//+------------------------------------------------------------------+

//| LabTrend3_v1.mq4 |

//| Copyright © 2006, Forex-TSD.com |

//| Written by IgorAD,igorad2003@yahoo.co.uk |

//| http://finance.groups.yahoo.com/group/TrendLaboratory |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2006, Forex-TSD.com "

#property link "http://www.forex-tsd.com/"

#property indicator_chart_window

#property indicator_buffers 2

#property indicator_color1 Aqua

#property indicator_color2 Magenta

//---- input parameters

extern int Risk=3; // Sensivity Factor

extern double MoneyRisk=2.0; // Offset Factor

extern int BarsNumber=1000;

//---- indicator buffers

double UpTrendBuffer[];

double DownTrendBuffer[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

string short_name;

//---- indicator line

SetIndexBuffer(0,UpTrendBuffer);

SetIndexBuffer(1,DownTrendBuffer);

SetIndexStyle(0,DRAW_ARROW);

SetIndexStyle(1,DRAW_ARROW);

SetIndexArrow(0,159);

SetIndexArrow(1,159);

IndicatorDigits(MarketInfo(Symbol(),MODE_DIGITS));

//---- name for DataWindow and indicator subwindow label

short_name="LabTrend3("+Risk+","+MoneyRisk+")";

IndicatorShortName(short_name);

SetIndexLabel(0,"UpTrend Stop");

SetIndexLabel(1,"DownTrend Stop");

//----

SetIndexDrawBegin(0,10);

SetIndexDrawBegin(1,10);

SetIndexDrawBegin(2,10);

SetIndexDrawBegin(3,10);

SetIndexDrawBegin(4,10);

SetIndexDrawBegin(5,10);

//----

return(0);

}

//+------------------------------------------------------------------+

//| LabTrend3_v1 |

//+------------------------------------------------------------------+

int start()

{

int i,shift,trend;

double Kv=0.382,smax[25000],smin[25000],bsmax[25000],bsmin[25000];

int Length=10; // Volatility(ATR) Period

int Nbars=BarsNumber+100;

for (shift=Nbars;shift>=0;shift--)

{

UpTrendBuffer[shift]=0;

DownTrendBuffer[shift]=0;

}

for (shift=Nbars-Length-100;shift>=0;shift--)

{

double Range=iATR(NULL,0,Length,shift);

double AvgRange=iATR(NULL,0,100,shift);

if (Range<AvgRange) Range=AvgRange;

double high=High[Highest(NULL,0,MODE_HIGH,9,shift)];

double low =Low[Lowest(NULL,0,MODE_LOW,9,shift)];

smin[shift]=low + 0.3*(high-low);

smax[shift]=high- 0.3*(high-low);

bsmax[shift]=High[shift]+(1.0+0.1*Risk)*Range;

bsmin[shift]=Low[shift]-(1.0+0.1*Risk)*Range;

if(Close[shift]>smax[shift]) trend=1;

if(Close[shift]<smin[shift]) trend=-1;

if(trend>0)

{

if(Low[shift]-bsmin[shift]<Kv*MoneyRisk*Range) bsmin[shift]=Low[shift]-Kv*MoneyRisk*Range;

if(bsmin[shift]<bsmin[shift+1]) bsmin[shift]=bsmin[shift+1];

}

if(trend<0)

{

if(bsmax[shift]-High[shift]<Kv*MoneyRisk*Range) bsmax[shift]=High[shift]+Kv*MoneyRisk*Range;

if(bsmax[shift]>bsmax[shift+1]) bsmax[shift]=bsmax[shift+1];

}

if (trend>0)

{

if (UpTrendBuffer[shift+1]==-1.0)

{

bsmin[shift]=Low[shift]-0.1*Risk*Range;

UpTrendBuffer[shift]=bsmin[shift];

}

else

{

UpTrendBuffer[shift]=bsmin[shift];

}

DownTrendBuffer[shift]=-1.0;

}

if (trend<0)

{

if (DownTrendBuffer[shift+1]==-1.0)

{

bsmax[shift]=High[shift]+0.1*Risk*Range;

DownTrendBuffer[shift]=bsmax[shift];

}

else

{

DownTrendBuffer[shift]=bsmax[shift];

}

UpTrendBuffer[shift]=-1.0;

}

}

return(0);

}

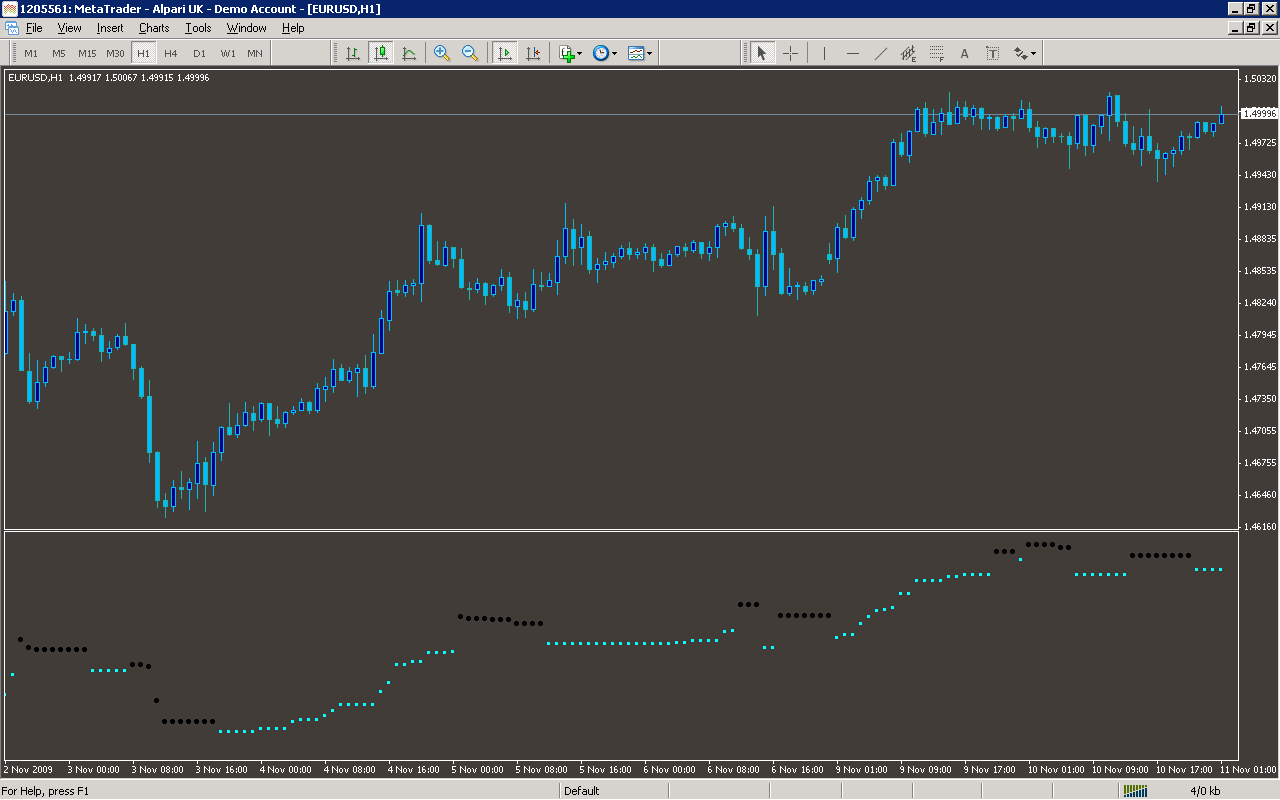

Sample

Analysis

Market Information Used:

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_ARROW

Indicators Used:

Indicator of the average true range

Custom Indicators Used:

Order Management characteristics:

Other Features: