/*-----------------------------+

| |

| Shared by www.Aptrafx.com |

| |

+------------------------------*/

//+------------------------------------------------------------------+

//| icwr.mq4 |

//| Copyright © 2006, tageiger aka fxid10t@yahoo.com |

//| http://www.metatrader.org |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2006, tageiger aka fxid10t@yahoo.com"

#property link "http://www.metatrader.org"

extern double MaximumRisk =0.02; //%account balance to risk per position

extern double DecreaseFactor =3; //lot size divisor(reducer) during loss streak

extern double Lot.Margin =50; //Margin for 1 lot

extern int Magic =69;

extern string comment ="m icwr ea";

double spread; spread =Ask-Bid;

int slip; slip =spread/Point;

int RequiredWaveHeight,b,s,cnt,b.ticket,s.ticket;

double rsi,SL,ICWR,ICWRv0,awp1,awp2,active.high,active.low,high.c,high.r,low.r,low.c;

datetime awt1,awt2,a.high.shift,a.low.shift,shift;

int init(){return(0);}

int deinit(){return(0);}

int start(){

PosCounter();

rsi=iRSI(Symbol(),1440,14,PRICE_CLOSE,0);

if(Period()==5) {RequiredWaveHeight=40;SL=50*Point;}

if(Period()==240) {RequiredWaveHeight=150;SL=100*Point;}

ICWR=iCustom(Symbol(),Period(),"ICWR",10,5,3,RequiredWaveHeight,0,0);

ICWRv0=iCustom(Symbol(),Period(),"ICWR v0","ZigZag",10,5,3,"ActiveWave",50,RequiredWaveHeight,0,0);

awt1=ObjectGet("Activewave",OBJPROP_TIME1);

awp1=ObjectGet("Activewave",OBJPROP_PRICE1);

awt2=ObjectGet("Activewave",OBJPROP_TIME2);

awp2=ObjectGet("Activewave",OBJPROP_PRICE2);

if(awp1>awp2) {

active.high=awp1;

a.high.shift=iBarShift(Symbol(),Period(),awt1);

active.low=awp2;

a.low.shift=iBarShift(Symbol(),Period(),awt2);}

else {

active.high=awp2;

a.high.shift=iBarShift(Symbol(),Period(),awt2);

active.low=awp1;

a.low.shift=iBarShift(Symbol(),Period(),awt1);}

if(a.high.shift<a.low.shift) shift=a.high.shift;

else shift=a.low.shift;

high.c=NormalizeDouble(active.low+((active.high-active.low)*0.75),Digits);

high.r=NormalizeDouble(active.low+((active.high-active.low)*0.618),Digits);

low.r=NormalizeDouble(active.low+((active.high-active.low)*0.382),Digits);

low.c=NormalizeDouble(active.low+((active.high-active.low)*0.25),Digits);

if(rsi>50) {

for(int i=0;i<shift;i++) {

if(Close[i]<high.r && Close[i]>low.r && Low[1]>high.c && b==0) {

b.ticket=OrderSend(Symbol(),

OP_BUY,

LotsOptimized(),

Ask,

slip,

Ask-SL,

0,

Period()+comment,

Magic,0,Blue);

if(b.ticket>0) {

if(OrderSelect(b.ticket,SELECT_BY_TICKET,MODE_TRADES))

{ Print(b.ticket); }

else Print("Error Opening BuyStop Order: ",GetLastError());

return(0);}}}}

if(rsi<50 && rsi>0) {

for(int ii=0;ii<shift;ii++) {

if(Close[ii]<high.r && Close[ii]>low.r && High[1]<low.c && s==0) {

s.ticket=OrderSend(Symbol(),

OP_SELL,

LotsOptimized(),

Bid,

slip,

Bid+SL,

0,

Period()+comment,

Magic,0,Orange);

if(s.ticket>0) {

if(OrderSelect(s.ticket,SELECT_BY_TICKET,MODE_TRADES))

{ Print(s.ticket); }

else Print("Error Opening SellStop Order: ",GetLastError());

return(0);}}}}

if(b>0) {

for(int c=0;c<shift;c++) {

if(High[1]<low.c) {

OrderClose(b.ticket,OrderLots(),Bid,slip,0);}}}

if(s>0) {

for(int cc=0;cc<shift;cc++) {

if(Low[1]>high.c) {

OrderClose(s.ticket,OrderLots(),Ask,slip,0);}}}

comments();

return(0);}

//+---------------------------FUNCTIONS------------------------------+

void PosCounter() {

b=0;s=0;b.ticket=0;s.ticket=0;

for(cnt=0;cnt<=OrdersTotal();cnt++) {

OrderSelect(cnt, SELECT_BY_POS, MODE_TRADES);

if(OrderSymbol()==Symbol() && OrderMagicNumber()==Magic) {

if(OrderType()==OP_SELL) {

s.ticket=OrderTicket();

s++;}

if(OrderType()==OP_BUY) {

b.ticket=OrderTicket();

b++;} }}}

void comments() {

if(MarketInfo(Symbol(),MODE_SWAPLONG)>0) string swap="longs.";

else swap="shorts.";

if(MarketInfo(Symbol(),MODE_SWAPLONG)<0 && MarketInfo(Symbol(),MODE_SWAPSHORT)<0) swap="your broker. :(";

Comment("Last Tick: ",TimeToStr(CurTime(),TIME_DATE|TIME_SECONDS),"\n",

"Swap favors ",swap,"\n",

"Daily RSI= ",rsi,"\n",

"Active High: ",active.high,"\n",

"High shift: ",a.high.shift,"\n",

"High Confirm: ",high.c,"\n",

"High Retrace: ",high.r,"\n",

"Low Retrace: ",low.r,"\n",

"Low Confirm: ",low.c,"\n",

"Active Low: ",active.low,"\n",

"Low shift: ",a.low.shift,"\n",

"Open Ticket #",b.ticket," ",s.ticket); }

double LotsOptimized() {

double lot;

int orders=HistoryTotal();

int losses=0;

lot=NormalizeDouble(AccountFreeMargin()*MaximumRisk/Lot.Margin,2);

if(DecreaseFactor>0) {

for(int i=orders-1;i>=0;i--) {

if(OrderSelect(i,SELECT_BY_POS,MODE_HISTORY)==false) { Print("Error in history!"); break; }

if(OrderSymbol()!=Symbol() || OrderType()>OP_SELL) continue;

if(OrderProfit()>0) break;

if(OrderProfit()<0) losses++; }

if(losses>1) lot=NormalizeDouble(lot-lot*losses/DecreaseFactor,2); }

if(lot<0.01) lot=0.01;

return(lot); }//end LotsOptimized

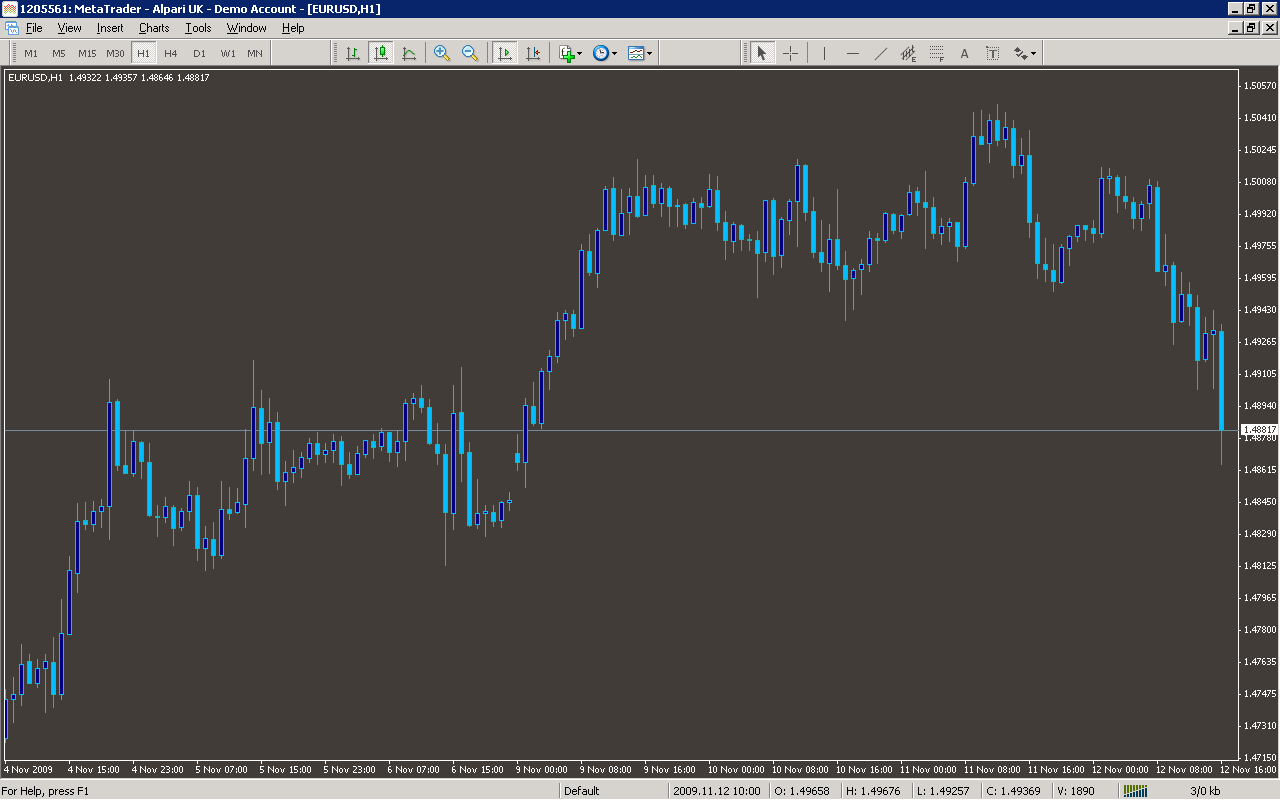

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Series array that contains the lowest prices of each bar

Series array that contains the highest prices of each bar

Indicator Curves created:

Indicators Used:

Relative strength index

Custom Indicators Used:

ICWR

ICWR v0

Order Management characteristics:

It Closes Orders by itself

Checks for the total of open orders

Other Features: