//

//

//+--------------------------+

//| BollTrade Indicator v05a

//+--------------------------+

//

//

#property copyright "Ron Thompson"

#property link "http://www.ForexMT4.com/"

// This INDICATOR is NEVER TO BE SOLD individually

// This INDICATOR is NEVER TO BE INCLUDED as part of a collection that is SOLD

/*

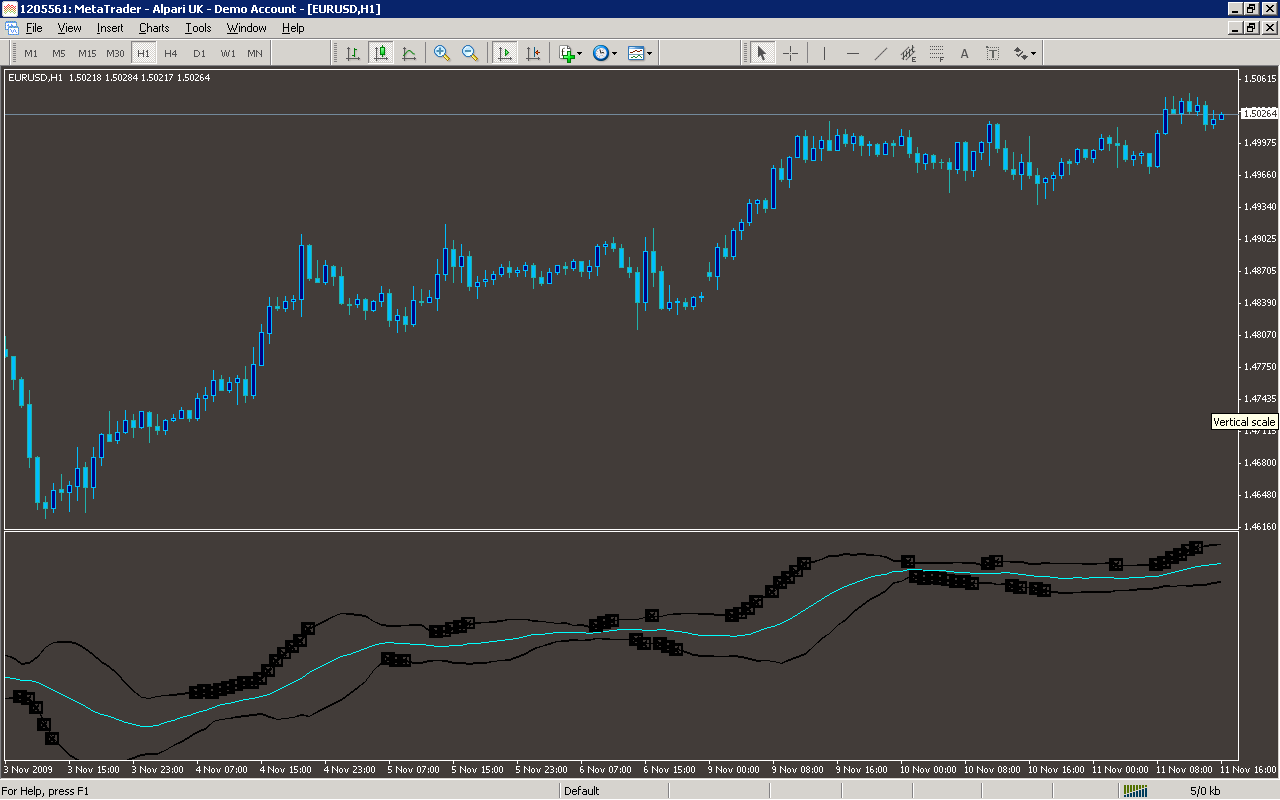

===== Theory =====

This is designed for EURUSD M15

You should place BUY and SELL MARKET ORDERS depending on how far outside the

Bollinger Bands the current price falls. This is a counter-trade system, that

is, you should SELL when the UPPER bands are exceeded by BDistance pips and

BUY when the LOWER Band is exceeded.

BDistance, BPeriod and Deviation control the Bollinger Bands

It depends on retracement and exhaustion to make profit.

You should only places one trade per bar, and one trade at a time.

===== Operation =====

The Gray lines are BDistance from the Bollinger bands

White square is where the price exceeds the upper/lower BDistance value

and where you would place your market order (Sell if upper, Buy if lower)

Red is LossLimit from the white marker, Green is ProfitMade

If you set UseATR true then the chart markers will reflect ATR-derived

bands, and use the ATR_* properties for LossLimit and ProfitMade.

