//+------------------------------------------------------------------+

//| wip.mq4 |

//| Copyright © 2007, fxid10t@yahoo.com |

//| http://www.metaquotes.net |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2007, fxid10t@yahoo.com"

#property link "http://www.metaquotes.net"

//internal variables

double sto15s,sto60s,sto240s,sto1440s,sto10080s,sto43200s;

double sto15m,sto60m,sto240m,sto1440m,sto10080m,sto43200m;

double rng,sum.rng,avg.rng;

string DR;

int ticket,cnt,total;

double profit;

int MagicNumber=9876543210;

extern double lots=0.01;

extern double min.profit=0.05;

datetime TimePrev;

string Ordercomment="";

color Color;

//--**--

int init() {return(0);}

int deinit() {return(0);}

int start() { Pivot.Plot();

//stoch signal

sto15s = iStochastic(Symbol(),15,5,3,3,MODE_SMA,0,MODE_SIGNAL,0);

sto60s = iStochastic(Symbol(),60,5,3,3,MODE_SMA,0,MODE_SIGNAL,1);

sto240s = iStochastic(Symbol(),240,5,3,3,MODE_SMA,0,MODE_SIGNAL,1);

sto1440s = iStochastic(Symbol(),1440,5,3,3,MODE_SMA,0,MODE_SIGNAL,1);

/*

sto10080s = iStochastic(Symbol(),10080,5,3,3,MODE_SMA,0,MODE_SIGNAL,1);

sto43200s = iStochastic(Symbol(),43200,5,3,3,MODE_SMA,0,MODE_SIGNAL,1); */

//stoch main

sto15m = iStochastic(Symbol(),15,5,3,3,MODE_SMA,0,MODE_MAIN,0);

sto60m = iStochastic(Symbol(),60,5,3,3,MODE_SMA,0,MODE_MAIN,1);

sto240m = iStochastic(Symbol(),240,5,3,3,MODE_SMA,0,MODE_MAIN,1);

sto1440m = iStochastic(Symbol(),1440,5,3,3,MODE_SMA,0,MODE_MAIN,1);

/*

sto10080m = iStochastic(Symbol(),10080,5,3,3,MODE_SMA,0,MODE_MAIN,1);

sto43200m = iStochastic(Symbol(),43200,5,3,3,MODE_SMA,0,MODE_MAIN,1); */

//

total=OrdersTotal();

if(total>0) {

for(cnt=0; cnt<OrdersTotal(); cnt++) {

OrderSelect(cnt,SELECT_BY_POS,MODE_TRADES);

if(OrderSymbol()==Symbol() && OrderMagicNumber()==MagicNumber) {

profit=0;

if(OrderType()==OP_BUY) { profit=OrderProfit();

if(OrderComment()=="Oversold Daily" && sto240s>=80.0000 && profit > min.profit &&

sto15m > 80.0000) {

OrderClose(OrderTicket(),OrderLots(),Bid,MarketInfo(Symbol(),MODE_SPREAD),Olive);

return; }

if(OrderComment()=="Oversold 4hr" && sto60m>=80.0000 && profit > min.profit) {

OrderClose(OrderTicket(),OrderLots(),Bid,MarketInfo(Symbol(),MODE_SPREAD),Olive);

return; }

if(OrderComment()=="Oversold uptrend" && sto15s > 80.0000 && profit > min.profit) {

OrderClose(OrderTicket(),OrderLots(),Bid,MarketInfo(Symbol(),MODE_SPREAD),Olive);

return; }

if(profit <= (-3.00/0.01)*lots) {

OrderClose(OrderTicket(),OrderLots(),Bid,MarketInfo(Symbol(),MODE_SPREAD),Olive);

return; }

if(sto15m >= 75.000 && profit > min.profit && OrderComment()=="") {

OrderClose(OrderTicket(),OrderLots(),Bid,MarketInfo(Symbol(),MODE_SPREAD),MintCream);

return; }

} }

if(OrderType()==OP_SELL) { profit=OrderProfit();

if(OrderComment()=="Overbought Daily" && sto240s<=20.0000 && profit > min.profit &&

sto15m < 20.0000) {

OrderClose(OrderTicket(),OrderLots(),Ask,MarketInfo(Symbol(),MODE_SPREAD),Violet);

return; }

if(OrderComment()=="Overbought 4hr" && sto60m<=20.0000 && profit > min.profit) {

OrderClose(OrderTicket(),OrderLots(),Ask,MarketInfo(Symbol(),MODE_SPREAD),Violet);

return; }

if(OrderComment()=="Overbought downtrend" && sto15s < 20.0000 && profit > min.profit) {

OrderClose(OrderTicket(),OrderLots(),Ask,MarketInfo(Symbol(),MODE_SPREAD),Violet);

return; }

if(profit <= (-3.00/0.01)*lots) {

OrderClose(OrderTicket(),OrderLots(),Ask,MarketInfo(Symbol(),MODE_SPREAD),Violet);

return; }

if(sto15m <= 25.000 && profit > min.profit && OrderComment()=="") {

OrderClose(OrderTicket(),OrderLots(),Ask,MarketInfo(Symbol(),MODE_SPREAD),MintCream);

return; }

} } }

comments();

Ordercomment="";

Daily.Range();

if( Time[0] == TimePrev ) { return(0); }

//---- Yes we have a new bar ... set TimePrev & continue

TimePrev = Time[0] ;

if(sto15m==0 || sto15s==0 ||

sto60m==0 || sto60s==0 ||

sto240m==0 || sto240s==0 ||

sto1440m==0 || sto1440s==0) {return(0);}

if(sto1440s > 90.0000 && sto15m >80.0000) {

Ordercomment="Overbought Daily"; Color=Red; Sell(); }

if(sto1440s < 10.0000 && sto15m < 20.0000) {

Ordercomment="Oversold Daily"; Color=Blue; Buy(); }

/*

if(sto240s > 90.0000 && sto60m > 80 && sto15m > 80.0000) {

Ordercomment="Overbought 4hr"; Color=Crimson; Sell(); } sells to early

if(sto240s < 10.0000 && sto60m < 20 && sto15m < 20.0000) {

Ordercomment="Oversold 4hr"; Color=MediumBlue; Buy(); } buys to early*/

if( sto1440m > 20.0000 &&/* sto240s > 20.0000 &&

(sto1440m < sto1440s) &&*/ (sto240m < 75.0000) &&

sto60s > 80.0000 && sto15s > 80.0000) {

Ordercomment="Overbought downtrend"; Color=OrangeRed; Sell(); }

if( sto1440m < 80.0000 &&/* sto240s < 80.0000 &&

(sto1440m > sto1440s) &&*/ (sto240m > 25.0000) &&

sto60s < 20.0000 && sto15s < 20.0000) {

Ordercomment="Oversold uptrend"; Color=RoyalBlue; Buy(); }

/*

if( sto15m > 80.0000 && sto60m > 80.0000) {

Ordercomment=""; Color=DeepPink; Sell(); }

if( sto15m < 20.0000 && sto60m < 20.0000) {

Ordercomment=""; Color=Lime; Buy(); } */

// origional scripting

if( ((sto1440s < 80 && (sto1440m > sto1440s)) || sto1440m < 10) &&

( ((sto240s < 80 && (sto240m > sto240s)) || sto240m < 10) &&

sto60s<20 && sto15s<20) ) {

// buy...

Ordercomment=""; Color=Lime; Buy(); }

if( ((sto1440s > 20 && (sto1440m < sto1440s)) || sto1440m > 90) &&

( ((sto240s > 20 && (sto240m < sto240s)) || sto240m > 90) &&

sto60s>80 && sto15s>80) ) {

// sell...

Ordercomment=""; Color=DeepPink; Sell(); }

return(0);}

//+------------------------------------------------------------------+

void Buy() {

ticket=OrderSend(Symbol(),OP_BUY,lots,Ask,//Ask

MarketInfo(Symbol(),MODE_SPREAD),//slippage

0,//no stoploss defined

0,//no tp defined

Ordercomment,//comment

MagicNumber,

0,//time expire,

Color);

if(ticket>0) {

if(OrderSelect(ticket,SELECT_BY_TICKET,MODE_TRADES)) {Print(ticket);}

else Print("Error Opening BuyStop Order: ",GetLastError());

return(0); } }

void Sell() {

ticket=OrderSend(Symbol(),OP_SELL,lots,Bid,//Bid

MarketInfo(Symbol(),MODE_SPREAD),//slippage

0,//no stoploss set when stop order is executed

0,//no tp defined

Ordercomment,

MagicNumber,

0,//time expire,

Color);

if(ticket>0) {

if(OrderSelect(ticket,SELECT_BY_TICKET,MODE_TRADES)) {Print(ticket);}

else Print("Error Opening SellStop Order: ",GetLastError());

return(0); } }

void comments() {

if(MarketInfo(Symbol(),MODE_SWAPLONG)>0) string swap="longs,"; else swap="shorts.";

if(MarketInfo(Symbol(),MODE_SWAPLONG)<0 && MarketInfo(Symbol(),MODE_SWAPSHORT)<0) swap="your broker, :(";

Comment("Last Tick: ",TimeToStr(TimeCurrent(),TIME_DATE|TIME_SECONDS),"\n",

"Swap favors ",swap,

" Swap Long ",MarketInfo(Symbol(),MODE_SWAPLONG),

", Swap Short ",MarketInfo(Symbol(),MODE_SWAPSHORT),"\n",

/*"Average Daily Range: ",NormalizeDouble(avg.rng,Digits),"\n",*/

"Current Spread: ",Ask-Bid,", Profit: ",profit,"\n",

"sto15s: ",sto15s," sto15m: ",sto15m,"\n",

"sto60s: ",sto60s," sto60m: ",sto60m,"\n",

"sto240s: ",sto240s," sto240m: ",sto240m,"\n",

"sto1440s: ",sto1440s," sto1440m: ",sto1440m,"\n",

"AccountProfit() ",AccountProfit(),"\n",

"AccountBalance() ",AccountBalance(),"\n",

"AccountEquity() ",AccountEquity()); }

double Daily.Range() {

if(DR==TimeToStr(TimeCurrent(),TIME_DATE))

{return(NormalizeDouble(avg.rng,Digits));}

//Print(DR," ",NormalizeDouble(avg.rng,Digits));

rng=0;sum.rng=0;avg.rng=0;

for(int i=0;i<iBars(Symbol(),1440);i++) {

rng=(iHigh(Symbol(),PERIOD_D1,i)-iLow(Symbol(),PERIOD_D1,i));

sum.rng+=rng;}

double db=iBars(Symbol(),1440);

avg.rng=sum.rng/db;

DR=TimeToStr(TimeCurrent(),TIME_DATE);

return(NormalizeDouble(avg.rng,Digits));}

void Pivot.Plot() {

string t1,t2,PPn,s1n,s2n,r1n,r2n,LOPS1n,LOPS2n,HOPS1n,HOPS2n;

double PP,s1,s2,r1,r2,LOPS1,LOPS2,HOPS1,HOPS2,H,L,C;

PPn="PP "+TimeToStr(CurTime(),TIME_DATE);

s1n="S1 "+TimeToStr(CurTime(),TIME_DATE);

s2n="S2 "+TimeToStr(CurTime(),TIME_DATE);

r1n="R1 "+TimeToStr(CurTime(),TIME_DATE);

r2n="R2 "+TimeToStr(CurTime(),TIME_DATE);

LOPS1n="LOPS1 "+TimeToStr(CurTime(),TIME_DATE);

LOPS2n="LOPS2 "+TimeToStr(CurTime(),TIME_DATE);

HOPS1n="HOPS1 "+TimeToStr(CurTime(),TIME_DATE);

HOPS2n="HOPS2 "+TimeToStr(CurTime(),TIME_DATE);

H=iHigh(Symbol(),PERIOD_D1,1);

L=iLow(Symbol(),PERIOD_D1,1);

C=iClose(Symbol(),PERIOD_D1,1);

LOPS1=iLow(Symbol(),PERIOD_D1,1);

LOPS2=iLow(Symbol(),PERIOD_D1,2);

HOPS1=iHigh(Symbol(),PERIOD_D1,1);

HOPS2=iHigh(Symbol(),PERIOD_D1,2);

t1=TimeToStr(CurTime(),TIME_DATE)+" 00:00:00";

t2=TimeToStr(CurTime(),TIME_DATE)+" 23:59:59";

PP=NormalizeDouble((H+L+C)/3,Digits);

s1=NormalizeDouble((PP*2)-H,Digits);

r1=NormalizeDouble((PP*2)-L,Digits);

s2=NormalizeDouble(PP-(r1-s1),Digits);

r2=NormalizeDouble(PP+(r1-s1),Digits);

ObjectCreate(PPn,OBJ_TREND,0,StrToTime(t1),PP,StrToTime(t2),PP);

ObjectSet(PPn,10,false);

ObjectSet(PPn,6,Gray);

ObjectSet(PPn,7,STYLE_DOT);

ObjectSet(PPn,9,true);

ObjectCreate(s1n,OBJ_TREND,0,StrToTime(t1),s1,StrToTime(t2),s1);

ObjectSet(s1n,10,false);

ObjectSet(s1n,6,LightCoral);

ObjectSet(s1n,7,STYLE_DOT);

ObjectSet(s1n,9,true);

ObjectCreate(s2n,OBJ_TREND,0,StrToTime(t1),s2,StrToTime(t2),s2);

ObjectSet(s2n,10,false);

ObjectSet(s2n,6,Tomato);

ObjectSet(s2n,7,STYLE_DOT);

ObjectSet(s2n,9,true);

ObjectCreate(r1n,OBJ_TREND,0,StrToTime(t1),r1,StrToTime(t2),r1);

ObjectSet(r1n,10,false);

ObjectSet(r1n,6,LightGreen);

ObjectSet(r1n,7,STYLE_DOT);

ObjectSet(r1n,9,true);

ObjectCreate(r2n,OBJ_TREND,0,StrToTime(t1),r2,StrToTime(t2),r2);

ObjectSet(r2n,10,false);

ObjectSet(r2n,6,SpringGreen);

ObjectSet(r2n,7,STYLE_DOT);

ObjectSet(r2n,9,true);

ObjectCreate(LOPS1n,OBJ_TREND,0,StrToTime(t1),LOPS1,StrToTime(t2),LOPS1);

ObjectSet(LOPS1n,10,false);

ObjectSet(LOPS1n,6,LightGreen);

ObjectSet(LOPS1n,7,STYLE_DASH);

ObjectSet(LOPS1n,9,true);

ObjectCreate(LOPS2n,OBJ_TREND,0,StrToTime(t1),LOPS2,StrToTime(t2),LOPS2);

ObjectSet(LOPS2n,10,false);

ObjectSet(LOPS2n,6,SpringGreen);

ObjectSet(LOPS2n,7,STYLE_DASH);

ObjectSet(LOPS2n,9,true);

ObjectCreate(HOPS1n,OBJ_TREND,0,StrToTime(t1),HOPS1,StrToTime(t2),HOPS1);

ObjectSet(HOPS1n,10,false);

ObjectSet(HOPS1n,6,LightCoral);

ObjectSet(HOPS1n,7,STYLE_DASH);

ObjectSet(HOPS1n,9,true);

ObjectCreate(HOPS2n,OBJ_TREND,0,StrToTime(t1),HOPS2,StrToTime(t2),HOPS2);

ObjectSet(HOPS2n,10,false);

ObjectSet(HOPS2n,6,Tomato);

ObjectSet(HOPS2n,7,STYLE_DASH);

ObjectSet(HOPS2n,9,true);

if(Period()>=1440) {ObjectDelete(PPn); ObjectDelete(s1n); ObjectDelete(s2n); ObjectDelete(r1n);

ObjectDelete(r2n); ObjectDelete(LOPS1n);ObjectDelete(LOPS2n);ObjectDelete(HOPS1n);

ObjectDelete(HOPS2n); }}

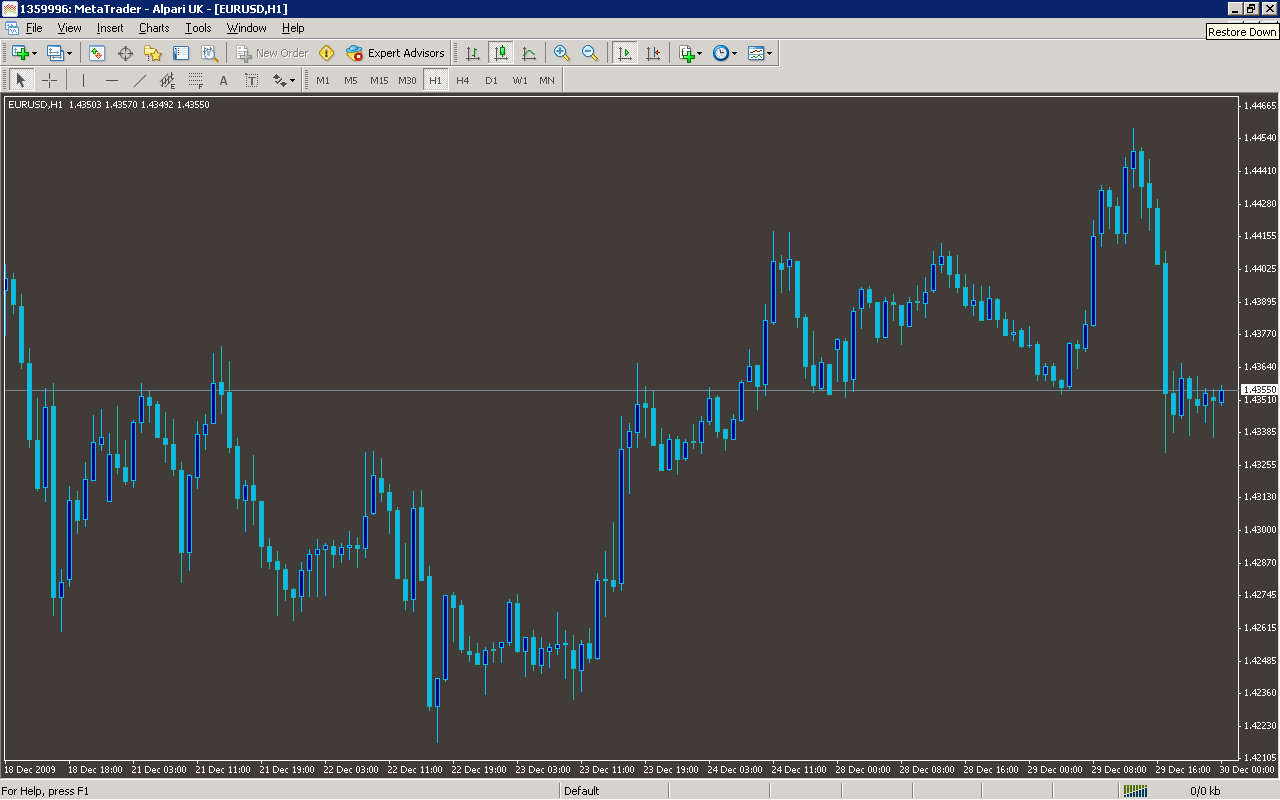

Sample

Analysis

Market Information Used:

Series array that contains open time of each bar

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Series array that contains close prices for each bar

Indicator Curves created:

Indicators Used:

Stochastic oscillator

Custom Indicators Used:

Order Management characteristics:

Checks for the total of open orders

It Closes Orders by itself

Other Features: