//+------------------------------------------------------------------+

//| Murrey_Math_MT_VG.mq4 |

//| Copyright © 2004, MetaQuotes Software Corp. |

//| http://www.metaquotes.net |

//+------------------------------------------------------------------+

#property copyright "Vladislav Goshkov (VG)."

#property link "4vg@mail.ru"

#property indicator_chart_window

extern int P = 64;

extern int StepBack = 0;

double dmml = 0,

dvtl = 0,

sum = 0,

v1 = 0,

v2 = 0,

mn = 0,

mx = 0,

x1 = 0,

x2 = 0,

x3 = 0,

x4 = 0,

x5 = 0,

x6 = 0,

y1 = 0,

y2 = 0,

y3 = 0,

y4 = 0,

y5 = 0,

y6 = 0,

octave = 0,

fractal = 0,

range = 0,

finalH = 0,

finalL = 0,

mml[13];

string ln_txt[13],

buff_str = "";

int

bn_v1 = 0,

bn_v2 = 0,

OctLinesCnt = 13,

mml_thk = 8,

mml_clr[13],

mml_shft = 3,

nTime = 0,

CurPeriod = 0,

nDigits = 0,

i = 0;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init() {

//---- indicators

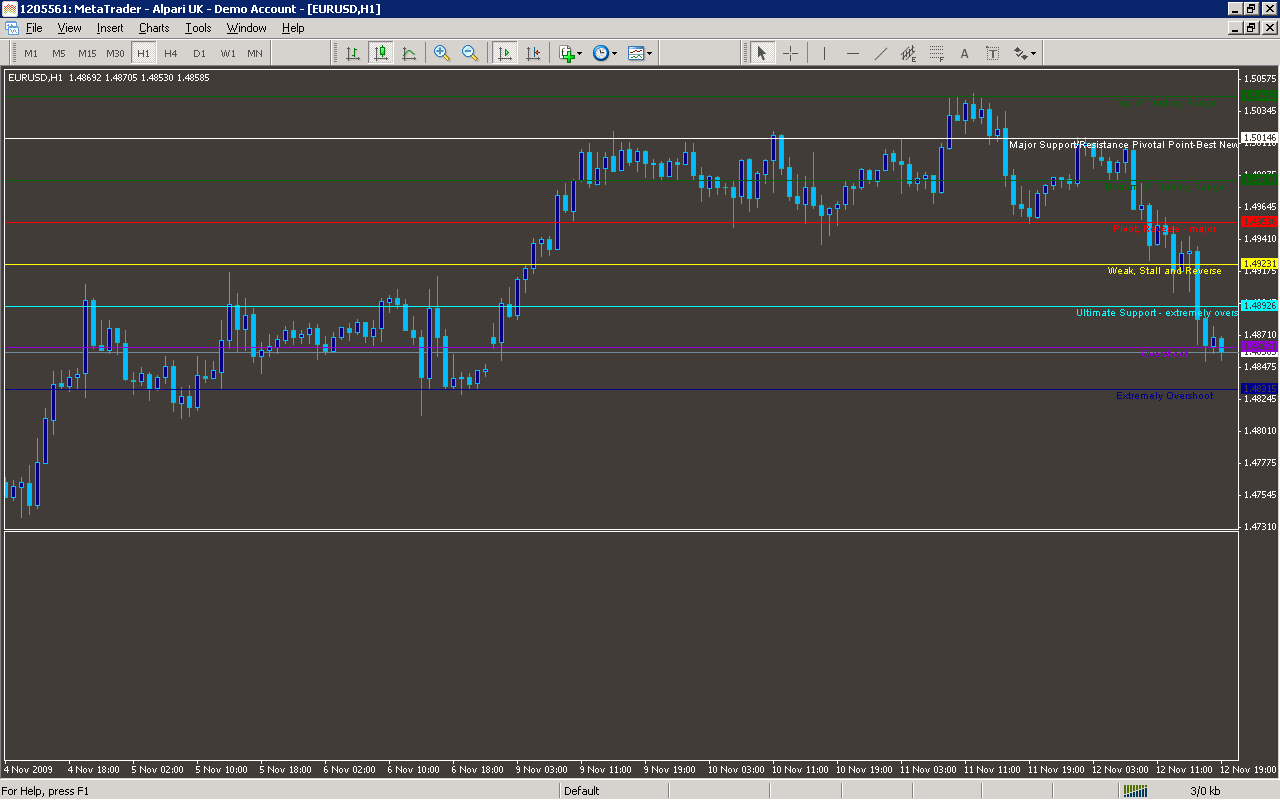

ln_txt[0] = "Extremely Overshoot";// "extremely overshoot [-2/8]";// [-2/8]

ln_txt[1] = "Overshoot";// "overshoot [-1/8]";// [-1/8]

ln_txt[2] = "Ultimate Support - extremely oversold";// "Ultimate Support - extremely oversold [0/8]";// [0/8]

ln_txt[3] = "Weak, Stall and Reverse";// "Weak, Stall and Reverse - [1/8]";// [1/8]

ln_txt[4] = "Pivot, Reverse - major";// "Pivot, Reverse - major [2/8]";// [2/8]

ln_txt[5] = "Bottom of Trading Range";// "Bottom of Trading Range - [3/8], if 10-12 bars then 40% Time. BUY Premium Zone";//[3/8]

ln_txt[6] = "Major Support/Resistance Pivotal Point-Best New BUY or SELL level";// "Major Support/Resistance Pivotal Point [4/8]- Best New BUY or SELL level";// [4/8]

ln_txt[7] = "Top of Trading Range";// "Top of Trading Range - [5/8], if 10-12 bars then 40% Time. SELL Premium Zone";//[5/8]

ln_txt[8] = "Pivot, Reverse - major";// "Pivot, Reverse - major [6/8]";// [6/8]

ln_txt[9] = "Weak, Stall and Reverse";// "Weak, Stall and Reverse - [7/8]";// [7/8]

ln_txt[10] = "Ultimate Resistance - extremely overbought";// "Ultimate Resistance - extremely overbought [8/8]";// [8/8]

ln_txt[11] = "Overshoot";// "overshoot [+1/8]";// [+1/8]

ln_txt[12] = "Extremely Overshoot";// "extremely overshoot [+2/8]";// [+2/8]

mml_shft = 3;

mml_thk = 3;

mml_clr[0] = DarkBlue; // [-2]/8

mml_clr[1] = DarkViolet; // [-1]/8

mml_clr[2] = Aqua; // [0]/8

mml_clr[3] = Yellow; // [1]/8

mml_clr[4] = Red; // [2]/8

mml_clr[5] = DarkGreen; // [3]/8

mml_clr[6] = White; // [4]/8

mml_clr[7] = DarkGreen; // [5]/8

mml_clr[8] = Red; // [6]/8

mml_clr[9] = Yellow; // [7]/8

mml_clr[10] = Aqua; // [8]/8

mml_clr[11] = DarkViolet; // [+1]/8

mml_clr[12] = DarkBlue; // [+2]/8

return(0);

}

//+------------------------------------------------------------------+

//| Custor indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit() {

Comment(" ");

for(i=0;i<OctLinesCnt;i++) {

buff_str = "mml"+i;

ObjectDelete(buff_str);

buff_str = "mml_txt"+i;

ObjectDelete(buff_str);

}

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start() {

if( (nTime != Time[0]) || (CurPeriod != Period()) ) {

//price

bn_v1 = Lowest(NULL,0,MODE_LOW,P+StepBack,0);

bn_v2 = Highest(NULL,0,MODE_HIGH,P+StepBack,0);

v1 = Low[bn_v1];

v2 = High[bn_v2];

//determine fractal.....

if( v2<=250000 && v2>25000 )

fractal=100000;

else

if( v2<=25000 && v2>2500 )

fractal=10000;

else

if( v2<=2500 && v2>250 )

fractal=1000;

else

if( v2<=250 && v2>25 )

fractal=100;

else

if( v2<=25 && v2>12.5 )

fractal=12.5;

else

if( v2<=12.5 && v2>6.25)

fractal=12.5;

else

if( v2<=6.25 && v2>3.125 )

fractal=6.25;

else

if( v2<=3.125 && v2>1.5625 )

fractal=3.125;

else

if( v2<=1.5625 && v2>0.390625 )

fractal=1.5625;

else

if( v2<=0.390625 && v2>0)

fractal=0.1953125;

range=(v2-v1);

sum=MathFloor(MathLog(fractal/range)/MathLog(2));

octave=fractal*(MathPow(0.5,sum));

mn=MathFloor(v1/octave)*octave;

if( (mn+octave)>v2 )

mx=mn+octave;

else

mx=mn+(2*octave);

// calculating xx

//x2

if( (v1>=(3*(mx-mn)/16+mn)) && (v2<=(9*(mx-mn)/16+mn)) )

x2=mn+(mx-mn)/2;

else x2=0;

//x1

if( (v1>=(mn-(mx-mn)/8))&& (v2<=(5*(mx-mn)/8+mn)) && (x2==0) )

x1=mn+(mx-mn)/2;

else x1=0;

//x4

if( (v1>=(mn+7*(mx-mn)/16))&& (v2<=(13*(mx-mn)/16+mn)) )

x4=mn+3*(mx-mn)/4;

else x4=0;

//x5

if( (v1>=(mn+3*(mx-mn)/8))&& (v2<=(9*(mx-mn)/8+mn))&& (x4==0) )

x5=mx;

else x5=0;

//x3

if( (v1>=(mn+(mx-mn)/8))&& (v2<=(7*(mx-mn)/8+mn))&& (x1==0) && (x2==0) && (x4==0) && (x5==0) )

x3=mn+3*(mx-mn)/4;

else x3=0;

//x6

if( (x1+x2+x3+x4+x5) ==0 )

x6=mx;

else x6=0;

finalH = x1+x2+x3+x4+x5+x6;

// calculating yy

//y1

if( x1>0 )

y1=mn;

else y1=0;

//y2

if( x2>0 )

y2=mn+(mx-mn)/4;

else y2=0;

//y3

if( x3>0 )

y3=mn+(mx-mn)/4;

else y3=0;

//y4

if( x4>0 )

y4=mn+(mx-mn)/2;

else y4=0;

//y5

if( x5>0 )

y5=mn+(mx-mn)/2;

else y5=0;

//y6

if( (finalH>0) && ((y1+y2+y3+y4+y5)==0) )

y6=mn;

else y6=0;

finalL = y1+y2+y3+y4+y5+y6;

for( i=0; i<OctLinesCnt; i++) {

mml[i] = 0;

}

dmml = (finalH-finalL)/8;

mml[0] =(finalL-dmml*2); //-2/8

for( i=1; i<OctLinesCnt; i++) {

mml[i] = mml[i-1] + dmml;

}

for( i=0; i<OctLinesCnt; i++ ){

buff_str = "mml"+i;

if(ObjectFind(buff_str) == -1) {

ObjectCreate(buff_str, OBJ_HLINE, 0, Time[0], mml[i]);

ObjectSet(buff_str, OBJPROP_STYLE, STYLE_SOLID);

ObjectSet(buff_str, OBJPROP_COLOR, mml_clr[i]);

ObjectMove(buff_str, 0, Time[0], mml[i]);

}

else {

ObjectMove(buff_str, 0, Time[0], mml[i]);

}

buff_str = "mml_txt"+i;

if(ObjectFind(buff_str) == -1) {

ObjectCreate(buff_str, OBJ_TEXT, 0, Time[mml_shft], mml_shft);

ObjectSetText(buff_str, ln_txt[i], 8, "Arial", mml_clr[i]);

ObjectMove(buff_str, 0, Time[mml_shft], mml[i]);

}

else {

ObjectMove(buff_str, 0, Time[mml_shft], mml[i]);

}

} // for( i=1; i<=OctLinesCnt; i++ ){

nTime = Time[0];

CurPeriod= Period();

}

//---- End Of Program

return(0);

}

//+------------------------------------------------------------------+

Sample

Analysis

Market Information Used:

Series array that contains open time of each bar

Series array that contains the lowest prices of each bar

Series array that contains the highest prices of each bar

Indicator Curves created:

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: