//+------------------------------------------------------------------+

//| AbsoluteStrength_v1.1.mq4 |

//| Copyright © 2006, TrendLaboratory Ltd. |

//| http://finance.groups.yahoo.com/group/TrendLaboratory |

//| E-mail: igorad2004@list.ru |

//+------------------------------------------------------------------+

//mod.2008fxtsd 4c mtf ki

#property copyright "Copyright © 2006, TrendLaboratory Ltd."

#property link "http://finance.groups.yahoo.com/group/TrendLaboratory"

#property indicator_separate_window

#property indicator_buffers 8

#property indicator_color5 CornflowerBlue

#property indicator_width5 2

#property indicator_color6 OrangeRed

#property indicator_width6 2

#property indicator_color3 DeepSkyBlue

#property indicator_width3 1

#property indicator_style3 0

#property indicator_color4 Orange

#property indicator_width4 1

#property indicator_style4 0

#property indicator_color1 Silver//Goldenrod

#property indicator_width1 1

#property indicator_style1 0

#property indicator_color2 SlateGray//Red

#property indicator_width2 1

#property indicator_style2 0

#property indicator_color7 DimGray //Chocolate

#property indicator_width7 1

#property indicator_style7 0

#property indicator_color8 DarkSlateGray //Maroon

#property indicator_width8 1

#property indicator_style8 0

//---- input parameters

extern int Length = 10; // Period of evaluation

extern int Smooth = 5; // Period of smoothing

extern int Signal = 5; // Period of Signal Line

extern int MA_method = 3; // Mode of Moving Average

extern int MA_Price = 0; // Price mode : 0-Close,1-Open,2-High,3-Low,4-Median,5-Typical,6-Weighted

extern int AbS_Mode = 0; // 0-RSI method; 1-Stoch method; 2-ADX method

extern bool UseOBOSLevels = false;

extern double OverBoughtL = 80; // OverBought Level

extern double OverSoldL = 20; // OverSold Level

//extern int MaxBarsToCount = 1500;

extern double HistoMultiplier = 0.6;

extern int TimeFrame = 0;

extern string TimeFrames = "M1;5,15,30,60H1;240H4;1440D1;10080W1;43200MN";

extern string note_Price = "0C 1O 2H 3L 4Md 5Tp 6WghC, Md(HL/2)4,Tp(HLC/3)5,Wgh(HLCC/4)6";

extern string MA_Method_ = "SMA0 EMA1 SMMA2 LWMA3";

extern string AbS_Mode__ = "0-RSI 1-Stoch 2-ADX method";

string IndicatorFileName;

//---- buffers

double Bulls[];

double Bears[];

double AvgBulls[];

double AvgBears[];

double SmthBulls[];

double SmthBears[];

double SigBulls[];

double SigBears[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

IndicatorBuffers(8);

SetIndexStyle (4,DRAW_LINE);

SetIndexBuffer (4,SmthBulls);

SetIndexStyle (5,DRAW_LINE);

SetIndexBuffer (5,SmthBears);

SetIndexStyle (2,DRAW_LINE);

SetIndexBuffer (2,SigBulls);

SetIndexStyle (3,DRAW_LINE);

SetIndexBuffer (3,SigBears);

SetIndexStyle (0,DRAW_HISTOGRAM);

SetIndexBuffer(0,Bulls);

SetIndexStyle (1,DRAW_HISTOGRAM);

SetIndexBuffer(1,Bears);

SetIndexStyle (6,DRAW_HISTOGRAM);

SetIndexBuffer (6,AvgBulls);

SetIndexStyle (7,DRAW_HISTOGRAM);

SetIndexBuffer (7,AvgBears);

//----

switch(TimeFrame)

{

case 1: string TimeFrameStr = "M1"; break;

case 5 : TimeFrameStr = "M5"; break;

case 15 : TimeFrameStr = "M15"; break;

case 30 : TimeFrameStr = "M30"; break;

case 60 : TimeFrameStr = "H1"; break;

case 240 : TimeFrameStr = "H4"; break;

case 1440 : TimeFrameStr = "D1"; break;

case 10080 : TimeFrameStr = "W1"; break;

case 43200 : TimeFrameStr = "MN1"; break;

default : TimeFrameStr = "TF 0";

}

switch(AbS_Mode)

{

case 1: string AbS_Mode_Str = "STOmode"; break;

case 2 : AbS_Mode_Str = "ADXmode"; break;

default : AbS_Mode_Str = "RSImode";

}

//---- name for DataWindow and indicator subwindow label

string short_name="AbsStr ["+TimeFrameStr+"] "+Length+","+Smooth+","+Signal+

" ("+MA_method+") "+AbS_Mode_Str+"|";

IndicatorShortName(short_name);

IndicatorFileName = WindowExpertName();

SetIndexLabel(4,"Bulls"+short_name);

SetIndexLabel(5,"Bears"+short_name);

SetIndexLabel(2,"SignalBulls"+short_name);

SetIndexLabel(3,"SignalBears"+short_name);

SetIndexLabel(0,"Bulls-Bears"+short_name);

SetIndexEmptyValue(0,EMPTY_VALUE);

SetIndexEmptyValue(1,EMPTY_VALUE);

SetIndexEmptyValue(2,EMPTY_VALUE);

SetIndexEmptyValue(3,EMPTY_VALUE);

SetIndexEmptyValue(4,EMPTY_VALUE);

SetIndexEmptyValue(5,EMPTY_VALUE);

SetIndexEmptyValue(6,EMPTY_VALUE);

SetIndexEmptyValue(7,EMPTY_VALUE);

if (TimeFrame<Period()) TimeFrame=Period();

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int shift, counted_bars=IndicatorCounted();

double Price1, Price2, smax, smin;

int limit,i;

if(counted_bars < 0) return(-1);

limit = Bars-counted_bars;

if (TimeFrame != Period())

{

limit = MathMax(limit,TimeFrame/Period());

datetime TimeArray[];

ArrayCopySeries(TimeArray ,MODE_TIME ,NULL,TimeFrame);

for(i=0,int y=0; i<limit; i++)

{

if(Time[i]<TimeArray[y]) y++;

SmthBulls[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,4,y);

SmthBears[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,5,y);

SigBulls[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,2,y);

SigBears[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,3,y);

Bulls[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,0,y);

Bears[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,1,y);

AvgBulls[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,6,y);

AvgBears[i] = iCustom(NULL,TimeFrame,IndicatorFileName,

Length,Smooth,Signal,MA_method,MA_Price,AbS_Mode,

UseOBOSLevels,OverBoughtL,OverSoldL,HistoMultiplier,7,y);

}

return(0);

}

//----

if(counted_bars<0) return(-1);

if(counted_bars>0) counted_bars--;

limit = Bars-counted_bars;

limit=Bars-Length+Smooth+Signal-1;

// if(counted_bars>0) limit=Bars-counted_bars;

// limit--;

for( shift=limit; shift>=0; shift--)

{

Price1 = iMA(NULL,0,1,0,0,MA_Price,shift);

Price2 = iMA(NULL,0,1,0,0,MA_Price,shift+1);

if (AbS_Mode>2) AbS_Mode=2;

if (AbS_Mode==0)

{

Bulls[shift] = 0.5*(MathAbs(Price1-Price2)+(Price1-Price2));

Bears[shift] = 0.5*(MathAbs(Price1-Price2)-(Price1-Price2));

}

if (AbS_Mode==1)

{

smax=High[Highest(NULL,0,MODE_HIGH,Length,shift)];

smin=Low[Lowest(NULL,0,MODE_LOW,Length,shift)];

Bulls[shift] = Price1 - smin;

Bears[shift] = smax - Price1;

}

if (AbS_Mode==2)

{

Bulls[shift] = 0.5*(MathAbs(High[shift]-High[shift+1])+(High[shift]-High[shift+1]));

Bears[shift] = 0.5*(MathAbs(Low[shift+1]-Low[shift])+(Low[shift+1]-Low[shift]));

}

}

for( shift=limit; shift>=0; shift--)

{

AvgBulls[shift]=iMAOnArray(Bulls,0,Length,0,MA_method,shift);

AvgBears[shift]=iMAOnArray(Bears,0,Length,0,MA_method,shift);

}

for( shift=limit; shift>=0; shift--)

{

SmthBulls[shift]=iMAOnArray(AvgBulls,0,Smooth,0,MA_method,shift);

SmthBears[shift]=iMAOnArray(AvgBears,0,Smooth,0,MA_method,shift);

}

for( shift=limit; shift>=0; shift--)

{

if (UseOBOSLevels )

{

SigBulls[shift]=OverBoughtL/100*(SmthBulls[shift]+SmthBears[shift]);

SigBears[shift]=OverSoldL/100*(SmthBulls[shift]+SmthBears[shift]);

}

else

{

SigBulls[shift]=iMAOnArray(SmthBulls,0,Signal,0,MA_method,shift);

SigBears[shift]=iMAOnArray(SmthBears,0,Signal,0,MA_method,shift);

}

}

//----

// for (i=0;i<indicator_buffers;i++) SetIndexDrawBegin(i,Bars-BarsToDraw*TimeFrame/Period());

for( shift=limit; shift>=0; shift--)

{

Bulls[shift] = EMPTY_VALUE; Bears[shift] = EMPTY_VALUE;

AvgBulls[shift] = EMPTY_VALUE; AvgBears[shift] = EMPTY_VALUE;

double delta = (SmthBulls[shift] - SmthBears[shift])*HistoMultiplier ; //

double delta1 = (SmthBulls[shift+1] - SmthBears[shift+1])*HistoMultiplier ; //

if (delta>delta1)

{ if (delta>0) { Bulls[shift] = delta; Bears[shift] = EMPTY_VALUE; }

else { AvgBulls[shift]= delta; AvgBears[shift] = EMPTY_VALUE; }

}

else

{ if (delta>0) { Bears[shift] = delta; Bulls[shift] = EMPTY_VALUE; }

else { AvgBears[shift] = delta; AvgBulls[shift] = EMPTY_VALUE; }

}

}

return(0);

}

//+------------------------------------------------------------------+

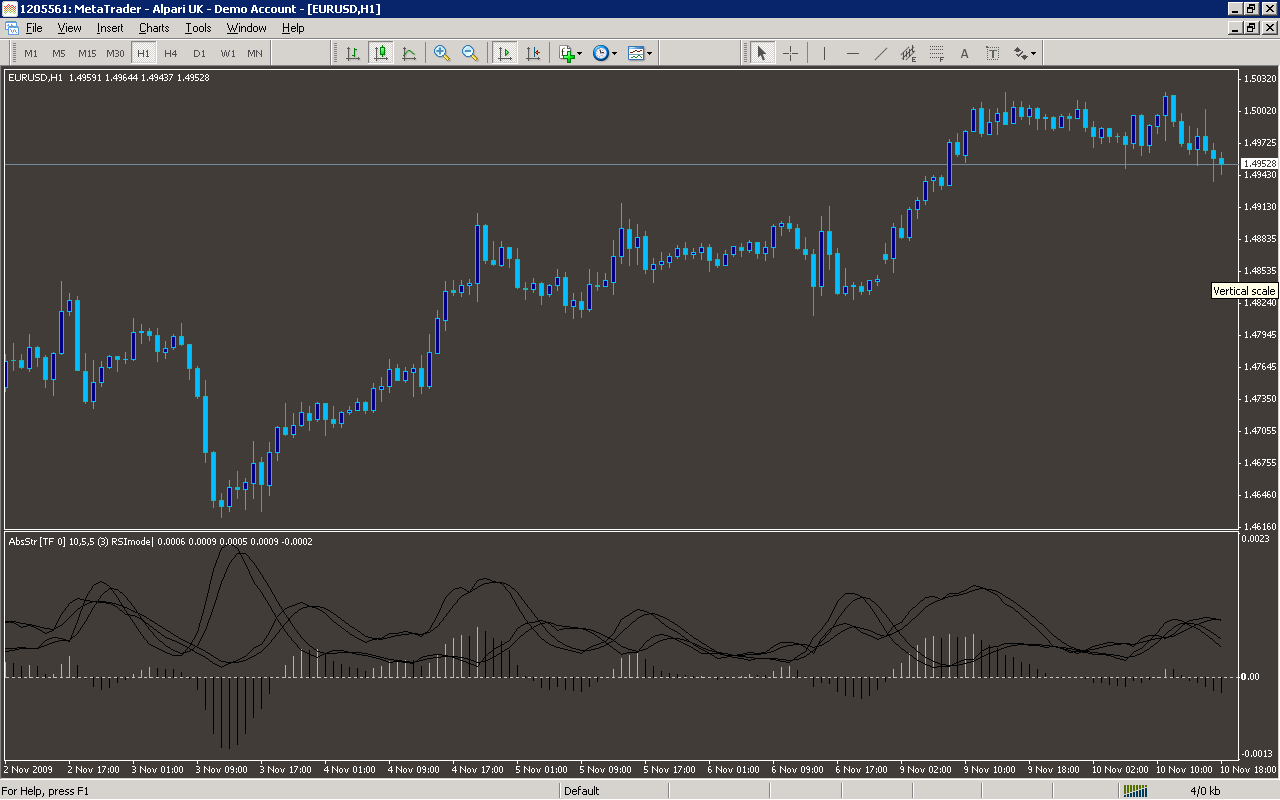

Sample

Analysis

Market Information Used:

Series array that contains open time of each bar

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Indicator Curves created:

Indicators Used:

Moving average indicator

Custom Indicators Used:

Order Management characteristics:

Other Features: