//+------------------------------------------------------------------+

//| CMO.mq4 |

//| Copyright © 2007, Alexandre |

//| http://www.kroufr.ru/content/view/1491/124/ |

//+------------------------------------------------------------------+

/* Ôîðìóëû èíäèêàòîðà äëÿ Ìåòàñòîêà |

CMO_1 |

Sum(If(C, >, Ref(C, -1), (C - Ref(C, -1)), 0), 14) |

CMO_2 |

Sum(If(C, <, Ref(C, -1), (Ref(C, -1) - C)), 0), 14) |

CMO_Final |

100 *((Fml("CMO_1") - Fml("CMO_2")) / (Fml("CMO_1") + Fml("CMO_2"))) |

Êîìáèíèðîâàííàÿ ôîðìóëà: |

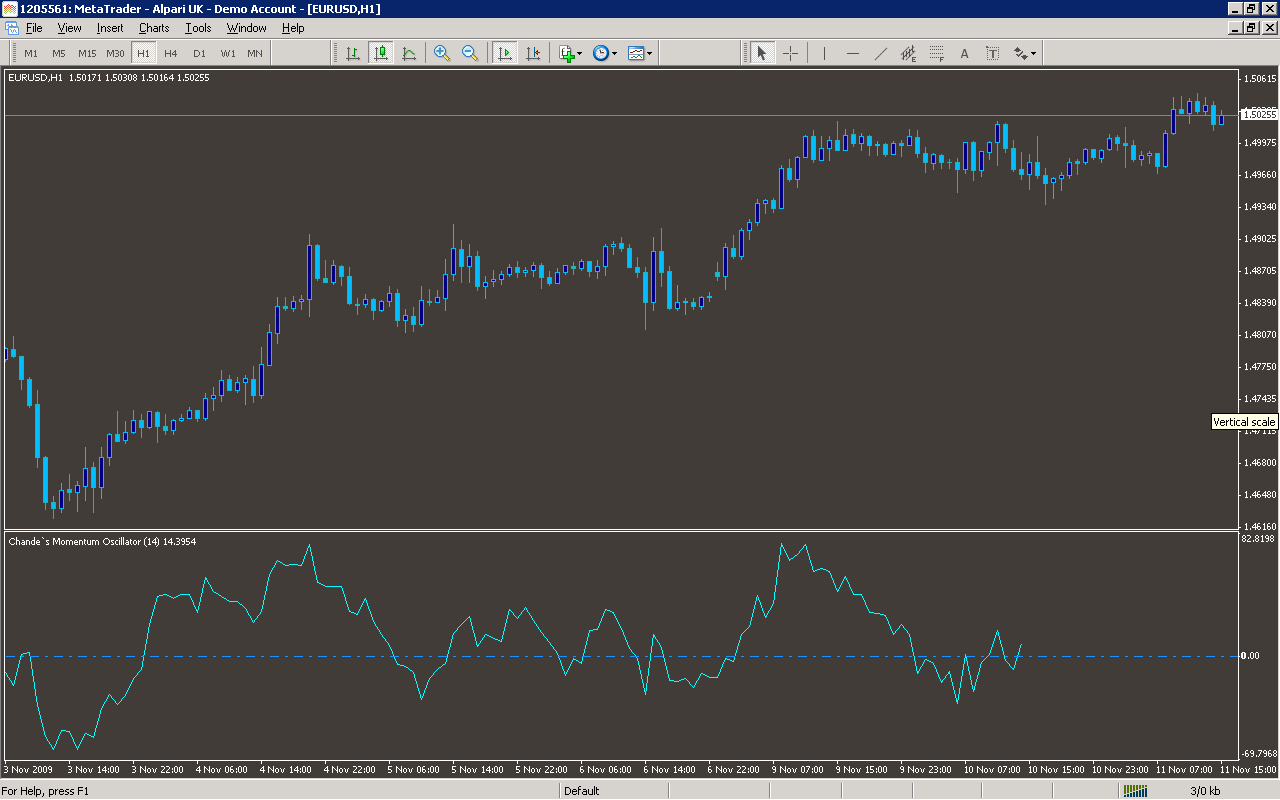

Chande's Momentum Oscillator |

100 * |

((Sum(If(C, >, Ref(C, -1), (C - Ref(C,-1)), 0), 14)) - |

(Sum(If(C, <, REF(C, -1), (REF(C,-1) - C), 0), 14))) / |

((Sum(If(C, >, Ref(C, -1), (C - Ref(C, -1)), 0), 14) + |

(Sum(If(C, <, REF(C, -1), (REF(C, -1) - C), 0), 14)))) |

//+------------------------------------------------------------------+

Ìîìåíòóì-îñöèëëÿòîð ×àíäå ðàññ÷èòûâàåòñÿ ïóòåì äåëåíèÿ ðàçíèöû ìåæäó |

äâèæåíèåì âîñõîäÿùåãî äíÿ è íèñõîäÿùåãî äíÿ íà ñóììó ìåæäó äâèæåíèåì |

âîñõîäÿùåãî äíÿ è íèñõîäÿùåãî äíÿ. Ïîëó÷åííûé ðåçóëüòàò óìíîæàåòñÿ íà|

100.  ðåçóëüòàòå ìû ïîëó÷àåì èíäèêàòîð, ÷üè çíà÷åíèÿ âàðüèðóþòñÿ îò |

-100 äî 100. |

Íàïðèìåð, èñïîëüçóåì äíåâíûå äàííûå â êà÷åñòâå ïðèìåðà. |

Åñëè ñåãîäíÿøíÿÿ öåíà çàêðûòèÿ âûøå â÷åðàøíåé öåíû çàêðûòèÿ, |

òî ñåãîäíÿøíèé äåíü ñ÷èòàåòñÿ âîñõîäÿùèì äíåì, àêòèâíîñòüþ |

âîñõîäÿùåãî äíÿ ñ÷èòàåì ðàçíèöó ìåæäó ñåãîäíÿøíåé öåíîé è â÷åðàøíåé |

öåíîé, íèñõîäÿùàÿ àêòèâíîñòü ñ÷èòàåòñÿ ðàâíîé 0. Ïðîòèâîïîëîæíîå |

âåðíî, åñëè ñåãîäíÿøíåå çàêðûòèå íèæå â÷åðàøíåãî çàêðûòèÿ. |

CMO = ((äâèæåíèå ââåðõ–äâèæåíèå âíèç)/(äâèæåíèå ââåðõ + |

äâèæåíèå âíèç)) * 100 |

Äàííàÿ ñèñòåìà ðàáîòàåò òîëüêî ñ äëèííûìè ïîçèöèÿìè. |

Ïðàâèëà: |

1. Îòêðûâàåì äëèííóþ ïîçèöèþ íà îòêðûòèè ñëåäóþùåãî áàðà, ïîñëå |

òîãî, êàê ÑÌÎ14 ïåðåñåêàåò âíèç óðîâåíü -50; |

2. Äëèííàÿ ïîçèöèÿ çàêðûâàåòñÿ, åñëè ÑÌÎ14 ïåðåñåêàåò ââåðõ |

óðîâåíü +50; |

3. Äëèííàÿ ïîçèöèÿ çàêðûâàåòñÿ ïðè äîñòèæåíèè öåëè ïðèáûëè 0.2 %; |

4. Äëèííàÿ ïîçèöèÿ çàêðûâàåòñÿ, åñëè íà 20 áàðå ïîñëå îòêðûòèÿ |

ïîçèöèè öåíà íàõîäèòñÿ íèæå óðîâíÿ âõîäà. |

//+------------------------------------------------------------------+

*/

#property copyright "Copyright © 2007, Alexandre"

#property link "http://www.kroufr.ru/content/view/1491/124/"

//----

#property indicator_separate_window

#property indicator_buffers 1

#property indicator_color1 Red

#property indicator_minimum -100

#property indicator_maximum 100

#property indicator_level1 50

#property indicator_level2 -50

//---- input parameters

extern bool LastBarOnly = true;

extern int CMO_Range = 14;

//---- buffers

double CMO_Buffer[];

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicators

IndicatorShortName("Chande`s Momentum Oscillator (" + CMO_Range + ")");

SetLevelStyle(STYLE_DASHDOT, 1, DodgerBlue);

SetIndexStyle(0, DRAW_LINE);

SetIndexLabel(0, "CMO");

SetIndexBuffer(0, CMO_Buffer);

SetIndexDrawBegin(0, CMO_Range);

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

//----

return(0);

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int start()

{

int counted_bars = IndicatorCounted();

int i, j, Limit, cnt_bars;

double dif_close, cmo_up, cmo_dw;

static bool run_once;

// to prevent possible error

if(counted_bars < 0)

{

return(-1);

}

Limit = Bars - counted_bars;

// run once on start

if(run_once == false)

cnt_bars = Limit - CMO_Range;

else

if(LastBarOnly == false)

cnt_bars = Limit;

else

cnt_bars = 0;

//----

for(i = cnt_bars; i >= 0; i--)

{

cmo_up = 0.0;

cmo_dw = 0.0;

//----

for(j = i + CMO_Range - 1; j >= i; j--)

{

dif_close = Close[j] - Close[j+1];

if(dif_close > 0)

cmo_up += dif_close;

else

if(dif_close < 0)

cmo_dw -= dif_close;

}

CMO_Buffer[i] = 100 * (cmo_up - cmo_dw) / (cmo_up + cmo_dw);

}

//----

if(run_once == false)

run_once = true;

//----

return(0);

}

//+------------------------------------------------------------------+

Sample

Analysis

Market Information Used:

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Indicators Used:

Custom Indicators Used:

Order Management characteristics:

Other Features: