//+------------------------------------------------------------------+

//| NeuroTrend_Indicator.mq4 |

//| Copyright © 2008, Arun Kumar Raj |

//| avoruganti@gmail.com |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2008, Arun Kumar Raj"

#property link "avoruganti@gmail.com"

#property indicator_chart_window

#property indicator_buffers 3

#property indicator_color1 Yellow

#property indicator_width1 1

#property indicator_color2 GreenYellow

#property indicator_width2 1

#property indicator_color3 Gold

#property indicator_width3 1

//includes

#include <NeuroTrend_Include.mqh>

//---- buffers

double gmNN1[];

double gmNN2[];

double gmNN3[];

extern bool alert = true;

extern bool sendMail = false;

extern string netfile = "neurotrend.net";

extern string logfile = "netlog.txt";

extern bool log = false;

extern bool barUpdate = true;

bool gmBuy = false, gmSell = false;

int reset, gmPrevBars = 0,h1shift = 0;

double input[17];

double output[3];

double cEMA = 0, cRSI = 0, pRSI = 0, cStochMain = 0, pStochMain = 0, cStochSignal = 0, pStochSignal = 0;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

SetIndexStyle(0,DRAW_LINE,EMPTY);

SetIndexStyle(1,DRAW_LINE,EMPTY);

SetIndexStyle(2,DRAW_LINE,EMPTY);

SetIndexBuffer(0,gmNN1);

SetIndexBuffer(1,gmNN2);

SetIndexBuffer(2,gmNN3);

SetIndexEmptyValue(0,0.0);

IndicatorDigits(Digits);

SetIndexShift (0, 0);

IndicatorShortName ("NeuroTrend");

SetIndexLabel (0, "NeuroTrend");

//create network

int units[3] = {17, 10, 3};

GenerateNetwork(3, units);

ReadNetwork(netfile, logfile, log);

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

if(Bars < 1500) return (0);

if(barUpdate && (gmPrevBars == Bars)) return (0);

int limit;

int counted_bars=IndicatorCounted();

//---- check for possible errors

if(counted_bars<0) return(-1);

//---- the last counted bar will be recounted

if(counted_bars>0) counted_bars--;

limit=Bars-counted_bars;

while(limit >= 0)

{

cEMA = iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit);

cRSI = iRSI(NULL,PERIOD_M15,9,PRICE_CLOSE,limit);

pRSI = iRSI(NULL,PERIOD_M15,9,PRICE_CLOSE,limit+1);

cStochMain = iStochastic(NULL,PERIOD_M15,5,3,3,MODE_EMA,0,MODE_MAIN,limit);

pStochMain = iStochastic(NULL,PERIOD_M15,5,3,3,MODE_EMA,0,MODE_MAIN,limit+1);

cStochSignal = iStochastic(NULL,PERIOD_M15,5,3,3,MODE_EMA,0,MODE_SIGNAL,limit);

pStochSignal = iStochastic(NULL,PERIOD_M15,5,3,3,MODE_EMA,0,MODE_SIGNAL,limit+1);

input[0] = gmThreshold((cEMA - iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit+1))/(Point*10));

input[1] = gmThreshold((iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit+1)-iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit+2))/(Point*10));

input[2] = gmThreshold((iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit+2)-iMA(NULL,PERIOD_M15,5,0,MODE_EMA,PRICE_CLOSE,limit+3))/(Point*10));

input[3] = gmThreshold(cRSI /100);

input[4] = gmThreshold(pRSI /100);

input[5] = gmThreshold((iWPR(NULL,PERIOD_M15,14,limit)+100)/100);

input[6] = gmThreshold((iWPR(NULL,PERIOD_M15,14,limit+1)+100)/100);

input[7] = gmThreshold(iMACD(NULL,PERIOD_M15,12,26,9,PRICE_CLOSE,MODE_MAIN,limit)*100);

input[8] = gmThreshold(iMACD(NULL,PERIOD_M15,12,26,9,PRICE_CLOSE,MODE_MAIN,limit+1)*100);

input[9] = gmThreshold(iMACD(NULL,PERIOD_M15,12,26,9,PRICE_CLOSE,MODE_SIGNAL,limit)*100);

input[10] = gmThreshold(iMACD(NULL,PERIOD_M15,12,26,9,PRICE_CLOSE,MODE_SIGNAL,limit+1)*100);

input[11] = gmThreshold(cStochMain /100);

input[12] = gmThreshold(pStochMain /100);

input[13] = gmThreshold(cStochSignal /100);

input[14] = gmThreshold(pStochSignal /100);

h1shift = iBarShift(NULL,PERIOD_H1,iTime(NULL,PERIOD_M15,limit),true);

input[15] = gmThreshold((iMA(NULL,PERIOD_H1,5,0,MODE_EMA,PRICE_CLOSE,h1shift)-iMA(NULL,PERIOD_H1,5,0,MODE_EMA,PRICE_CLOSE,h1shift+1))/(Point*10));

input[16] = gmThreshold((iMA(NULL,PERIOD_H1,5,0,MODE_EMA,PRICE_CLOSE,h1shift+1)-iMA(NULL,PERIOD_H1,5,0,MODE_EMA,PRICE_CLOSE,h1shift+2))/(Point*10));

SetInput(input);

PropagateNet();

gmNN1[limit] = GetOutput(1)*Point*10+ cEMA;

gmNN2[limit] = GetOutput(2)*Point*10+gmNN1[limit];

gmNN3[limit] = GetOutput(3)*Point*10+gmNN2[limit];

//Print(GetOutput(1)+" "+GetOutput(2)+" "+GetOutput(3));

if((limit < 2))

{

if((gmBuy == false) && (gmNN3[limit] > gmNN2[limit]) && (gmNN2[limit] > gmNN1[limit]) && (gmNN1[limit] > cEMA))

{

if((cRSI >= pRSI) && (cRSI > 45) && (cRSI < 50) && (cStochMain > cStochSignal) && (cStochMain >= pStochMain) && (cStochMain > 20) && (cStochMain < 80) && (cStochSignal >= pStochSignal) && (cStochSignal > 20) && (cStochSignal < 80))

{

if(sendMail && (IsDemo() == FALSE)) SendMail("BUY SIGNAL", DoubleToStr(Ask,5));

if(alert) Alert("BUY SIGNAL");

gmBuy = true;

gmSell = false;

}

}

if((gmSell == false) && (gmNN3[limit] < gmNN2[limit]) && (gmNN2[limit] < gmNN1[limit]) && (gmNN1[limit] < cEMA))

{

if((cRSI <= pRSI) && (cRSI > 50) && (cRSI < 55) && (cStochMain < cStochSignal) && (cStochMain <= pStochMain) && (cStochMain > 20) && (cStochMain < 80) && (cStochSignal <= pStochSignal) && (cStochSignal > 20) && (cStochSignal < 80))

{

if(sendMail && (IsDemo() == FALSE)) SendMail("SELL SIGNAL", DoubleToStr(Bid,5));

if(alert) Alert("SELL SIGNAL");

gmSell = true;

gmBuy = false;

}

}

}

limit--;

}//end while loop

gmPrevBars = Bars;

return(0);

}

//-------------------------------------------------------------------------------------------------

double gmThreshold(double value)

{

if(value > 0.99999) return (0.99999);

if(value < -0.99999) return (-0.99999);

return (value);

}

//-------------------------------------------------------------------------------------------------

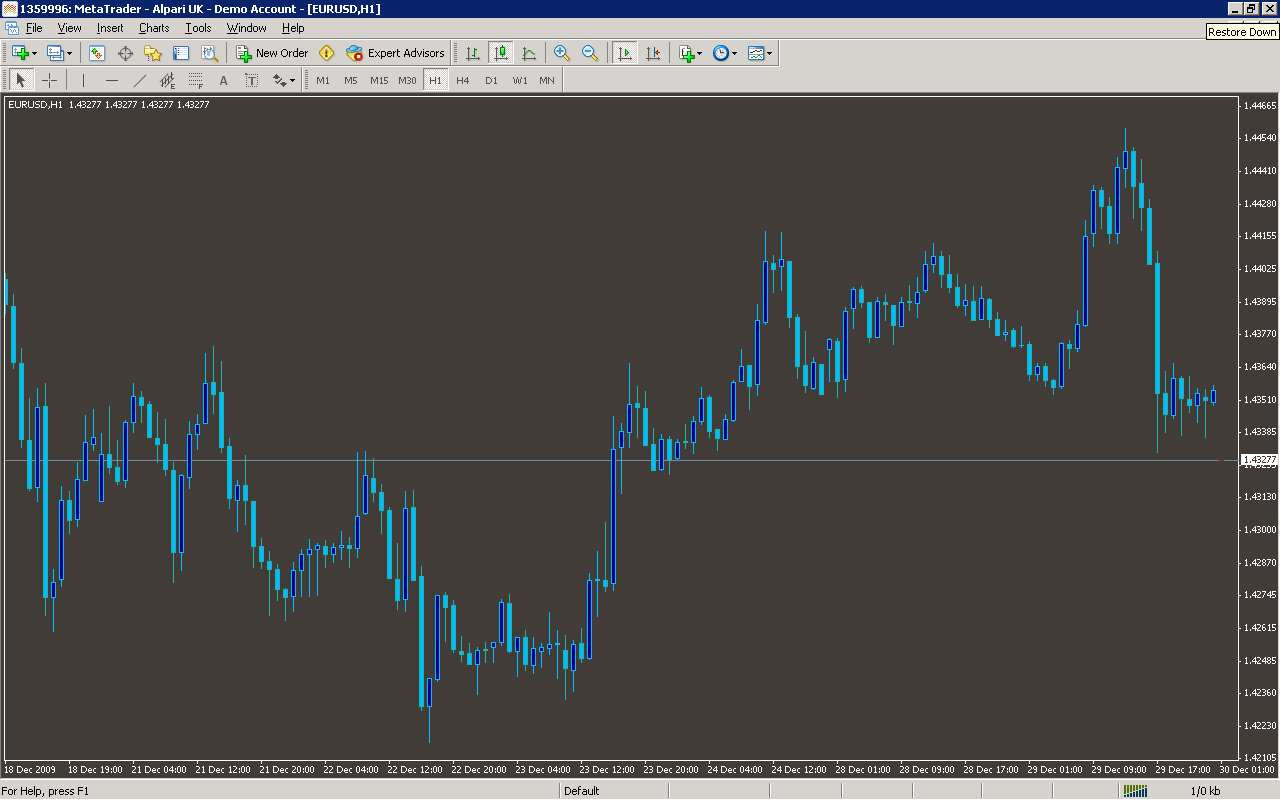

Sample

Analysis

Market Information Used:

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Moving average indicator

Relative strength index

Stochastic oscillator

Larry William percent range indicator

MACD Histogram

Custom Indicators Used:

Order Management characteristics:

Other Features:

It sends emails

It issuies visual alerts to the screen