//+------------------------------------------------------------------+

//| ASCTrend_Sound_MTF |

//| |

//| MODIFIED BY Avery T. Horton, Jr. aka TheRumpledOne |

//| |

//| Copyright © 2008, Avery T. Horton, Jr. aka TheRumpledOne |

//| |

//| PO BOX 43575, TUCSON, AZ 85733 |

//| |

//| GIFTS AND DONATIONS ACCEPTED |

//| |

//| therumpldone@gmail.com |

//+------------------------------------------------------------------+

#property copyright "Copyright © 2008, Avery T. Horton, Jr. aka TRO"

#property link "http://www.therumpldone.com/"

//+-------------------------------------------------------------------+

//| ASCTrendExpert snd e-mail.mq4 |

//| Copyright © 2004, MetaQuotes Software Corp. |

//| http://www.metaquotes.net |

//| Made/Modified by Alejandro Galindo |

//| |

//| You are free to use it |

//| |

//| If you want and if this work/modification is helpful to you |

//| send me a PayPal donation to ag@elcactus.com |

//| any help is apreciated :) |

//| Thanks. |

//+-------------------------------------------------------------------+

//| Original Version ASCTrend1sig_noSound.mq4

//| Ramdass - Conversion only

//+------------------------------------------------------------------+

#property indicator_chart_window

#property indicator_buffers 2

#property indicator_color1 Magenta

#property indicator_color2 Aqua

//---- input parameters

extern int myPeriod=60;

extern int RISK=3;

extern int CountBars=300;

extern int SoundON=1;

extern int EmailON=0;

//---- buffers

double val1[];

double val2[];

int flagval1 = 0;

int flagval2 = 0;

double open, high, low, close, open1, high1, low1, close1, close3 ;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

//---- indicator line

IndicatorBuffers(2);

SetIndexStyle(0,DRAW_ARROW);

SetIndexArrow(0,234);

SetIndexStyle(1,DRAW_ARROW);

SetIndexArrow(1,233);

SetIndexBuffer(0,val1);

SetIndexBuffer(1,val2);

GlobalVariableSet("AlertTime"+Symbol()+myPeriod,CurTime());

GlobalVariableSet("SignalType"+Symbol()+myPeriod,OP_SELLSTOP);

//----

return(0);

}

int deinit()

{

GlobalVariableDel("AlertTime"+Symbol()+myPeriod);

GlobalVariableDel("SignalType"+Symbol()+myPeriod);

return(0);

}

//+------------------------------------------------------------------+

//| ASCTrend1sig |

//+------------------------------------------------------------------+

int start()

{

if (CountBars>=1000) CountBars=950;

SetIndexDrawBegin(0,Bars-CountBars+11+1);

SetIndexDrawBegin(1,Bars-CountBars+11+1);

int i,shift,counted_bars=IndicatorCounted();

int Counter,i1,value10,value11;

double value1,x1,x2;

double value2,value3;

double TrueCount,Range,AvgRange,MRO1,MRO2;

double Table_value2[1000];

double tmp=0;

value10=3+RISK*2;

x1=67+RISK;

x2=33-RISK;

value11=value10;

//----

if(Bars<=11+1) return(0);

//---- initial zero

if(counted_bars<11+1)

{

for(i=1;i<=0;i++) val1[CountBars-i]=0.0;

for(i=1;i<=0;i++) val2[CountBars-i]=0.0;

}

//----

shift=CountBars-11-1;

while(shift>=0)

{

Counter=shift;

Range=0.0;

AvgRange=0.0;

high = iHigh(NULL,myPeriod,Counter);

low = iLow(NULL,myPeriod,Counter);

// for (Counter=shift; Counter<=shift+9; Counter++) AvgRange=AvgRange+MathAbs(High[Counter]-Low[Counter]);

for (Counter=shift; Counter<=shift+9; Counter++) AvgRange=AvgRange+MathAbs(high-low);

Range=AvgRange/10;

Counter=shift;

TrueCount=0;

while (Counter<shift+9 && TrueCount<1)

{

open = iOpen(NULL,myPeriod,Counter);

close1 = iClose(NULL,myPeriod,Counter+1);

// if (MathAbs(Open[Counter]-Close[Counter+1])>=Range*2.0) TrueCount=TrueCount+1;

if (MathAbs(open-close1)>=Range*2.0) TrueCount=TrueCount+1;

Counter=Counter+1;

}

if (TrueCount>=1) {MRO1=Counter;} else {MRO1=-1;}

Counter=shift;

TrueCount=0;

while (Counter<shift+6 && TrueCount<1)

{

close = iClose(NULL,myPeriod,Counter);

close3 = iClose(NULL,myPeriod,Counter+3);

// if (MathAbs(Close[Counter+3]-Close[Counter])>=Range*4.6) TrueCount=TrueCount+1;

if (MathAbs(close3-close)>=Range*4.6) TrueCount=TrueCount+1;

Counter=Counter+1;

}

if (TrueCount>=1) {MRO2=Counter;} else {MRO2=-1;}

if (MRO1>-1) {value11=3;} else {value11=value10;}

if (MRO2>-1) {value11=4;} else {value11=value10;}

// value2=100-MathAbs(iWPR(NULL,0,value11,shift)); // PercentR(value11=9)

value2=100-MathAbs(iWPR(NULL,myPeriod,value11,shift)); // PercentR(value11=9)

Table_value2[shift]=value2;

val1[shift]=0;

val2[shift]=0;

value3=0;

if (value2<x2)

{i1=1;

while (Table_value2[shift+i1]>=x2 && Table_value2[shift+i1]<=x1){i1++;}

if (Table_value2[shift+i1]>x1)

{

high = iHigh(NULL,myPeriod,shift);

// value3=High[shift]+Range*0.5;

value3=high+Range*0.5;

if (shift == 1 && flagval1==0){ flagval1=1; flagval2=0; }

val1[shift]=value3;

}

}

if (value2>x1)

{i1=1;

while (Table_value2[shift+i1]>=x2 && Table_value2[shift+i1]<=x1){i1++;}

if (Table_value2[shift+i1]<x2)

{

low = iLow(NULL,myPeriod,shift);

// value3=Low[shift]-Range*0.5;

value3=low-Range*0.5;

if (shift == 1 && flagval2==0) { flagval2=1; flagval1=0; }

val2[shift]=value3;

}

}

shift--;

}

if (flagval1==1 && CurTime() > GlobalVariableGet("AlertTime"+Symbol()+myPeriod) && GlobalVariableGet("SignalType"+Symbol()+myPeriod)!=OP_BUY) {

if (SoundON==1) Alert("SELL signal at Ask=",Ask,", Bid=",Bid,", Date=",TimeToStr(CurTime(),TIME_DATE)," ",TimeHour(CurTime()),":",TimeMinute(CurTime())," Symbol=",Symbol()," Period=",myPeriod);

if (EmailON==1) SendMail("SELL signal alert","SELL signal at Ask="+DoubleToStr(Ask,4)+", Bid="+DoubleToStr(Bid,4)+", Date="+TimeToStr(CurTime(),TIME_DATE)+" "+TimeHour(CurTime())+":"+TimeMinute(CurTime())+" Symbol="+Symbol()+" Period="+myPeriod);

tmp = CurTime() + (myPeriod-MathMod(Minute(),myPeriod))*60;

GlobalVariableSet("AlertTime"+Symbol()+myPeriod,tmp);

GlobalVariableSet("SignalType"+Symbol()+myPeriod,OP_BUY);

}

if (flagval2==1 && CurTime() > GlobalVariableGet("AlertTime"+Symbol()+myPeriod) && GlobalVariableGet("SignalType"+Symbol()+myPeriod)!=OP_SELL) {

if (SoundON==1) Alert("BUY signal at Ask=",Ask,", Bid=",Bid,", Time=",TimeToStr(CurTime(),TIME_DATE)," ",TimeHour(CurTime()),":",TimeMinute(CurTime())," Symbol=",Symbol()," Period=",myPeriod);

if (EmailON==1) SendMail("BUY signal alert","BUY signal at Ask="+DoubleToStr(Ask,4)+", Bid="+DoubleToStr(Bid,4)+", Date="+TimeToStr(CurTime(),TIME_DATE)+" "+TimeHour(CurTime())+":"+TimeMinute(CurTime())+" Symbol="+Symbol()+" Period="+myPeriod);

tmp = CurTime() + (myPeriod-MathMod(Minute(),myPeriod))*60;

GlobalVariableSet("AlertTime"+Symbol()+myPeriod,tmp);

GlobalVariableSet("SignalType"+Symbol()+myPeriod,OP_SELL);

}

return(0);

}

//+------------------------------------------------------------------+

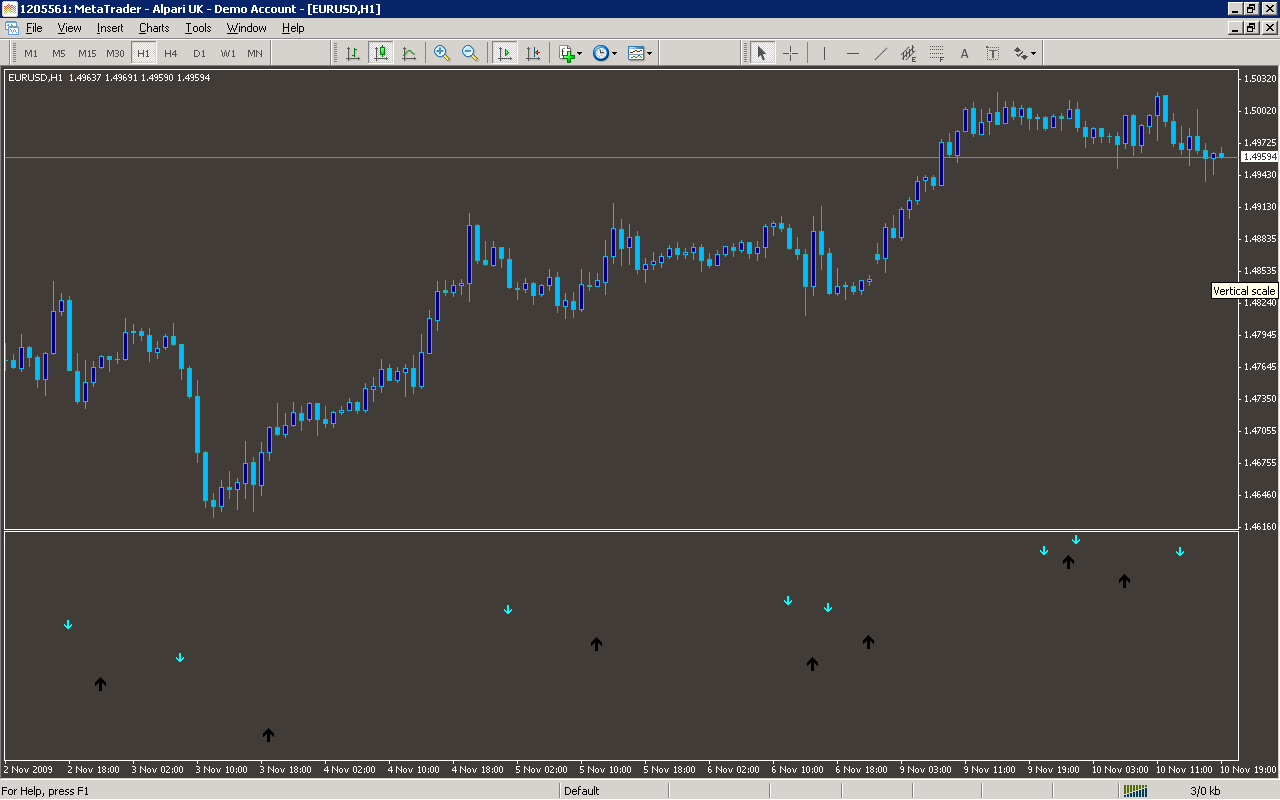

Sample

Analysis

Market Information Used:

Series array that contains the highest prices of each bar

Series array that contains the lowest prices of each bar

Series array that contains open prices of each bar

Series array that contains close prices for each bar

Indicator Curves created:

Implements a curve of type DRAW_ARROW

Indicators Used:

Larry William percent range indicator

Custom Indicators Used:

Order Management characteristics:

Other Features:

It issuies visual alerts to the screen

It sends emails