*/

#property indicator_chart_window

#property indicator_buffers 8

#property indicator_color1 White

#property indicator_color2 White

#property indicator_color3 White

#property indicator_color4 Gray

#property indicator_color5 Gray

#property indicator_color6 White

#property indicator_color7 LimeGreen

#property indicator_color8 Red

extern int BPeriod = 15; // Bollinger period

extern double Deviation = 1.8; // Bollinger deviation

extern double BDistance = 14; // plus how much

extern double ProfitMade = 8;

extern double LossLimit = 9;

extern bool UseATR = false;

extern int ATR_Period = 4;

extern double ATR_BDistanceMult = 1.4;

extern double ATR_LossLimitMult = 3.6;

extern double ATR_ProfitMadeMult= 0.8;

//---- buffers

int mybars=1000;

double BollMA[1000];

double BollUpper[1000];

double BollLower[1000];

double UpperPlus[1000];

double LowerPlus[1000];

double BuySell[1000];

double TP[1000];

double SL[1000];

//+----------------+

//| Custom init |

//+----------------+

int init()

{

// 233 up arrow

// 234 down arrow

// 159 big dot

// 158 little dot

// 168 open square

// 120 box with X

IndicatorBuffers(8);

SetIndexStyle(0,DRAW_LINE); //bollinger ma

SetIndexArrow(0,158);

SetIndexBuffer(0,BollMA);

SetIndexStyle(1,DRAW_LINE); //bollinger upper

SetIndexArrow(1,158);

SetIndexBuffer(1,BollUpper);

SetIndexStyle(2,DRAW_LINE); //bollinger lower

SetIndexArrow(2,158);

SetIndexBuffer(2,BollLower);

SetIndexStyle(3,DRAW_LINE); //upperplus

SetIndexArrow(3,158);

SetIndexBuffer(3,UpperPlus);

SetIndexStyle(4,DRAW_LINE); //lowerplus

SetIndexArrow(4,168);

SetIndexBuffer(4,LowerPlus);

SetIndexStyle(5,DRAW_ARROW); //buysell

SetIndexArrow(5,168);

SetIndexBuffer(5,BuySell);

SetIndexStyle(6,DRAW_ARROW); //TP

SetIndexArrow(6,120);

SetIndexBuffer(6,TP);

SetIndexStyle(7,DRAW_ARROW); //SL

SetIndexArrow(7,120);

SetIndexBuffer(7,SL);

}

//+----------------+

//| Custom DE-init |

//+----------------+

int deinit()

{

Print("DE-Init happened ",CurTime());

Comment(" ");

}

//+-----+

//| TPB |

//+-----+

int start()

{

int i;

double stddev;

double bup0;

double bdn0;

double myBDistance;

double myATR;

double myProfitMade;

double myLossLimit;

for (i=mybars; i>=0; i--)

{

// Bollinger moving average

BollMA[i] = iMA(Symbol(),0,BPeriod,0,MODE_SMA,PRICE_OPEN,i);

// upper & lower bands

stddev = iStdDev(Symbol(),0,BPeriod,0,MODE_SMA,PRICE_OPEN,i);

BollUpper[i] = BollMA[i] + (Deviation*stddev); //upper

BollLower[i] = BollMA[i] - (Deviation*stddev); //lower

// buy/sell limit cross

if(UseATR)

{

myATR=iATR(Symbol(),0,ATR_Period,i); // expressed as .xxxx

myBDistance = (ATR_BDistanceMult * myATR); // so doesn't need Point

UpperPlus[i] = BollUpper[i]+(myBDistance); //upperplus

LowerPlus[i] = BollLower[i]-(myBDistance); //lowerplus

}

else

{

myBDistance=BDistance;

UpperPlus[i] = BollUpper[i]+(myBDistance*Point); //upperplus

LowerPlus[i] = BollLower[i]-(myBDistance*Point); //lowerplus

}

if( High[i]>=UpperPlus[i])

{

BuySell[i]=UpperPlus[i]; //SELL

if(UseATR)

{

TP[i]=UpperPlus[i]-(myATR*ATR_ProfitMadeMult);

SL[i]=UpperPlus[i]+(myATR*ATR_LossLimitMult);

}

else

{

TP[i]=UpperPlus[i]-(ProfitMade*Point);

SL[i]=UpperPlus[i]+(LossLimit*Point);

}

}

if( Low[i]<=LowerPlus[i])

{

BuySell[i]=LowerPlus[i]; //BUY

if(UseATR)

{

TP[i]=LowerPlus[i]+(myATR*ATR_ProfitMadeMult);

SL[i]=LowerPlus[i]-(myATR*ATR_LossLimitMult);

}

else

{

TP[i]=LowerPlus[i]+(ProfitMade*Point);

SL[i]=LowerPlus[i]-(LossLimit*Point);

}

}

}//for

}//start

Sample

Analysis

Market Information Used:

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Indicator Curves created:

Implements a curve of type DRAW_LINE

Implements a curve of type DRAW_ARROW

Indicators Used:

Moving average indicator

Standard Deviation indicator

Indicator of the average true range

Custom Indicators Used:

Order Management characteristics:

Other Features: