel(0,"Weekly Pivot R3");

SetIndexLabel(1,"Weekly Pivot R2");

SetIndexLabel(2,"Weekly Pivot R1");

SetIndexLabel(3,"Weekly Pivot Point");

SetIndexLabel(4,"Weekly Pivot S1");

SetIndexLabel(5,"Weekly Pivot S2");

SetIndexLabel(6,"Weekly Pivot S3");

break;

case PIVOTSET_MONTHLY:

IndicatorShortName("Monthly Pivot Points");

SetIndexLabel(0,"Monthly Pivot R3");

SetIndexLabel(1,"Monthly Pivot R2");

SetIndexLabel(2,"Monthly Pivot R1");

SetIndexLabel(3,"Monthly Pivot Point");

SetIndexLabel(4,"Monthly Pivot S1");

SetIndexLabel(5,"Monthly Pivot S2");

SetIndexLabel(6,"Monthly Pivot S3");

break;

}

return(0);

}

int start() {

double dPrices[4];

double dPivots[7];

// Don't show lines on inappropriate timeframes

switch (PivotSet) {

case PIVOTSET_DAILY:

if (Period() > PERIOD_H1) return(0);

break;

case PIVOTSET_WEEKLY:

if (Period() > PERIOD_D1) return(0);

break;

case PIVOTSET_MONTHLY:

if (Period() > PERIOD_W1) return(0);

break;

}

// Determine how far back to iterate

int iBarsToCalc = Bars - IndicatorCounted();

if (iBarsToCalc < Bars) iBarsToCalc++;

// Iterate over bars and perform calcs

for (int i=iBarsToCalc-1;i>=0;i--) {

// DAILY PIVOTS

// If PivotSet = PIVOTSET_DAILY and it's a new day then calc pivots

if (PivotSet == PIVOTSET_DAILY) {

datetime dtDayStart0 = getDayStart(Time[i]);

datetime dtDayStart1 = getDayStart(Time[i+1]);

if (dtDayStart0 != dtDayStart1) {

getPrevDayPrices(dPrices,dtDayStart0);

getPivots(dPivots,dPrices);

}

} // end daily pivot block

// WEEKLY PIVOTS

// If PivotSet = PIVOTSET_WEEKLY and it's a new week then calc pivots

if (PivotSet == PIVOTSET_WEEKLY) {

datetime dtWeekStart0 = getWeekStart(Time[i]);

datetime dtWeekStart1 = getWeekStart(Time[i+1]);

if (dtWeekStart0 != dtWeekStart1) {

getPrevWeekPrices(dPrices,dtWeekStart0);

getPivots(dPivots,dPrices);

}

} // end weekly pivot block

// MONTHLY PIVOTS

// If PivotSet = PIVOTSET_MONTHLY and it's a new month then calc pivots

if (PivotSet == PIVOTSET_MONTHLY) {

datetime dtMonthStart0 = getMonthStart(Time[i]);

datetime dtMonthStart1 = getMonthStart(Time[i+1]);

if (dtMonthStart0 != dtMonthStart1) {

getPrevMonthPrices(dPrices,dtMonthStart0);

getPivots(dPivots,dPrices);

}

} // end weekly pivot block

// If the pivots have been updated, this will push out the changes

// if the pivots haven't been updated, the previous values will carry forward

dR3Buffer[i] = dPivots[PIVOT_R3];

dR2Buffer[i] = dPivots[PIVOT_R2];

dR1Buffer[i] = dPivots[PIVOT_R1];

dPPBuffer[i] = dPivots[PIVOT_PP];

dS1Buffer[i] = dPivots[PIVOT_S1];

dS2Buffer[i] = dPivots[PIVOT_S2];

dS3Buffer[i] = dPivots[PIVOT_S3];

}

return(0);

}

void getPivots(double& pivots[], double prices[]) {

// Calculate the pivots

pivots[PIVOT_PP] = NormalizeDouble((prices[PRICE_HIGH] + prices[PRICE_LOW] + prices[PRICE_CLOSE]) / 3,Digits);

pivots[PIVOT_R1] = NormalizeDouble(pivots[PIVOT_PP] + ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 0.382),Digits);

pivots[PIVOT_S1] = NormalizeDouble(pivots[PIVOT_PP] - ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 0.382),Digits);

pivots[PIVOT_R2] = NormalizeDouble(pivots[PIVOT_PP] + ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 0.618),Digits);

pivots[PIVOT_S2] = NormalizeDouble(pivots[PIVOT_PP] - ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 0.618),Digits);

pivots[PIVOT_R3] = NormalizeDouble(pivots[PIVOT_PP] + ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 1.000),Digits);

pivots[PIVOT_S3] = NormalizeDouble(pivots[PIVOT_PP] - ((prices[PRICE_HIGH] - prices[PRICE_LOW]) * 1.000),Digits);

}

void getPrevDayPrices(double& prices[], datetime timestamp) {

// Get the last bar of the previous trading day

// since iBarShift exact param = false, the previous existing bar will be returned

int iBarIndex = iBarShift(NULL,PERIOD_H1,timestamp-SECONDS_IN_HOUR,false);

datetime dtPrevDayStart = getDayStart(iTime(NULL,PERIOD_H1,iBarIndex));

// Get close price for the day and set initial values for high and low

prices[PRICE_HIGH] = iHigh (NULL,PERIOD_H1,iBarIndex);

prices[PRICE_LOW] = iLow (NULL,PERIOD_H1,iBarIndex);

prices[PRICE_OPEN] = iOpen (NULL,PERIOD_H1,iBarIndex);

prices[PRICE_CLOSE] = iClose(NULL,PERIOD_H1,iBarIndex);

iBarIndex++;

// Iterate back and check for high/low prices until all of previous trading day covered

while (getDayStart(iTime(NULL,PERIOD_H1,iBarIndex)) == dtPrevDayStart) {

prices[PRICE_HIGH] = MathMax(prices[PRICE_HIGH], iHigh (NULL,PERIOD_H1,iBarIndex));

prices[PRICE_LOW] = MathMin(prices[PRICE_LOW], iLow (NULL,PERIOD_H1,iBarIndex));

prices[PRICE_OPEN] = iOpen(NULL,PERIOD_H1,iBarIndex);

iBarIndex++;

}

return;

}

void getPrevWeekPrices(double& prices[], datetime timestamp) {

// Get start of previous week

datetime dtPrevWeekStart = timestamp - 7 * SECONDS_IN_DAY;

// Get offset for previous week bar

int iBarIndex = iBarShift(NULL,PERIOD_W1,dtPrevWeekStart,true);

// Get pricing for previous week and fill array

prices[PRICE_HIGH] = iHigh (NULL,PERIOD_W1,iBarIndex);

prices[PRICE_LOW] = iLow (NULL,PERIOD_W1,iBarIndex);

prices[PRICE_OPEN] = iOpen (NULL,PERIOD_W1,iBarIndex);

prices[PRICE_CLOSE] = iClose(NULL,PERIOD_W1,iBarIndex);

return;

}

void getPrevMonthPrices(double& prices[], datetime timestamp) {

// Get start of previous month

datetime dtPrevMonthStart = getMonthStart(timestamp - SECONDS_IN_DAY);

// Get offset for previous month bar

int iBarIndex = iBarShift(NULL,PERIOD_MN1,dtPrevMonthStart,true);

// Get pricing for previous week and fill array

prices[PRICE_HIGH] = iHigh (NULL,PERIOD_MN1,iBarIndex);

prices[PRICE_LOW] = iLow (NULL,PERIOD_MN1,iBarIndex);

prices[PRICE_OPEN] = iOpen (NULL,PERIOD_MN1,iBarIndex);

prices[PRICE_CLOSE] = iClose(NULL,PERIOD_MN1,iBarIndex);

return;

}

datetime getDayStart(datetime timestamp) {

// Strip seconds from timestamp

// (probably not required)

timestamp -= TimeSeconds(timestamp);

// Strip minutes from timestamp

timestamp -= TimeMinute(timestamp) * SECONDS_IN_MINUTE;

// Subtract enough hours to reach previous day start

if (TimeHour(timestamp) >= DayStartHour)

timestamp -= (TimeHour(timestamp) - DayStartHour) * SECONDS_IN_HOUR;

else

timestamp -= (TimeHour(timestamp) + (24 - DayStartHour)) * SECONDS_IN_HOUR;

return(timestamp);

}

datetime getWeekStart(datetime timestamp) {

// Strip seconds from timestamp

// (probably not required)

timestamp -= TimeSeconds(timestamp);

// Strip minutes from timestamp

timestamp -= TimeMinute(timestamp) * SECONDS_IN_MINUTE;

// Strip hours from timestamp

timestamp -= TimeHour(timestamp) * SECONDS_IN_HOUR;

// Strip days past Sunday from timestamp

timestamp -= TimeDayOfWeek(timestamp) * SECONDS_IN_DAY;

return(timestamp);

}

datetime getMonthStart(datetime timestamp) {

// Strip seconds from timestamp

// (probably not required)

timestamp -= TimeSeconds(timestamp);

// Strip minutes from timestamp

timestamp -= TimeMinute(timestamp) * SECONDS_IN_MINUTE;

// Strip hours from timestamp

timestamp -= TimeHour(timestamp) * SECONDS_IN_HOUR;

// Strip days past 1 from timestamp

timestamp -= (TimeDay(timestamp) - 1) * SECONDS_IN_DAY;

return(timestamp);

}

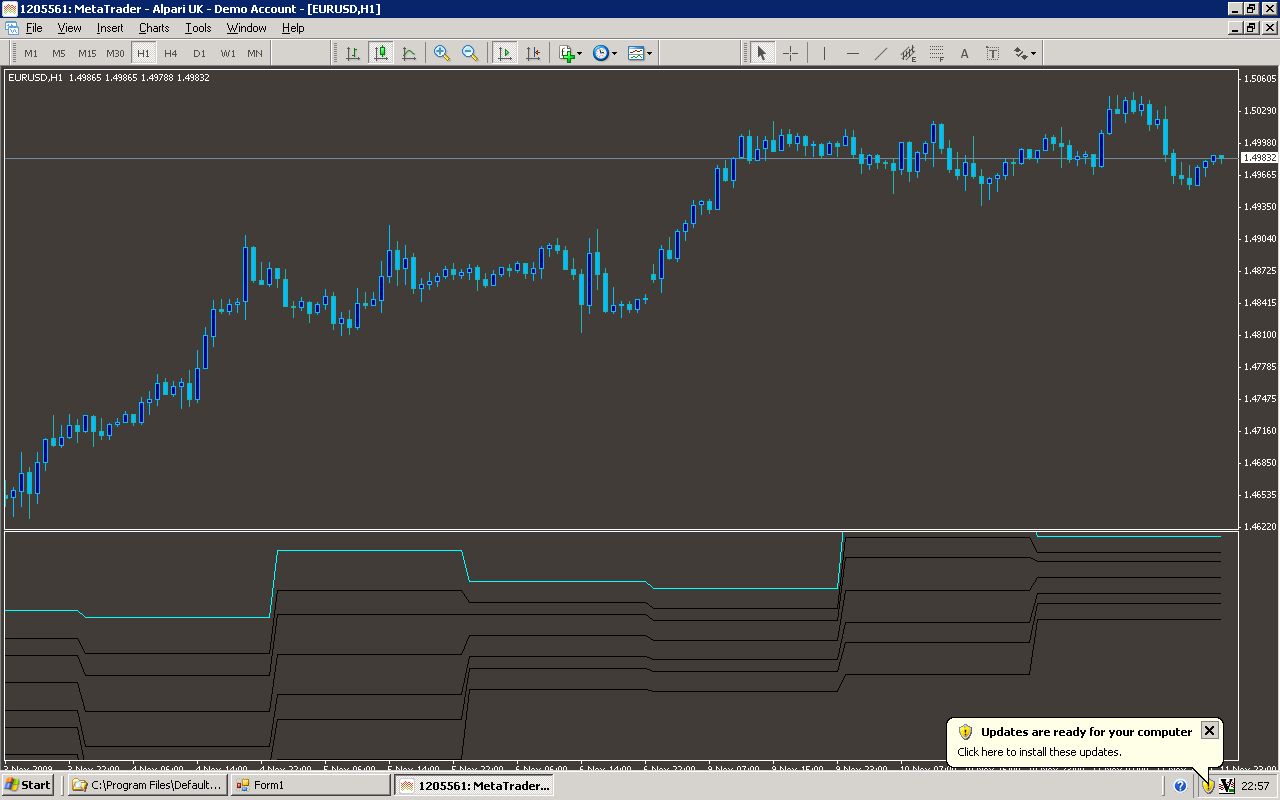

Sample

Analysis

Market Information Used:

Series array that contains open time of each bar

Series array that contains close prices for each bar

Series array that contains open prices of each bar

Indicator Curves created:

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: