//+------------------------------------------------------------------+

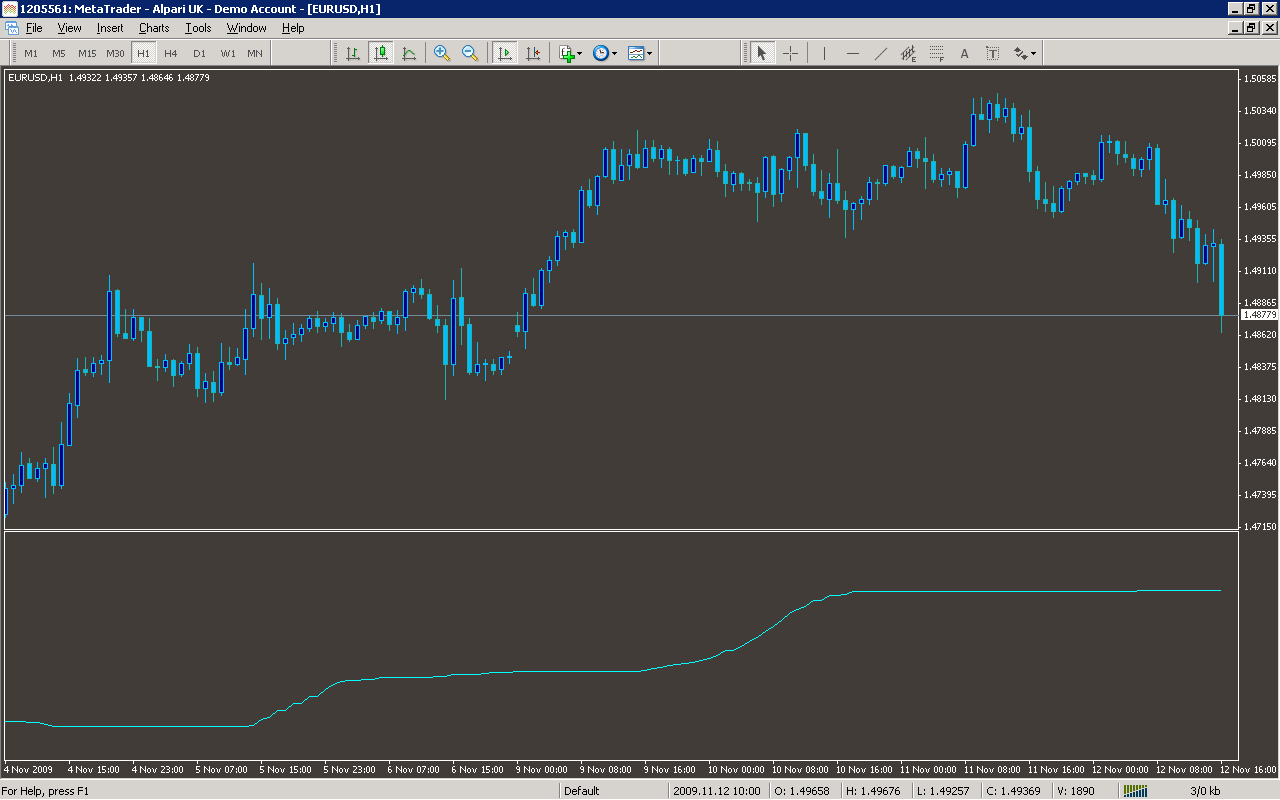

//| Die Stärke des Corrected Average (CA) besteht darin, |

//| dass der aktuelle Wert der Zeitreihe einen von der momentanen |

//| Volatilität abhängigen Schwellenwert überschreiten muss, |

//| damit der Filter steigt bzw. fällt, wodurch Fehlsignale |

//| in trendschwachen Phasen vermieden werden. |

//| -A.Uhl- |

//+------------------------------------------------------------------+

//|Germany, 23.03.2007

#property copyright "A.Uhl, © RickD 2006, Alexander Piechotta"

#property link "http://onix-trade.net/forum/"

//----

#define major 1

#define minor 0

//----

#property indicator_chart_window

#property indicator_buffers 1

#property indicator_color1 Gold

//----

extern int MA.Period=35;

extern int MA.method=MODE_SMA;

extern int MA.applied_price=PRICE_CLOSE;

//----

double MABuf[];

double CABuf[];

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

void init()

{

IndicatorBuffers(2);

SetIndexStyle(2, DRAW_LINE, STYLE_SOLID,1);

SetIndexDrawBegin(0, MA.Period);

//

SetIndexBuffer(0, CABuf);

SetIndexBuffer(1, MABuf);

IndicatorShortName("Corrected Average (CA) ("+MA.Period+")");

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

void deinit()

{}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

void start()

{

int counted=IndicatorCounted();

if (counted < 0) return(-1);

if (counted > 0) counted--;

int limit=Bars-counted;

double v1, v2, k;

//----

for(int i=limit-1; i>=0; i--)

{

MABuf[i]=iMA(NULL, 0, MA.Period, 0, MA.method, MA.applied_price, i);

if (i==Bars-1)

{

CABuf[i]=MABuf[i];

continue;

}

v1=MathPow(iStdDev(NULL, 0, MA.Period, 0, MA.method, MA.applied_price, i), 2);

v2=MathPow(CABuf[i+1] - MABuf[i], 2);

//----

k=0;

if (v2 < v1 || v2==0) k=0; else k=1 - v1/v2;

CABuf[i]=CABuf[i+1] + k*(MABuf[i]-CABuf[i+1]);

}

}

//+------------------------------------------------------------------+

Sample

Analysis

Market Information Used:

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Moving average indicator

Standard Deviation indicator

Custom Indicators Used:

Order Management characteristics:

Other Features: