//+------------------------------------------------------------------+

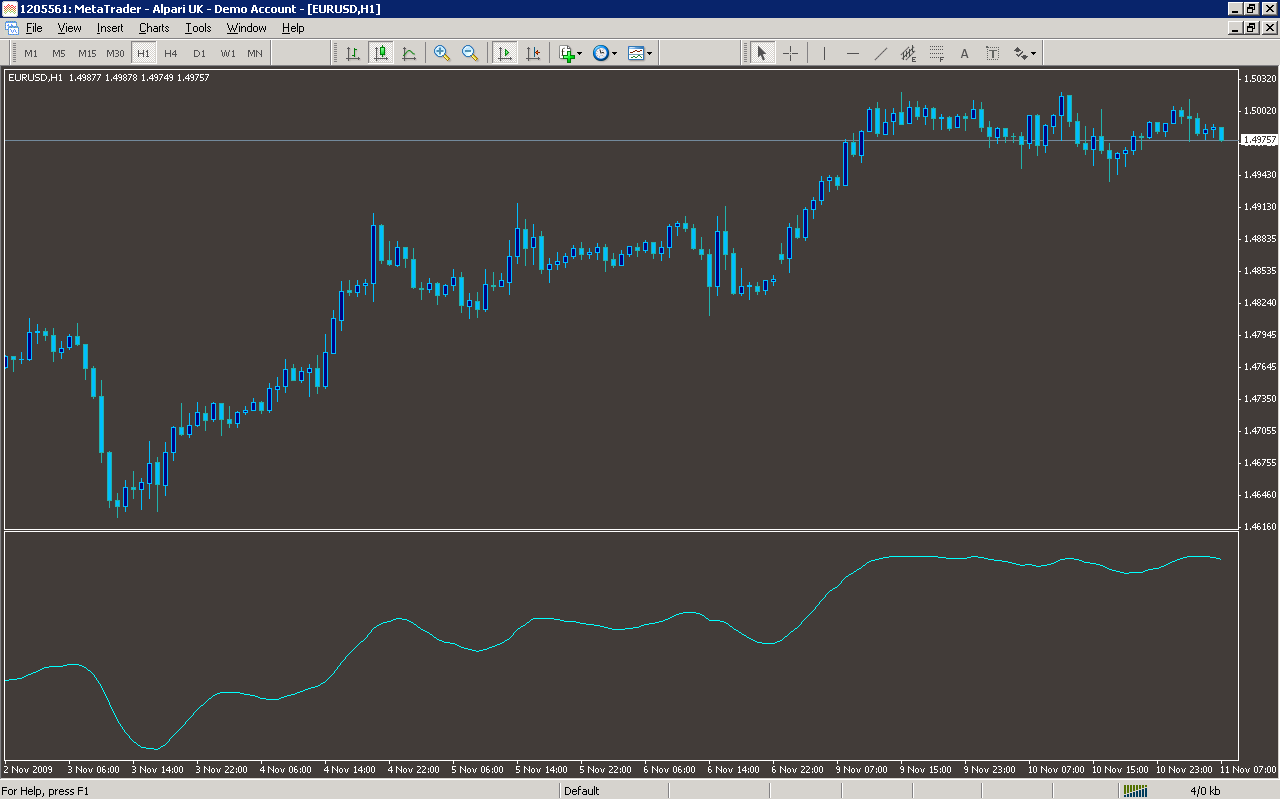

//| Digital Low Pass (FATL/SATL, KGLP) Filter |

//| Copyright (c) Sergey Iljukhin, Novosibirsk. |

//| email sergey[at]tibet.ru http://fx.qrz.ru/ |

//+------------------------------------------------------------------+

#property copyright "Copyright (c) 2005, Sergey Iljukhin, Novosibirsk"

#property link "http://fx.qrz.ru/"

// --- Parameters: P1=20, D1=15, A1=40

// --- P2=52, D2=31, A2=40, Ripple=0.08, Delay=0

// --- Order [Auto]=60, Calculate method=2

#property indicator_chart_window

#property indicator_buffers 1

#property indicator_color1 Red

//---- buffers

double FilterBuffer[];

//+------------------------------------------------------------------+

//| Digital filter indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

string short_name;

//---- indicator line

SetIndexStyle(0,DRAW_LINE);

SetIndexBuffer(0,FilterBuffer);

SetIndexDrawBegin(0,60);

//----

return(0);

}

//+------------------------------------------------------------------+

//| Digital filter main function |

//+------------------------------------------------------------------+

int start()

{

int i,counted_bars=IndicatorCounted();

double response;

//----

if(Bars<=60) return(0);

//---- initial zero

if(counted_bars<60)

for(i=1;i<=0;i++) FilterBuffer[Bars-i]=0.0;

//----

i=Bars-60-1;

if(counted_bars>=60) i=Bars-counted_bars-1;

while(i>=0)

{

response=

0.2293323462290*Close[i+0]

+0.2190511774408*Close[i+1]

+0.1993338024147*Close[i+2]

+0.1717839272009*Close[i+3]

+0.1386151049464*Close[i+4]

+0.1024156042123*Close[i+5]

+0.0659166494902*Close[i+6]

+0.0317217378766*Close[i+7]

+0.002079470071233*Close[i+8]

-0.02130792789267*Close[i+9]

-0.0374268275447*Close[i+10]

-0.0459936283555*Close[i+11]

-0.0474259365311*Close[i+12]

-0.0427588576676*Close[i+13]

-0.0334977083382*Close[i+14]

-0.02140608423347*Close[i+15]

-0.00831222363772*Close[i+16]

+0.00407036177848*Close[i+17]

+0.01434938362745*Close[i+18]

+0.02153142648075*Close[i+19]

+0.02512154466442*Close[i+20]

+0.02510327738679*Close[i+21]

+0.02189857806786*Close[i+22]

+0.01627002586538*Close[i+23]

+0.00919219607002*Close[i+24]

+0.001715283739057*Close[i+25]

-0.00517798268754*Close[i+26]

-0.01067498610433*Close[i+27]

-0.01422638532721*Close[i+28]

-0.01558683320084*Close[i+29]

-0.01481246860304*Close[i+30]

-0.01222431739350*Close[i+31]

-0.00833254540991*Close[i+32]

-0.00376393232851*Close[i+33]

+0.000817306374321*Close[i+34]

+0.00481007826645*Close[i+35]

+0.00777795365965*Close[i+36]

+0.00945330021850*Close[i+37]

+0.00971329124828*Close[i+38]

+0.00871792340730*Close[i+39]

+0.00669388219623*Close[i+40]

+0.00402693885178*Close[i+41]

+0.001124223165593*Close[i+42]

-0.001611047082491*Close[i+43]

-0.00384067886774*Close[i+44]

-0.00532970462554*Close[i+45]

-0.00596390011682*Close[i+46]

-0.00575534582940*Close[i+47]

-0.00482122830067*Close[i+48]

-0.00336352013268*Close[i+49]

-0.001628348582629*Close[i+50]

+0.0001363259868462*Close[i+51]

+0.001712878999932*Close[i+52]

+0.002950623420766*Close[i+53]

+0.00378692903128*Close[i+54]

+0.00427038044820*Close[i+55]

+0.00458163321886*Close[i+56]

+0.00507077382485*Close[i+57]

+0.00632942992793*Close[i+58]

-0.00623335101520*Close[i+59];

FilterBuffer[i]=response;

i--;

}

return(0);

}

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: