//+------------------------------------------------------------------+

//| TrailingByATR.mq4 |

//| I_D |

//| http://www.mymmk.com/ |

//+------------------------------------------------------------------+

#property copyright "I_D"

#property link "http://www.mymmk.com/"

extern int iTicket; // óíèêàëüíûé íîìåð (òèêåò) îòêðûòîé ïîçèöèè

extern int iAtr_timeframe; // ïåðèîä ãðàôèêà, íà êîòîðîì ñ÷èòàåòñÿ ATR (1, 5, 15, 30, 60, 240, 1440, 10080, 43200)

extern int iAtr1_period = 5; // ïåðèîä ïåðâîãî ATR

extern int iAtr1_shift = 1; // ñäâèã ïåðâîãî ATR

extern int iAtr2_period = 36; // ïåðèîä âòîðîãî ATR

extern int iAtr2_shift = 1; // ñäâèã âòîðîãî ATR

extern double dCoeff = 1; // êîýôôèöèåíò, íà êîòîðûé ìíîæèì ATR, ÷òîáû ïîëó÷èòü ñòîïëîññ (ïðè coeff=1 ñòîï áóäåð ðàçìåùåí íà ðàññòîÿíèè â 1 ATR, ïðè coeff=1.5 - íà ðàññòîÿíèè â ïîëòîðà ATR è ò.ä.)

extern bool bTrlinloss = false; // ñëåäóåò ëè òðàëèòü íà ó÷àñòêå ëîññîâ (ìåæäó êóðñîì ñòîïëîññà è îòêðûòèÿ)

//+------------------------------------------------------------------+

//| ÒÐÅÉËÈÍÃ ÏÎ ATR (Average True Range, Ñðåäíèé èñòèííûé äèàïàçîí) |

//| Ïðè çàïóñêå ýêñïåðòà åìó íåîáõîäèìî óêàçàòü óíèêàëüíûé íîìåð |

//| (òèêåò) îòêðûòîé ïîçèöèè, à òàêæå îïðåäåëèòü ïàðàìåòðû òðåéëèíãà:|

//| ïåðèîä ÀÒR è êîýôôèöèåíò, íà êîòîðûé óìíîæàåòñÿ ATR. Ò.î. |

//| ñòîïëîññ "òÿíåòñÿ" íà ðàññòîÿíèè ATR õ N îò òåêóùåãî êóðñà; |

//| ïåðåíîñ - íà íîâîì áàðå (ò.å. îò öåíû îòêðûòèÿ î÷åðåäíîãî áàðà) |

//+------------------------------------------------------------------+

//+------------------------------------------------------------------+

//| expert initialization function |

//+------------------------------------------------------------------+

int init()

{

return(0);

}

//+------------------------------------------------------------------+

//| expert deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| expert start function |

//+------------------------------------------------------------------+

int start()

{

TrailingByATR(iTicket,iAtr_timeframe,iAtr1_period,iAtr1_shift,iAtr2_period,iAtr2_shift,dCoeff,bTrlinloss);

return(0);

}

//+------------------------------------------------------------------+

void TrailingByATR(int ticket,int atr_timeframe,int atr1_period,int atr1_shift,int atr2_period,int atr2_shift,double coeff,bool trlinloss)

{

// ïðîâåðÿåì ïåðåäàííûå çíà÷åíèÿ

if ((ticket==0) || (atr1_period<1) || (atr2_period<1) || (coeff<=0) || (!OrderSelect(ticket,SELECT_BY_TICKET)) ||

((atr_timeframe!=1) && (atr_timeframe!=5) && (atr_timeframe!=15) && (atr_timeframe!=30) && (atr_timeframe!=60) &&

(atr_timeframe!=240) && (atr_timeframe!=1440) && (atr_timeframe!=10080) && (atr_timeframe!=43200)) || (atr1_shift<0) || (atr2_shift<0))

{

Print("Òðåéëèíã ôóíêöèåé TrailingByATR() íåâîçìîæåí èç-çà íåêîððåêòíîñòè çíà÷åíèé ïåðåäàííûõ åé àðãóìåíòîâ.");

return(0);

}

double curr_atr1; // òåêóùåå çíà÷åíèå ATR - 1

double curr_atr2; // òåêóùåå çíà÷åíèå ATR - 2

double best_atr; // áîëüøåå èç çíà÷åíèé ATR

double atrXcoeff; // ðåçóëüòàò óìíîæåíèÿ áîëüøåãî èç ATR íà êîýôôèöèåíò

double newstop; // íîâûé ñòîïëîññ

// òåêóùåå çíà÷åíèå ATR-1, ATR-2

curr_atr1 = iATR(Symbol(),atr_timeframe,atr1_period,atr1_shift);

curr_atr2 = iATR(Symbol(),atr_timeframe,atr2_period,atr2_shift);

// áîëüøåå èç çíà÷åíèé

best_atr = MathMax(curr_atr1,curr_atr2);

// ïîñëå óìíîæåíèÿ íà êîýôôèöèåíò

atrXcoeff = best_atr * coeff;

// åñëè äëèííàÿ ïîçèöèÿ (OP_BUY)

if (OrderType()==OP_BUY)

{

// îòêëàäûâàåì îò òåêóùåãî êóðñà (íîâûé ñòîïëîññ)

newstop = Bid - atrXcoeff;

// åñëè trlinloss==true (ò.å. ñëåäóåò òðàëèòü â çîíå ëîññîâ), òî

if (trlinloss==true)

{

// åñëè ñòîïëîññ íåîïðåäåëåí, òî òðàëèì â ëþáîì ñëó÷àå

if ((OrderStopLoss()==0) && (newstop<Bid-MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

{

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

// èíà÷å òðàëèì òîëüêî åñëè íîâûé ñòîï ëó÷øå ñòàðîãî

else

{

if ((newstop>OrderStopLoss()) && (newstop<Bid-MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

}

else

{

// åñëè ñòîïëîññ íåîïðåäåëåí, òî òðàëèì, åñëè ñòîï ëó÷øå îòêðûòèÿ

if ((OrderStopLoss()==0) && (newstop>OrderOpenPrice()) && (newstop<Bid-MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

{

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

// åñëè ñòîï íå ðàâåí 0, òî ìåíÿåì åãî, åñëè îí ëó÷øå ïðåäûäóùåãî è êóðñà îòêðûòèÿ

else

{

if ((newstop>OrderStopLoss()) && (newstop>OrderOpenPrice()) && (newstop<Bid-MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

}

}

// åñëè êîðîòêàÿ ïîçèöèÿ (OP_SELL)

if (OrderType()==OP_SELL)

{

// îòêëàäûâàåì îò òåêóùåãî êóðñà (íîâûé ñòîïëîññ)

newstop = Ask + atrXcoeff;

// åñëè trlinloss==true (ò.å. ñëåäóåò òðàëèòü â çîíå ëîññîâ), òî

if (trlinloss==true)

{

// åñëè ñòîïëîññ íåîïðåäåëåí, òî òðàëèì â ëþáîì ñëó÷àå

if ((OrderStopLoss()==0) && (newstop>Ask+MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

{

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

// èíà÷å òðàëèì òîëüêî åñëè íîâûé ñòîï ëó÷øå ñòàðîãî

else

{

if ((newstop<OrderStopLoss()) && (newstop>Ask+MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

}

else

{

// åñëè ñòîïëîññ íåîïðåäåëåí, òî òðàëèì, åñëè ñòîï ëó÷øå îòêðûòèÿ

if ((OrderStopLoss()==0) && (newstop<OrderOpenPrice()) && (newstop>Ask+MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

{

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

// åñëè ñòîï íå ðàâåí 0, òî ìåíÿåì åãî, åñëè îí ëó÷øå ïðåäûäóùåãî è êóðñà îòêðûòèÿ

else

{

if ((newstop<OrderStopLoss()) && (newstop<OrderOpenPrice()) && (newstop>Ask+MarketInfo(Symbol(),MODE_STOPLEVEL)*Point))

if (!OrderModify(ticket,OrderOpenPrice(),newstop,OrderTakeProfit(),OrderExpiration()))

Print("Íå óäàëîñü ìîäèôèöèðîâàòü îðäåð ¹",OrderTicket(),". Îøèáêà: ",GetLastError());

}

}

}

}

//+------------------------------------------------------------------+

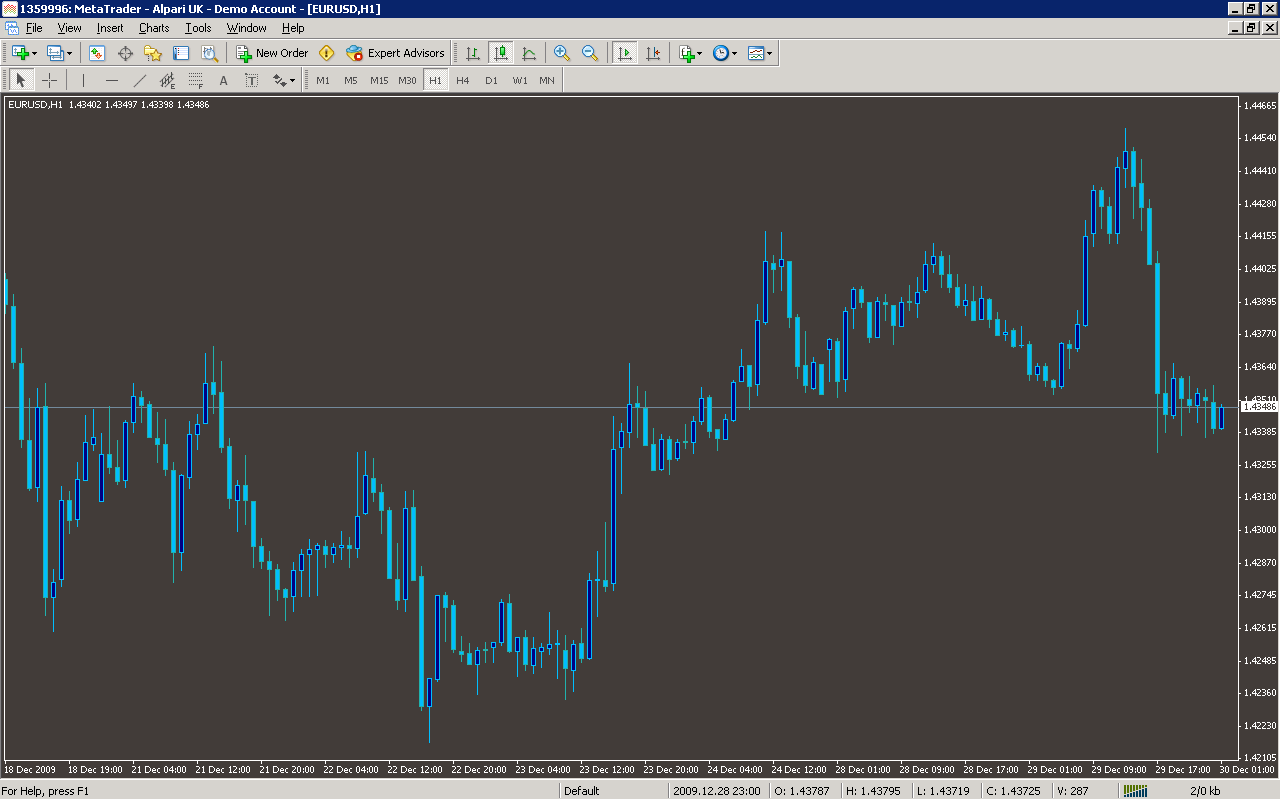

Sample

Analysis

Market Information Used:

Indicator Curves created:

Indicators Used:

Indicator of the average true range

Custom Indicators Used:

Order Management characteristics:

It can change open orders parameters, due to possible stepping strategy

Other Features: