//+-------------------------------------------------------------------+

//| Relative Momentum Index.mq4 |

//| Original indicator by davinviproject |

//| Modified and Corrected by Linuxser for forex TSD |

//| |

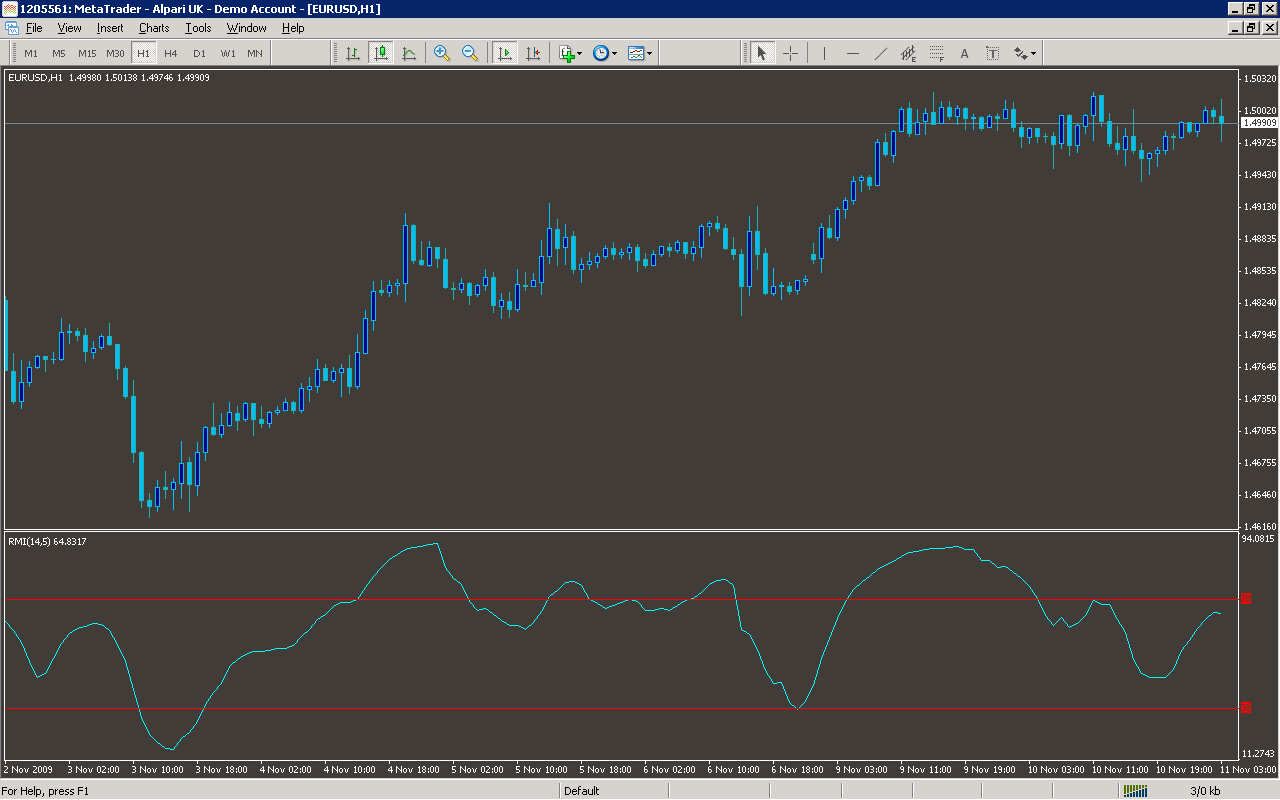

//| Relative Momentum Index (RMI) |

//| Overview |

//| The Relative Momentum Index (RMI) was developed by Roger Altman. |

//| It was first introduced in the February 1993 issue of Technical |

//| Analysis of Stocks & Commodities magazine. |

//| The RMI is a variation of the RSI indicator. The RMI counts up and|

//| down days from the close relative to the close x-days ago (where x|

//| is not limited to 1 as is required by the RSI) instead of counting|

//| up and down days from close to close as the RSI does. |

//| |

//| Note that an RMI with parameters of C, 14, 1 is equivalent to a 14|

//| period RSI of the Close price. This is because the momentum |

//|parameter is calculating only a 1-day price change (which the RSI |

//|does by (default). |

//|As the momentum periods are increased the RMI fluctuations become |

//|smoother. |

//| Since the RMI is an oscillator it exhibits the same strengths and |

//| weaknesses of other overbought / oversold indicators. |

//|During strong trending markets it is likely that the RMI will |

//|remain at overbought or oversold levels for an extended period of |

//|time. |

//|However, during non-trending markets the RMI tends to oscillate more

//|predictably between an overbought level of 70 to 90 and an oversold|

//|level of 10 to 30. |

//+-------------------------------------------------------------------+

#property copyright ""

#property link ""

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Peru

#property indicator_minimum 0

#property indicator_maximum 100

//---- input parameters

extern int RMIPeriod=14;

extern int MomPeriod=5;

//---- buffers

double RMIBuffer[];

double PosBuffer[];

double NegBuffer[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

string short_name;

//---- 2 additional buffers are used for counting.

IndicatorBuffers(3);

SetIndexBuffer(1,PosBuffer);

SetIndexBuffer(2,NegBuffer);

//---- indicator line

SetIndexStyle(0,DRAW_LINE);

SetIndexBuffer(0,RMIBuffer);

SetLevelValue(0,30);

SetLevelValue(1,70);

SetLevelStyle(STYLE_SOLID,1,Red);

//---- name for DataWindow and indicator subwindow label

short_name="RMI("+RMIPeriod+","+MomPeriod+")";

IndicatorShortName(short_name);

SetIndexLabel(0,short_name);

//----

SetIndexDrawBegin(0,RMIPeriod);

//----

return(0);

}

//+------------------------------------------------------------------+

//| RMI - Relative Momentum Index |

//+------------------------------------------------------------------+

int start()

{

int i,counted_bars=IndicatorCounted();

double rel,negative,positive;

//----

if(Bars<=RMIPeriod) return(0);

//---- initial zero

if(counted_bars<1)

for(i=1;i<=RMIPeriod;i++) RMIBuffer[Bars-i]=0.0;

//----

i=Bars-RMIPeriod-1;

if(counted_bars>=RMIPeriod) i=Bars-counted_bars-1;

while(i>=0)

{

double sumn=0.0,sump=0.0;

if(i==Bars-RMIPeriod-1)

{

int k=Bars-2;

//---- initial accumulation

while(k>=i)

{

rel=Close[k]-Close[k+MomPeriod];

if(rel>0) sump+=rel;

else sumn-=rel;

k--;

}

positive=sump/RMIPeriod;

negative=sumn/RMIPeriod;

}

else

{

//---- simple moving average

rel=Close[i]-Close[i+MomPeriod];

if(rel>0) sump=rel;

else sumn=-rel;

positive=(PosBuffer[i+1]*(RMIPeriod-1)+sump)/RMIPeriod;

negative=(NegBuffer[i+1]*(RMIPeriod-1)+sumn)/RMIPeriod;

}

PosBuffer[i]=positive;

NegBuffer[i]=negative;

if(negative==0.0) RMIBuffer[i]=0.0;

else RMIBuffer[i]=100.0*positive/(positive+negative);

i--;

}

//----

return(0);

}

//+------------------------------------------------------------------+

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: