//+------------------------------------------------------------------+

//| Mrs V traffic lights 04 with filters and configurable ema.mq4 |

//| |

//| |

//+------------------------------------------------------------------+

//mod

//#property copyright "Wolfe"

//#property link "xxxxwolfe@gmail.com"

#property indicator_separate_window

#property indicator_minimum 7

#property indicator_maximum 100

#property indicator_buffers 4

#property indicator_color3 DodgerBlue

#property indicator_color4 Tomato

#property indicator_width1 2

#property indicator_width2 2

#property indicator_width3 4

#property indicator_width4 4

//extern int RSI_Timeframe=0;//0=current chart,1=m1,5=m5,15=m15,30=m30,60=h1,240=h4,etc...

//extern int RSI_Period = 8;

//extern int RSI_Applied_Price = 0;//0=close, 1=open, 2=high, 3=low, 4=(high+low)/2, 5=(high+low+close)/3, 6=(high+low+close+close)/4

//extern int MA1_Period = 8;

//extern int MA1_Method = 0;// 0=SMA, 1=EMA, 2=SMMA, 3=LWMA

extern int fast_ema=5;

extern int fast_ema_shift = 3;

extern int slow_ema = 34;

extern int Line_width = 4;

extern int Line_height1 = 60;

extern int Line_height2 = 3;

extern int Line_height3 = 60;

extern int Line_height4 = 2;

extern string note1 = "choose only 1 of the following options";

extern bool All_signals = true;

extern bool Five_shift_and_34cross =false;

extern bool PAaboveFive_shift_and_34 =false;

extern bool PAaboveOnly_34 = false;

extern bool PAaboveOnly_5_shift = false;

double MA1_Array[],RSI[];

double SignalUp[];

double SignalDown[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators setting

SetIndexBuffer(0,RSI);

SetIndexStyle(0,DRAW_NONE,STYLE_SOLID,2);

IndicatorShortName("MrsV TL 04");

// string short_name = "";

// IndicatorShortName(short_name);

IndicatorDigits(MarketInfo(Symbol(),MODE_DIGITS)-4);

SetIndexBuffer(1,MA1_Array);

SetIndexStyle(1,DRAW_NONE,STYLE_SOLID,2);

SetIndexBuffer(2,SignalUp);

SetIndexStyle(2,DRAW_HISTOGRAM,STYLE_SOLID,Line_width);

SetIndexBuffer(3,SignalDown);

SetIndexStyle(3,DRAW_HISTOGRAM,STYLE_SOLID,Line_width);

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int counted_bars=IndicatorCounted();

if(counted_bars<0) return(-1);

if(counted_bars>0) counted_bars--;

int limit=Bars-counted_bars;

//int limit = Bars - IndicatorCounted() - 1;

//---- indicator calculation

for(int i=limit; i>=0; i--)

{

RSI[i]= iRSI(NULL,0,8,0,i);

}

for(i=limit; i>=0; i--)

{

MA1_Array[i] = iMAOnArray(RSI,0,8,0,0,i);

}

//+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

//=================FOR ALL SIGNALS OPTION======================

if(All_signals == true)

{

//======= going long=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)>iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) > iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) > iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) < iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

// &&

// Close[i]>iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalUp[i]=Line_height1;

else

SignalUp[i]=Line_height2;

//======= going short=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)<iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) < iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) < iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) > iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

// &&

// Close[i]<iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalDown[i]=Line_height3;

else

SignalDown[i]=Line_height4;

}

//++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

//=================FOR PAaboveFive_shift_and_34 OPTION======================

if(PAaboveFive_shift_and_34 == true)

{

//======= going long=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)>iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) > iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) > iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) < iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]>iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]>iMA(NULL,0,slow_ema,0,1,0,i)

)

SignalUp[i]=Line_height1;

else

SignalUp[i]=Line_height2;

//======= going short=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)<iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) < iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) < iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) > iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]<iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]< iMA(NULL,0,slow_ema,0,1,0,i)

)

SignalDown[i]=Line_height3;

else

SignalDown[i]=Line_height4;

}

//++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

//=================FOR Five_shift_and_34 OPTION======================

if(Five_shift_and_34cross == true)

{

//======= going long=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)>iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) > iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) > iMAOnArray(RSI,0,8,0,0,i)

&&

iMA(NULL,0,slow_ema,0,1,0,i) < iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

// &&

// Close[i]>iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalUp[i]=Line_height1;

else

SignalUp[i]=Line_height2;

//======= going short=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)<iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) < iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) < iMAOnArray(RSI,0,8,0,0,i)

&&

iMA(NULL,0,slow_ema,0,1,0,i) > iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

// &&

// Close[i]<iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalDown[i]=Line_height3;

else

SignalDown[i]=Line_height4;

}

//++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

//=================FOR Only_5_shift OPTION======================

if(PAaboveOnly_5_shift == true)

{

//======= going long=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)>iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) > iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) > iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) < iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]>iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalUp[i]=Line_height1;

else

SignalUp[i]=Line_height2;

//======= going short=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)<iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) < iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) < iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) > iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]<iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

)

SignalDown[i]=Line_height3;

else

SignalDown[i]=Line_height4;

}

//++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

//=================FOR Only_34 OPTION======================

if(PAaboveOnly_34 == true)

{

//======= going long=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)>iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) > iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) > iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) < iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]>iMA(NULL,0,slow_ema,0,1,0,i)

)

SignalUp[i]=Line_height1;

else

SignalUp[i]=Line_height2;

//======= going short=====================

for(i=limit; i>=0; i--)

if

(

(iMACD(NULL,0,12,26,1,0,0,i)<iMACD(NULL,0,12,26,1,0,0,i+1))

&&

(iStochastic(NULL,0,5,3,3,0,0,0,i) < iStochastic(NULL,0,5,3,3,0,0,1,i))

&&

iRSI(NULL,0,8,0,i) < iMAOnArray(RSI,0,8,0,0,i)

// &&

// iMA(NULL,0,slow_ema,0,1,0,i) > iMA(NULL,0,fast_ema,fast_ema_shift,1,0,i)

&&

Close[i]<iMA(NULL,0,slow_ema,0,1,0,i)

)

SignalDown[i]=Line_height3;

else

SignalDown[i]=Line_height4;

}

//----

return(0);

}

//+------------------------------------------------------------------+

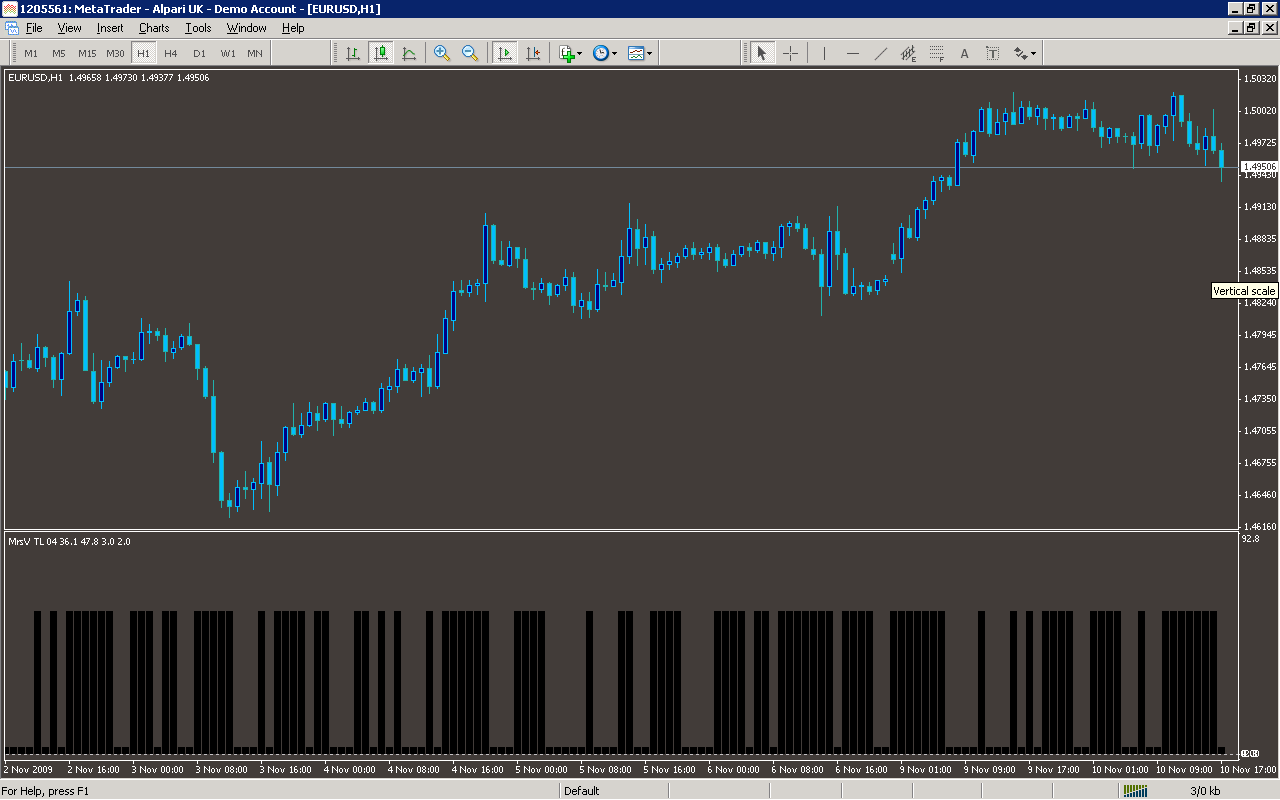

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_NONE

Implements a curve of type DRAW_HISTOGRAM

Indicators Used:

Relative strength index

Moving average indicator

MACD Histogram

Stochastic oscillator

Custom Indicators Used:

Order Management characteristics:

Other Features: