#property indicator_chart_window

#property indicator_buffers 3

#property indicator_color1 SpringGreen

#property indicator_color2 OrangeRed

#property indicator_color3 White

extern double ChannelWidth=0.5;

extern double HoursLookBack=4.0;

double RangeUP[], RangeDOWN[], AvRange[];

double RangeFactor=0;

int currday,cnt,lookback;

double TodaysLow;

double TodaysHigh;

int init()

{

lookback = (HoursLookBack*60)/Period();

SetIndexStyle(0,DRAW_LINE,STYLE_DOT);

SetIndexBuffer(0,RangeUP);

SetIndexStyle(1,DRAW_LINE,STYLE_DOT);

SetIndexBuffer(1,RangeDOWN);

SetIndexStyle(2,DRAW_LINE,STYLE_DOT);

SetIndexBuffer(2,AvRange);

IndicatorDigits(MarketInfo(Symbol(),MODE_DIGITS));

}

//+------------------------------------------------------------------+

//| expert deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//----

//----

return(0);

}

//+------------------------------------------------------------------+

//| expert start function |

//+------------------------------------------------------------------+

int start()

{

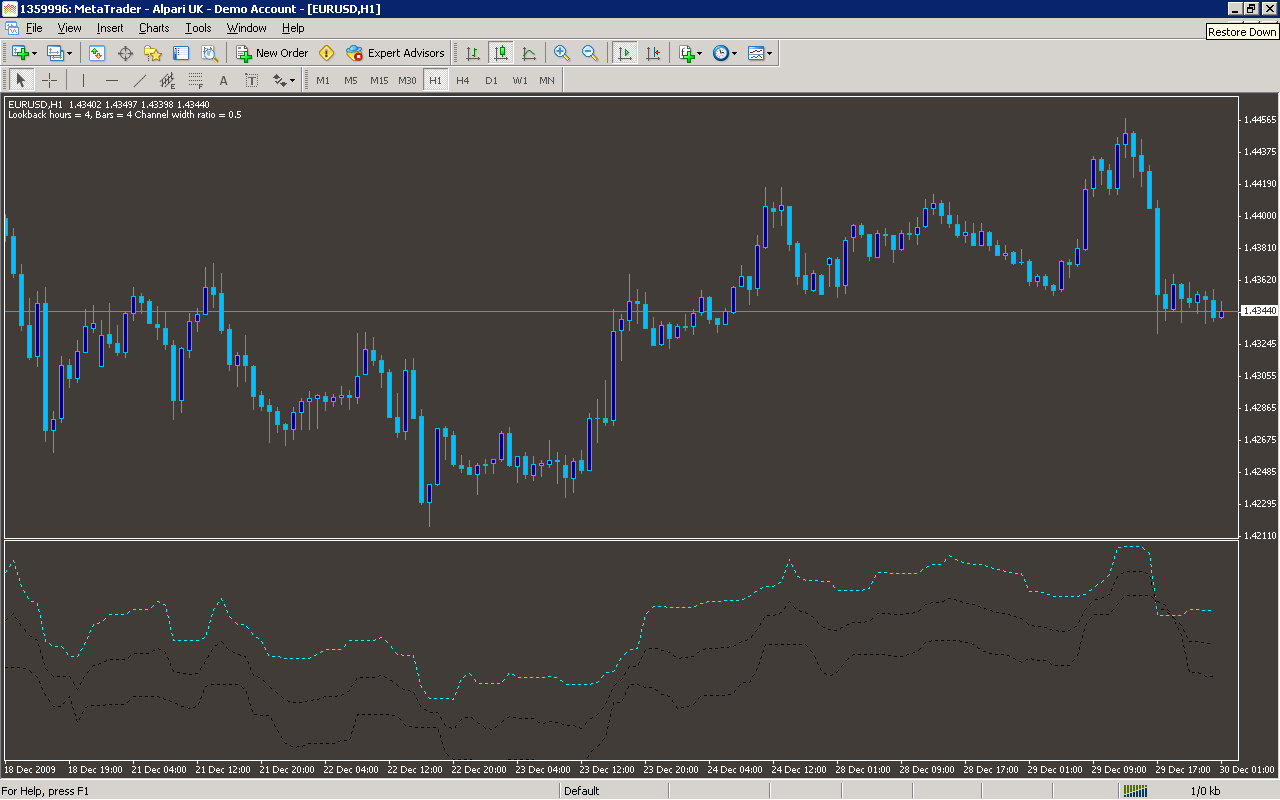

Comment("Lookback hours = ",HoursLookBack,", Bars = ",lookback, " Channel width ratio = ",ChannelWidth);

int counted_bars = IndicatorCounted();

if(counted_bars < 0)

return(-1);

if(counted_bars > 0)

counted_bars--;

int limit = Bars - counted_bars-200;

for(cnt = 0; cnt < limit ; cnt++)

{

currday=MathFloor(cnt*Period()/1440);

//if(TimeDay(Time[cnt]) != TimeDay(Time[cnt+1]))

//{

double Range1=Range(1);

double Range5=Range(5);

double Range10=Range(10);

double Range20=Range(20);

double AverageRange=(Range1+Range5+Range10+Range20)/4;

RangeFactor=AverageRange*ChannelWidth;

RangeFactor=NormalizeDouble(RangeFactor,Digits);

//}

TodaysLow=Low[iLowest(NULL,0,MODE_LOW,lookback,cnt)];

TodaysHigh=High[iHighest(NULL,0,MODE_HIGH,lookback,cnt)];

RangeUP[cnt] = TodaysLow + RangeFactor;

RangeDOWN[cnt] = TodaysHigh - RangeFactor;

AvRange[cnt] = ((TodaysLow + RangeFactor)+(TodaysHigh - RangeFactor))/2;

}

}

//+------------------------------------------------------------------+

double Range (int Days)

{

double DailyHigh,DailyLow,DailyRange,TotalRange,AR=0;

for (int i=1;i<=Days;i++)

{

int WeekDay=TimeDayOfWeek(iTime(NULL, PERIOD_D1,i+currday));

if (WeekDay != 0 || WeekDay != 6)

{

DailyHigh=iHigh(Symbol(),PERIOD_D1,i+currday);

DailyLow=iLow(Symbol(),PERIOD_D1,i+currday);

DailyRange=(DailyHigh-DailyLow);

TotalRange=TotalRange+DailyRange;

}

else

{

Days=Days+1;

}

}

AR=TotalRange/Days;

AR=NormalizeDouble(AR,Digits);

return(AR);

}

Sample

Analysis

Market Information Used:

Series array that contains the lowest prices of each bar

Series array that contains the highest prices of each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: