//+------------------------------------------------------------------+

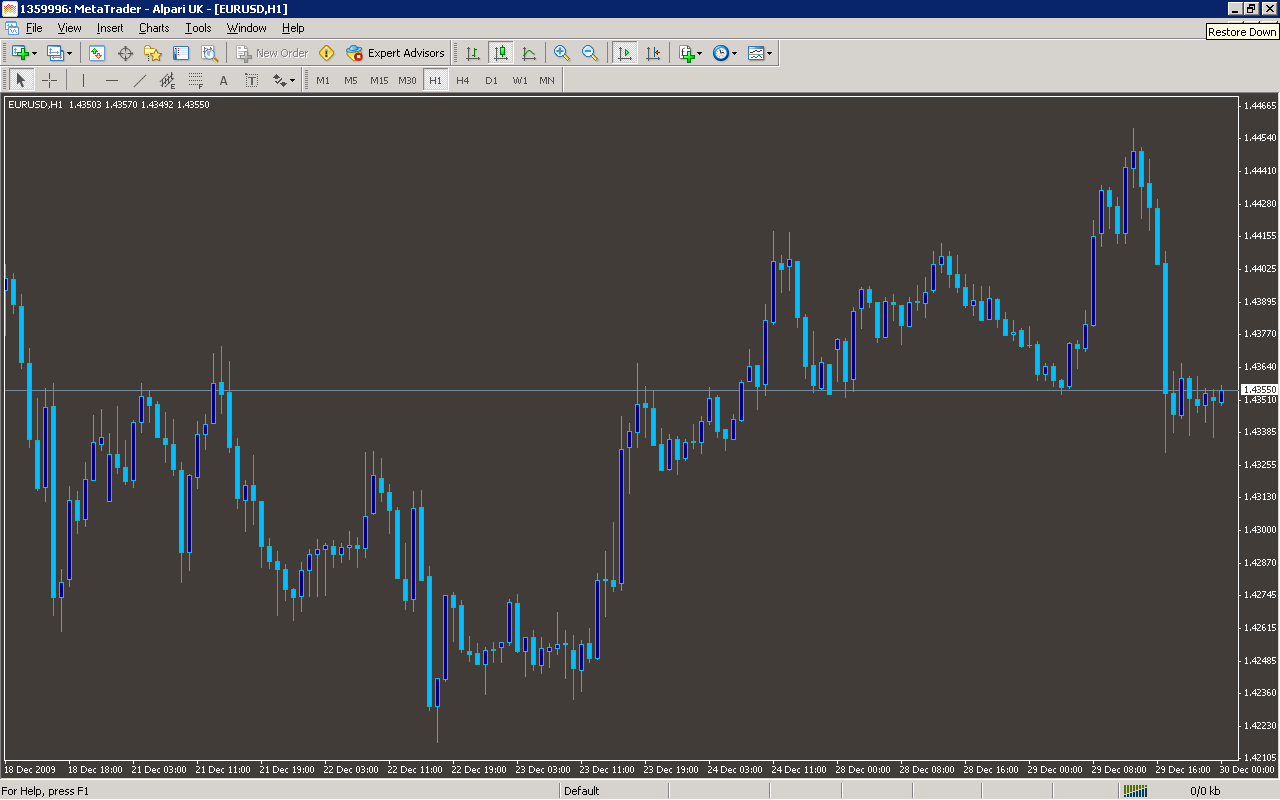

//| ForexMasterMaker.com |

//| Pivots.mq4 |

//+------------------------------------------------------------------+

#property copyright "ForexMasterMaker.com, © 2005"

#property link "http://www.forexmastermaker.com."

#property indicator_chart_window

//---- input parameters

extern int GMTshift=7;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custor indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int counted_bars=IndicatorCounted();

//---- TODO: add your code here

double day_high=0;

double day_low=0;

double yesterday_high=0;

double yesterday_open=0;

double yesterday_low=0;

double yesterday_close=0;

double today_open=0;

double P=0,S=0,R=0,S1=0,H4=0,S2=0,R2=0,S3=0,L4=0,nQ=0,nD=0,D=0;

double H3,H2,H1,L1,L2,L3;

int cnt=720;

double cur_day=0;

double prev_day=0;

double rates_d1[2][6];

//---- exit if period is greater than daily charts

if(Period() > 1440)

{

Print("Error - Chart period is greater than 1 day.");

return(-1); // then exit

}

//---- Get new daily prices & calculate pivots

while (cnt!= 0)

{

cur_day = TimeDay(Time[cnt]- (GMTshift*3600));

if (prev_day != cur_day)

{

yesterday_close = Close[cnt+1];

today_open = Open[cnt];

yesterday_high = day_high;

yesterday_low = day_low;

day_high = High[cnt];

day_low = Low[cnt];

prev_day = cur_day;

}

if (High[cnt]>day_high)

{

day_high = High[cnt];

}

if (Low[cnt]<day_low)

{

day_low = Low[cnt];

}

// SetIndexValue(cnt, 0);

cnt--;

}

//------ Pivot Points ------

P = (yesterday_high + yesterday_low + yesterday_close)/3;

H4 = (yesterday_high - yesterday_low)*0.55+yesterday_close;

H3 = (yesterday_high - yesterday_low)*0.275+yesterday_close;

L3 = yesterday_close-(yesterday_high - yesterday_low)*0.275;

L4 = yesterday_close-(yesterday_high - yesterday_low)*0.55;

//------ DRAWING LINES ------

Comment("Camarilla Levels by www.ForexMasterMaker.com");

ObjectDelete("L4_Line");

ObjectDelete("L3_Line");

ObjectDelete("H3_Line");

ObjectDelete("H4_Line");

ObjectCreate("L4_Line", OBJ_HLINE,0, CurTime(),L4);

ObjectSet("L4_Line",OBJPROP_COLOR,Red);

ObjectSet("L4_Line",OBJPROP_STYLE,STYLE_SOLID);

ObjectCreate("L3_Line", OBJ_HLINE,0, CurTime(),L3);

ObjectSet("L3_Line",OBJPROP_COLOR,Red);

ObjectSet("L3_Line",OBJPROP_STYLE,STYLE_SOLID);

ObjectCreate("H3_Line", OBJ_HLINE,0, CurTime(),H3);

ObjectSet("H3_Line",OBJPROP_COLOR,Red);

ObjectSet("H3_Line",OBJPROP_STYLE,STYLE_SOLID);

ObjectCreate("H4_Line", OBJ_HLINE,0, CurTime(),H4);

ObjectSet("H4_Line",OBJPROP_COLOR,Red);

ObjectSet("H4_Line",OBJPROP_STYLE,STYLE_SOLID);

ObjectsRedraw();

// --- Typing Labels

if(ObjectFind("L3 label") != 0)

{

ObjectCreate("L3 label", OBJ_TEXT, 0, Time[0], L3);

ObjectSetText("L3 label", " L3 ", 8, "Arial", Red);

}

else

{

ObjectMove("L3 label", 0, Time[0], L3);

}

if(ObjectFind("L4 label") != 0)

{

ObjectCreate("L4 label", OBJ_TEXT, 0, Time[0], L4);

ObjectSetText("L4 label", " L4 ", 8, "Arial", Red);

}

else

{

ObjectMove("L4 label", 0, Time[0], L4);

}

if(ObjectFind("H4 label") != 0)

{

ObjectCreate("H4 label", OBJ_TEXT, 0, Time[0], H4);

ObjectSetText("H4 label", " H4 ", 8, "Arial", Red);

}

else

{

ObjectMove("H4 label", 0, Time[0], H4);

}

if(ObjectFind("H3 label") != 0)

{

ObjectCreate("H3 label", OBJ_TEXT, 0, Time[0], H3);

ObjectSetText("H3 label", " H3 ", 8, "Arial", Red);

}

else

{

ObjectMove("H3 label", 0, Time[0], H3);

}

if(ObjectFind("P label") != 0)

{

ObjectCreate(" label", OBJ_TEXT, 0, Time[0], );

ObjectSetText(" label", " ", 8, "Arial", DeepPink);

}

else

{

ObjectMove("P label", 0, Time[0], P);

}

return(0);

}

//+------------------------------------------------------------------+

���������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������é>��}

�tcè¦øÿÿ

Àt èÓ.��ðë3ö

ötthö�Æè÷ÿÿ

À|\hPö�Vè<

��

À|MFPÿpÐ�

À}

@Ç�Php �jè¯ùÿÿÄ

jÎÿhCCdDhp��jÿ4Ð�

Àt

ðèi��øëjÎÿ¾��ÀéTÿÿÿ3ÿ

ÿÃ

ÿtëhPö�EôPÿÐ�EüÀPEôPè%��ð

ö}+VhÐ �

@Ç�jèXùÿÿÄ

ÛÿÿÿjÏÿéùþÿÿGPÿu

è° ��ðÇèA ��

ö}Vh0 �ëºÛtjÏÿMüjÿ3Àë

jÎÿ¸��À_^[ÉÂ�ÌÌÌÌÌÌÿUìäøì

VÿÐ�Àt

@Ç�h �jèÄøÿÿYYé´���}����ÿuD$PÿÐ�}�t%D$PÿÜÐ�

À}

@Ç�PhÐ �jè}øÿÿÄ

D$

èñQ��h?��L$ðèR��

À|

jÎèT��

À}

@Ç�Ph !�jè=øÿÿÄ

L$

èûQ��}

�t"ÿu

èM6��

À}

@Ç�Php!�jè

øÿÿÄ

^å]Â

�ÌÌÌÌÌÌÿUìQQE

VWÆ��èböÿÿ

Àt è,��ðë3ö

öñ���èÀÝÿÿÀ\Vèôÿÿ

ÀÓ���hxö�Æèõÿÿ

À¿���èÝÿÿHFPÿR

À}0=��Àt

@Ç�PFPhÀ!�jèJ÷ÿÿÄjÎÿ3Àé���eü�EüPFPè���

À}$

@Ç�Ph "�jè÷ÿÿÄ

3ÿjÎÿÇëNeø�EøPÿuèI���ø

ÿ}

@Ç�Wh"�jè�÷ÿÿÄ

ëÆEü;EøM

ÀéwÿÿÿjÎÿ¸��À_^ÉÂ�ÌÌÌÌÌÿUììVWÿu3öEìÇEìý�uðuôuøuüèg��ø;þ}(

@Ç�Wh�#�jècöÿÿÄ

÷Mìè^g��_Æ^ÉÂ�9uøu¾��ÀëäÿuøÿtÐ�;Æu¾{��ÀëÐ@M

ëÆÌÌÌÌÌÌÿW3ÿF

~Ç(û�ÇF,û�è)��

��èü(��,��èmôÿÿ¾\��¾`��¾d��¾h��¾l��Æ_ÃÌÌÌÌÌÿUìVñè ���öEt

öt j�Vÿ(Ð�Æ^]Â�ÌÌÌÌÌÿVñWÇ(û�ÇF,û�è2��¾l��

ÉtÿP'�¾h��

ÉtÿP'�,��èËõÿÿ

��¿¼û�9è¹õÿÿN

9è¯õÿÿ_Ç8û�^ÃÌÌÌÌÌÌÿUìäøìHSV÷ÆD$è»��ÿÐ�Àt

@Ç�hP#�jèõÿÿYY¸H�Àé��uV,��èðñÿÿ

Ào��ßèU��

À|

@Ç�h #�j^Vè«ôÿÿYYÆD$�éà��è¸ÚÿÿD$f@`fÑè·È·fÑèW

fÁf�òèUóÿÿØ

Û}Shð#�j

@Ç�èôÿÿÄ

éÜ��D$w

À\VèHñÿÿØ

ÛÍ��ÿuÆèºñÿÿØ

Û¹��h`$�Vè��Ø

Û¤��è*Úÿÿu

ÿvHÿPØ

Û}

@Ç�SVhp$�jèôÿÿÄéd��d$ �jj@jD$(P¸���ÎÇD$,Ôû�è²*��Ø

Û}ShÐ$�

@Ç�jèÉóÿÿÄ

�D$

wPÎè@-��

À}0

@Ç�Ph@%�jèqóÿÿÄ

D$

PÆè*.��Ø

Û}Sh %�ë¨D$

èÍ/��E·�Àh·

��ÑèèòÿÿØ

Ûª��hö�Æè=ðÿÿØ

Û��ÿuÆèðÿÿØ

Û��D$<è¢L�� ��h?��ðèVN��Ø

Û}

Sh�&�é;��ÿwD$@h÷�Pè5R��Ø

Û��ÿ·4��D$@h ö�PèBR��Ø

Ûú��jh(ö�D$DèÌQ��Ø

Ûà��jh0ö�D$Dè²Q��Ø

ÛÆ��jh8ö�D$DèQ��Ø

Û¬��¡@Ç�@

Àt-G

è~&��PD$@Pè;��

À}

@Ç�PhÀ&�jè@òÿÿÄ

t$<è\N�� ��PÿpÐ�Ø

Û}

Sh '�éR��ßèw��Ø

Û}

Sh'�é:��L$<è¿K��L$

èø'��j^D$$PD$0PjjD$ PjD$0Pÿ·\��ÇD$8²F�h�àÙÿxÐ�Ø

Ûu

@Ç�hà'�VèñÿÿYY»��Àéõ���j�j�D$4Pÿ|Ð�\��ÓÿÐ�Ø3À;Øtû��u4PPPjD$<PÿhÐ�|$(t)h(�

@Ç�Vè>ñÿÿYY»�Àé���Sh0(�VéüÿÿD$

Ð�;shð(�ëÇh��Qh ö�Pè#��Ø

Û}ShP)�ëÅl��Ph°ö�ÿt$è���Ø

Û}Sh°)�ë¢3ÛëCSh`&�

@Ç�jè·ðÿÿÄ

L$<èuJ��L$

è®&��

Û}|$�t Çè¦���ë÷è���Ã^[å]Â�ÌÌÌÌÌh��S3Û;ËWtÿP

h��;Ët

ÿPh��¾l��;ËtÿP ¾`��;ËtÿÑ� \��d��4��ff0��Fff^$��f_f ��[ÃÌÌÌÌÌÌÿVðh��

Ét ÿPÀt-f÷ ��þÿv$��ë3Éf÷FþÿvFë3ÀjPQè¹öÿÿè(ÿÿÿ^ÃÌÌÌÌÌÌÿUìì

Vèîÿÿ

Àt è1$��ðë3ö

öu¸��Àë>W»0��ffÑè·ÀÀèîÿÿ

ÀEü|h@ö�Æè9ìÿÿ

ÀEü}jÎÿEü_^ÉÃWÆèìÿÿø

ÿ|

EøPEôPhÿ �FPÿlÐ�

À}øjÎÿÇëÅEø\��Eô`��3ÿëÞÌÌÌÌÌÌjhÿ�èì¨�eä�eü�EäPÿu

ÿUEÜÇEüþÿÿÿ¾���

Æt

Ph *�j

@Ç�èîÿÿÄ

¸��ÀëCMäÿuÿu

ÿP

øMäÿP

þtWh*�ëÅ3ÀëEì��Eà3À@ÃeèÇEüþÿÿÿEà觨�Â

�ÌÌÌÌÌÿ

Sample

Analysis

Market Information Used:

Series array that contains open time of each bar

Series array that contains close prices for each bar

Series array that contains open prices of each bar

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Indicator Curves created:

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: