//+------------------------------------------------------------------+

//| Synergy Signals [v2].mq4 |

//| SwingMan |

//| Sources: Traders Dynamic Index, HeikenAshi_DM |

//+------------------------------------------------------------------+

#property copyright "SwingMan"

#property link ""

//----

#property indicator_chart_window

#property indicator_buffers 7

//---- colors

#property indicator_color1 Green // long/short Signals

#property indicator_color2 Red

#property indicator_color3 IndianRed // StopLoss

#property indicator_color4 LimeGreen

#property indicator_color5 Yellow

#property indicator_color6 Yellow

#property indicator_color7 Green

//---- extern parameters

extern int PriceChannel_Period=5;

extern int RSI_Period=13; //8-25

extern int RSISmooth_Period=2;

extern int RSIVolatilityBand_Period=34; //20-40

extern int RSITradeSignal_Period=7;

extern int TrendIndicator_Period=55;

extern int RSI_Price=0; //0-6

extern int RSI_MavgMODE=0; //0-3

extern int RSITradeSignal_MavgMODE=0; //0-3

extern double Factor_ShortBars=0.50;

extern int SignalOffset=5;

//---- arrays Traders Dynamic Index

double RSIBuf[10000],UpZone[10000],BaseLine[10000],DnZone[10000];

double RSILine[10000],RedLine[10000];

//---- arrays HeikinAshi Candles

double haBuffer_Low[10000];

double haBuffer_High[10000];

double haBuffer_Open[10000];

double haBuffer_Close[10000];

//---- MovingAverages / PriceActionChannel / PAC

double mavHighs[];

double mavLows[];

double mavTrend[];

//---- signals

double LongSignal[];

double ShortSignal[];

double StopLong[];

double StopShort[];

//---- variables

string sName="Synergy Signals [v2]";

double dSignalOffset, Spread;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

IndicatorShortName(sName);

Comment(sName);

dSignalOffset=SignalOffset*Point;

Spread=MarketInfo(Symbol(), MODE_SPREAD) * Point;

//---- Set Arrays ----------------------------------------------------

ArraySetAsSeries(RSIBuf, true); // Traders Dynamic Index

ArraySetAsSeries(UpZone, true);

ArraySetAsSeries(BaseLine, true);

ArraySetAsSeries(DnZone, true);

ArraySetAsSeries(RSILine, true);

ArraySetAsSeries(RedLine, true);

ArraySetAsSeries(haBuffer_Low, true); // HeikinAshi Candles

ArraySetAsSeries(haBuffer_High, true);

ArraySetAsSeries(haBuffer_Open, true);

ArraySetAsSeries(haBuffer_Close, true);

//---- Long/Short Signals

SetIndexBuffer(0,LongSignal);

SetIndexBuffer(1,ShortSignal);

SetIndexStyle(0,DRAW_ARROW,0,1);

SetIndexStyle(1,DRAW_ARROW,0,1);

SetIndexArrow(0,159);

SetIndexArrow(1,159);

SetIndexLabel(0,"LONG Signal");

SetIndexLabel(1,"SHORT Signal");

//---- Stops Long/Short

SetIndexBuffer(2,StopLong);

SetIndexBuffer(3,StopShort);

SetIndexStyle(2,DRAW_ARROW,0,0);

SetIndexStyle(3,DRAW_ARROW,0,0);

SetIndexArrow(2,251);

SetIndexArrow(3,251);

SetIndexLabel(2,"Stop Long");

SetIndexLabel(3,"Stop Short");

//---- MovingAverages / PriceActionChannel / PAC

SetIndexBuffer(4,mavHighs);

SetIndexBuffer(5,mavLows);

SetIndexBuffer(6,mavTrend);

SetIndexStyle(4,DRAW_LINE,0,2);

SetIndexStyle(5,DRAW_LINE,0,2);

SetIndexStyle(6,DRAW_LINE,0,2);

SetIndexLabel(4,"High mavg");

SetIndexLabel(5,"Low mavg");

SetIndexLabel(6,"Trend line");

//---- Draw begin

SetIndexDrawBegin(0,TrendIndicator_Period);

SetIndexDrawBegin(1,TrendIndicator_Period);

SetIndexDrawBegin(2,TrendIndicator_Period);

SetIndexDrawBegin(3,TrendIndicator_Period);

SetIndexDrawBegin(4,TrendIndicator_Period);

SetIndexDrawBegin(5,TrendIndicator_Period);

SetIndexDrawBegin(6,TrendIndicator_Period);

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit() { return(0); }

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

bool TradeLong =false;

bool TradeShort=false;

//---- Traders Dynamic Index; Copyright © 2006, Dean Malone

double MA,RSI[];

ArrayResize(RSI,RSIVolatilityBand_Period);

int counted_bars=IndicatorCounted();

int limit=Bars-counted_bars-1;

for(int i=limit; i>=0; i--)

{

RSIBuf[i]=(iRSI(NULL,0,RSI_Period,RSI_Price,i));

MA=0;

for(int x=i; x<i+RSIVolatilityBand_Period; x++)

{

RSI[x-i]=RSIBuf[x];

MA+=RSIBuf[x]/RSIVolatilityBand_Period;

}

UpZone[i]=(MA + (1.6185 * StDev(RSI,RSIVolatilityBand_Period))); // upper Volatility Band; Blue

DnZone[i]=(MA - (1.6185 * StDev(RSI,RSIVolatilityBand_Period))); // lower Volatility Band; Blue

BaseLine[i]=((UpZone[i] + DnZone[i])*0.5); // Market Base Line (MBL); Yellow

}

for(i=limit-1;i>=0;i--)

{

RSILine[i]=(iMAOnArray(RSIBuf,0,RSISmooth_Period,0,RSI_MavgMODE,i)); // RSI Price Line; Green

RedLine[i]=(iMAOnArray(RSIBuf,0,RSITradeSignal_Period,0,RSITradeSignal_MavgMODE,i)); // Trade Signal Line (TSL); Red

}

// MovingAverages / PriceActionChannel / PAC

for(i=limit-1;i>=0;i--)

{

mavHighs[i]=iMA(NULL,0,PriceChannel_Period, 0,MODE_SMMA,PRICE_HIGH,i); // PriceActionChannel (PAC) Highs; Yellow

mavLows[i] =iMA(NULL,0,PriceChannel_Period, 0,MODE_SMMA,PRICE_LOW,i); // PriceActionChannel (PAC) Lows; Yellow

mavTrend[i]=iMA(NULL,0,TrendIndicator_Period,0,MODE_SMMA,PRICE_MEDIAN,i);// Trend Line; Green

}

//+----------------------------------------------------+

//| Signals |

//+----------------------------------------------------+

for(i=limit-1;i>=0;i--)

{

//---- HeikinAshi CANDLES --------------------------------------

double haOpen, haHigh, haLow, haClose;

haOpen=(haBuffer_Open[i+1]+haBuffer_Close[i+1])*0.50;

haClose=(Open[i]+High[i]+Low[i]+Close[i])*0.25;

haHigh=MathMax(High[i], MathMax(haOpen, haClose));

haLow=MathMin(Low[i], MathMin(haOpen, haClose));

if (haOpen<haClose)

{

haBuffer_Low[i] =haLow;

haBuffer_High[i]=haHigh;

}

else

{

haBuffer_Low[i] =haHigh;

haBuffer_High[i]=haLow;

}

haBuffer_Open[i] =haOpen;

haBuffer_Close[i]=haClose;

//---- local High/Low

if (haBuffer_High[i] > haBuffer_Low[i])

{

double thisHigh=haBuffer_High[i];

double thisLow =haBuffer_Low[i];

}

else

{

thisHigh=haBuffer_Low[i];

thisLow =haBuffer_High[i];

}

//+------------------------------------------------------+

//| ENTRY |

//+------------------------------------------------------+

//---- LONG SIGNALS --------------------------------------------

bool Long_RSI_PriceLine=(RSILine[i] > 50.0) && (RSILine[i] < 68.0);

bool Long_RSI_AboveTradeSignal =(RSILine[i] > RedLine[i]); // GreenLine > RedLine

bool Long_RSI_AboveMarketBaseLine=(RSILine[i] > BaseLine[i]); // GreenLine > YellowLine

bool Long_CloseHACandle =(haClose > mavHighs[i]); // Close HeikinAshi Candle

bool Long_PriceActionChannelUp =(mavHighs[i] > mavHighs[i+1]);

//---- SHORT SIGNALS -------------------------------------------

bool Short_RSI_PriceLine=(RSILine[i] < 50.0) && (RSILine[i] > 32.0);

bool Short_RSI_BelowTradeSignal =(RSILine[i] < RedLine[i]);

bool Short_RSI_BelowMarketBaseLine=(RSILine[i] < BaseLine[i]);

bool Short_CloseHACandle =(haClose < mavLows[i]);

bool Short_PriceActionChannelDown =(mavLows[i] < mavLows[i+1]);

//---- CHECK ENTRY CONDITIONS ----------------------------------

if(Long_RSI_PriceLine && Long_RSI_AboveTradeSignal && Long_RSI_AboveMarketBaseLine &&

Long_CloseHACandle && Long_PriceActionChannelUp )

{

LongSignal[i]=thisHigh + dSignalOffset;

TradeLong =true;

TradeShort=false;

}

if(Short_RSI_PriceLine && Short_RSI_BelowTradeSignal && Short_RSI_BelowMarketBaseLine &&

Short_CloseHACandle && Short_PriceActionChannelDown )

{

ShortSignal[i]=thisLow - dSignalOffset;

TradeLong =false;

TradeShort=true;

}

//+------------------------------------------------------+

//| EXIT |

//+------------------------------------------------------+

bool Exit_RSI_PriceLine=(RSILine[i] > 68.0) || (RSILine[i] < 32.0);

bool Exit_BarRange =MathAbs(haBuffer_High[i] - haBuffer_Low[i]) < // HeikinAshi Candles

Factor_ShortBars*MathAbs(haBuffer_High[i+1] - haBuffer_Low[i+1]);

//---- LONG EXITS ----------------------------------------------

// GreenLine crosses below the TSL; Trade Signal Line; RedLine

bool XLong_RSI_BelowTradeSignal=(RSILine[i] < RedLine[i]) && (RSILine[i+1] > RedLine[i+1]);

// GreenLine crosses below the upper Volatility Band; BlueLine

bool XLong_RSI_BelowUpperVB=(RSILine[i] < UpZone[i]) && (RSILine[i+1] > UpZone[i+1]);

// HeikinAshi Candles

bool XLong_OpenCloseChange =(haBuffer_Close[i] < haBuffer_Open[i]) && (haBuffer_Close[i+1] > haBuffer_Open[i+1]);

bool XLong_ClosePriceChannel=(haClose < mavHighs[i]) || ((haClose < mavHighs[i]) && (haClose > mavLows[i]));

//---- SHORT EXITS ---------------------------------------------

// GreenLine crosses above the TSL; Trade Signal Line; RedLine

bool XShort_RSI_AboveTradeSignal=(RSILine[i] > RedLine[i]) && (RSILine[i+1] < RedLine[i+1]);

// GreenLine crosses above the lower Volatility Band; BlueLine

bool XShort_RSI_AboveLoverVB=(RSILine[i] > DnZone[i]) && (RSILine[i+1] < DnZone[i+1]);

// HeikinAshi Candles

bool XShort_OpenCloseChange =(haBuffer_Close[i] > haBuffer_Open[i]) && (haBuffer_Close[i+1] < haBuffer_Open[i+1]);

bool XShort_ClosePriceChannel=(haClose > mavLows[i]) || ((haClose < mavHighs[i]) && (haClose > mavLows[i]));

/*if (i==14)

{

Print("==Close=",Close[i]);

Print("==haBuffer_High[i]=",haBuffer_High[i]," haBuffer_Low[i]=",haBuffer_Low[i]);

Print("==haBuffer_High[i+1]=",haBuffer_High[i+1]," haBuffer_Low[i+1]=",haBuffer_Low[i+1]);

Print("==Exit_RSI_PriceLine=",Exit_RSI_PriceLine," XShort_RSI_AboveTradeSignal=",XShort_RSI_AboveTradeSignal," XShort_RSI_AboveLoverVB=",XShort_RSI_AboveLoverVB);

Print("==Exit_BarRange=",Exit_BarRange," XShort_OpenCloseChange=",XShort_OpenCloseChange," XShort_ClosePriceChannel=",XShort_ClosePriceChannel);

}*/

//---- CHECK EXIT CONDITIONS -----------------------------------

if(TradeLong && (Exit_RSI_PriceLine || XLong_RSI_BelowTradeSignal || XLong_RSI_BelowUpperVB ||

Exit_BarRange || XLong_OpenCloseChange || XLong_ClosePriceChannel))

{

StopLong[i]=thisLow - dSignalOffset;

}

if(TradeShort && (Exit_RSI_PriceLine || XShort_RSI_AboveTradeSignal || XShort_RSI_AboveLoverVB ||

Exit_BarRange || XShort_OpenCloseChange || XShort_ClosePriceChannel))

{

StopShort[i]=thisHigh + dSignalOffset;

}

}

//----

return(0);

}

//+------------------------------------------------------------------+

//| StDev

//+------------------------------------------------------------------+

double StDev(double& Data[], int Per)

{

return(MathSqrt(Variance(Data,Per)));

}

//+------------------------------------------------------------------+

//| Variance

//+------------------------------------------------------------------+

double Variance(double& Data[], int Per)

{

double sum, ssum;

for(int i=0; i<Per; i++)

{

sum+=Data[i];

ssum+=MathPow(Data[i],2);

}

return((ssum*Per - sum*sum)/(Per*(Per-1)));

}

//+------------------------------------------------------------------+

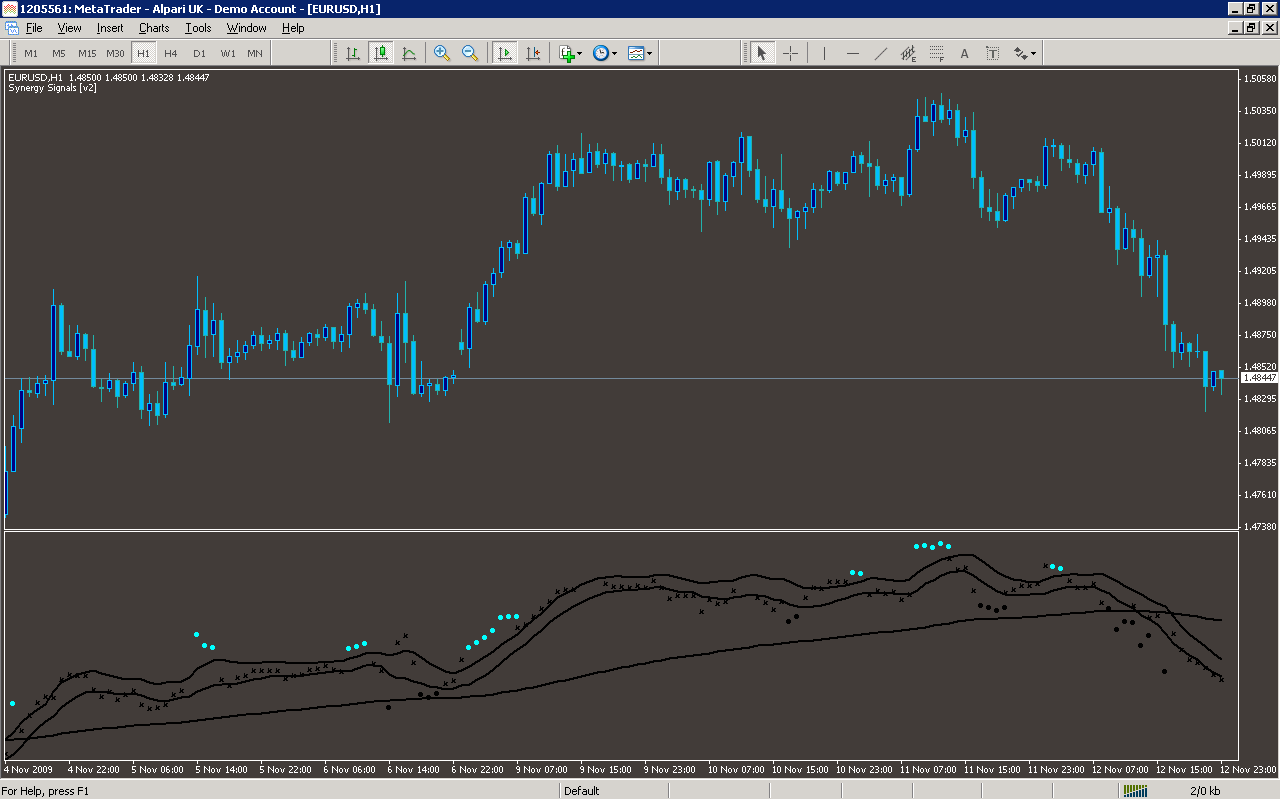

Sample

Analysis

Market Information Used:

Series array that contains the lowest prices of each bar

Series array that contains the highest prices of each bar

Series array that contains open prices of each bar

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_ARROW

Implements a curve of type DRAW_LINE

Indicators Used:

Relative strength index

Moving average indicator

Custom Indicators Used:

Order Management characteristics:

Other Features: